West Texas Intermediate shed 1.1%, after rising 2.6% last week. The virus is clouding the outlook for consumption across the Asia Pacific. China faces a fresh outbreak, Thailand is set to expand its quasi-lockdown measures, and infections in Sydney matched a record. Data showed China’s economic activity eased in July, implying a more steady recovery as risks mount.

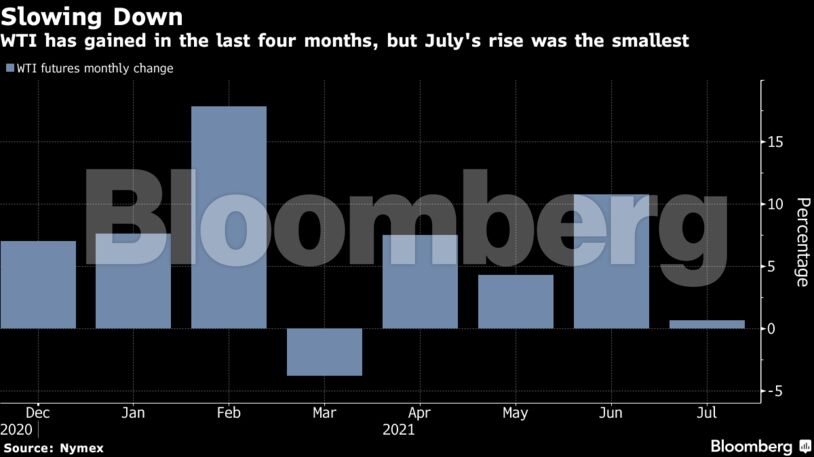

While oil prices have gained in each of the past four months, July’s increase was the smallest as Covid-19 offset the demand recovery. OPEC and its allies have largely followed through with plans to ease supply curbs, but some countries could struggle to return output to pre-Covid levels. Traders are also monitoring a rise in tensions between Iran and the U.S., after Washington formally blamed Tehran for an attack on an Israel-linked oil tanker.

Oil has “given back some of last week’s gains in response to weaker China data and continued worries about the spread of the delta variant,” said Ole Hansen, head of commodities research at Saxo Bank A/S. Crude has settled into a range “with delta demand worries offsetting the current tight supply outlook.”

| Prices: |

|---|

|

Prices are forecast to be “fairly rangebound” as inventory draws limit the downside, while the market lacks a catalyst to push higher, according to Warren Patterson, a commodity strategist at ING Group. He expects Brent to average $75 a barrel this quarter.

See tanker-tracker story: Saudi, Kuwait Export the Most Oil in Months

| Related news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire