Behind the headline futures price move, the market’s structure strengthened further. The nearest WTI contract was $1 more expensive than the next month at one point — a bullish pattern known as backwardation. The sharp gains at the front end of the futures curves for Brent and WTI are a sign that traders are banking on extreme market tightness in the coming weeks.

The OPEC+ meeting is happening against a backdrop of tightening supply. Crude inventories in the U.S. are falling at the fastest rate in decades, while shale producers are remaining disciplined with their spending and won’t overwhelm OPEC, ConocoPhillips Chief Executive Officer Ryan Lance said on Wednesday. In another bullish sign, TotalEnergies SE, one of Europe’s biggest refiners, bid for benchmark Forties crude at the highest premiums in 17 months.

“We absolutely think prices are going to continue to rally, especially if OPEC adds anything up to 500,000 barrels per day,” Amrita Sen, chief oil analyst at consultant Energy Aspects, said in a Bloomberg Television interview. “It’s a drop in the ocean.”

| Prices |

|---|

|

As oil prices rose, another energy market saw even stronger gains. European natural gas prices hit an all-time high on Thursday. The two markets are at times connected, as some gas contracts have a link to the crude and fuel-oil markets.

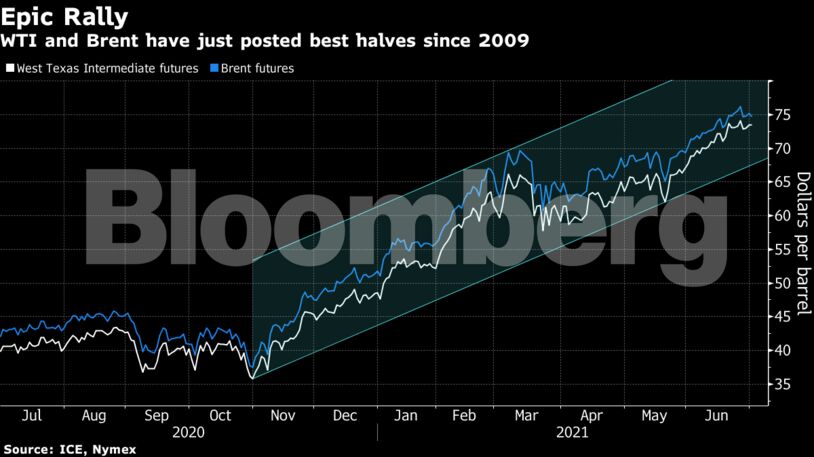

Oil surged more than 50% in the year through June, its best half since 2009, as vaccine rollouts helped to restore mobility in major energy markets such as the U.S., China and Europe. The risk of a quick return of Iranian crude also appears to be receding as negotiations with world powers over the country’s nuclear program face renewed delays. Citigroup Inc. said in a note that it expected the market to remain in “deep deficit” through this quarter even after accounting for increased output from OPEC+.

“Anything less than a 500,000-barrel-a-day supply increase in August will be enough to see the bulls push the market higher,” said Warren Patterson, head of commodities strategy at ING Group in Singapore. “While there are concerns over rising cases of the delta variant in some regions, the market is doing a good job at ignoring it for now.”

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS