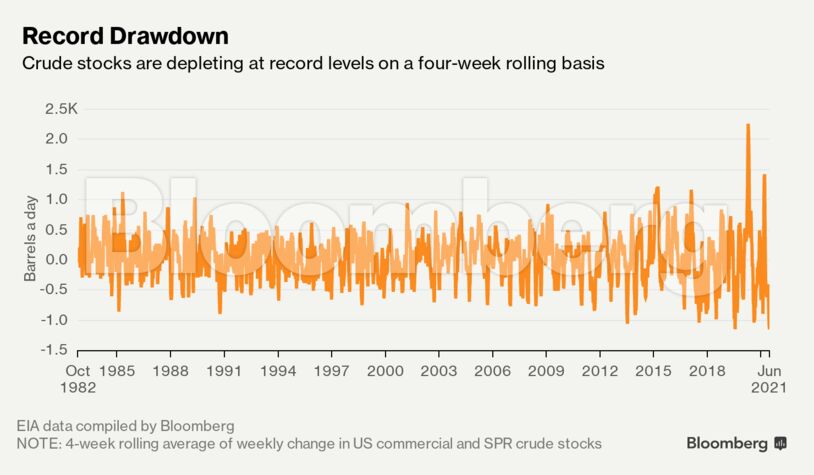

Over the last four weeks total stockpiles, including the Strategic Petroleum Reserve, have fallen at a rate of 1.15 million barrels a day marking the largest four-week decline on a rolling basis in Energy Information Administration Data going back to 1982. Meanwhile, Nymex calendar spreads rallied Wednesday, with the September West Texas Intermediate futures contract rising to $1 a barrel premium over October for the second time this month, pointing to expectations for ongoing supply tightness through the summer.

The record rate of drawdowns underscore the strength of the U.S. oil demand recovery just ahead of a critical meeting between OPEC and its allies on Thursday to debate a potential output increase.

Americans are taking to the roads and skies at increasing numbers as the country emerges from months of lockdowns. To meet demand, oil refiners boosted crude processing to levels only seen before the pandemic. Earlier this month, California, America’s most populous state, re-opened its economy, while New York ended most of its curbs.

At the same time U.S. drillers have been slow to respond to the oil prices, which are up more than 50% so far this year. Domestic crude production is holding at roughly 15% below peak levels seen early last year.

Further supporting the so-called timespreads are stockpile levels in Cushing, Oklahoma, the delivery point for WTI futures. Inventories in the hub are at the lowest levels in over a year. Analysts are estimating and traders are betting that supplies will drop to multi-year lows by the end of the summer.

Prior to this month, the spread between the second month and third month WTI contracts hadn’t exceeded $1 a barrel since 2018.

Overseas interest in American crude has also been climbing despite a bumpy recovery from the health crisis in Asia and Europe. Exports of U.S. crude remain strong even as rallies in WTI have narrowed its spread to less than $2 a barrel relative to global benchmark Brent.

The global supply situation looks set to remain tight as OPEC and its allies have yet to come to a consensus on how much shut-in oil to return to the market at a time when there is much demand uncertainty. That has delayed preliminary talks between ministers by a day to allow more time for a compromise before Thursday’s discussion. The International Energy Agency has warned of supply deficits in the second half of this year unless the group acts fast to add more crude.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS