“Imagine Shell decided to stop selling petrol and diesel today. This would certainly cut Shell’s carbon emissions,” Chief Executive Officer Ben van Beurden wrote on LinkedIn last week. “But it would not help the world one bit. Demand for fuel would not change. People will fill up their cars and delivery trucks at other service stations.”

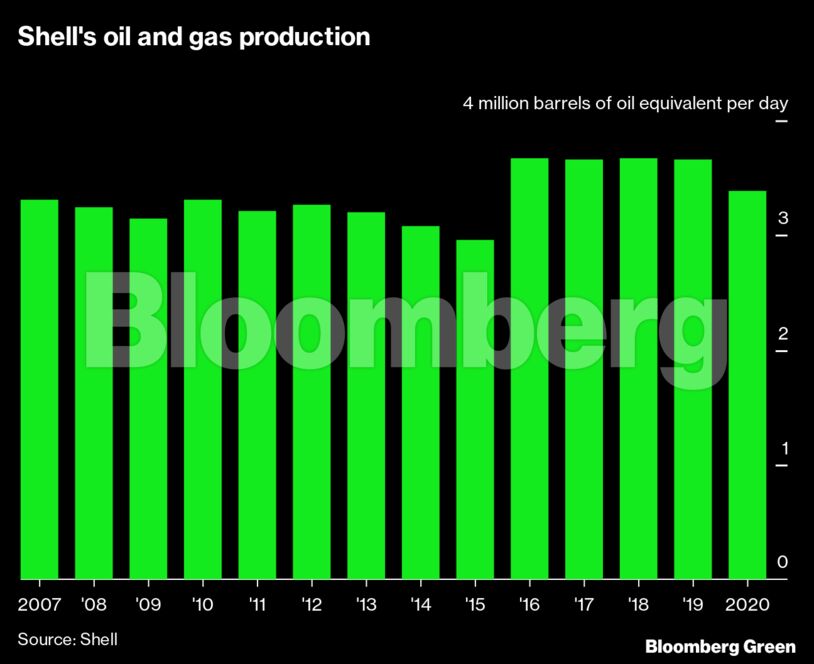

It’s not a new argument. Historically, oil demand has only gone up. It’s a trend that the industry has long used to explain why it needs to keep supplying oil even as it transitions to clean energy.

There’s a real risk that the market share ceded by international oil giants such as Shell goes to national oil companies, which are less transparent in reporting emissions and less accountable to private investors. But this time might be different, with a growing number of people convinced that peak oil demand may be in sight.

The business environment also is conducive for cutting emissions. Utilities and automakers are benefiting already from a sustained decline in renewable electricity costs and lithium-ion batteries. Shareholders, like the ones that voted in three climate-minded directors at Exxon Mobil Corp., and courts, like the Dutch one that ordered Royal Dutch Shell Plc to cut emissions 45% this decade, are taking the view that oil and gas companies need to clean up their act to improve profitability and help the world meet climate goals.

That’s why oil companies are taking their argument one step further. “We need to work together, with society, governments and our customers to achieve real, meaningful change in the worldwide energy system,” van Beurden wrote. “And this change must address the demand for carbon-based energy, not just its supply.”

So what can an oil company do to reduce the demand for oil? They have at least three levers: invest in clean technologies, move into clean-energy businesses and lobby for climate policies.

As a share of revenues, the energy industry spends some of the least money on research and development, according to PwC. What’s worrying is that even government spending on energy R&D has not increased substantially, International Energy Agency data shows. Providing funds to speed up innovation could accelerate the energy transition.

Oil companies also can invest in clean-energy businesses, such as renewable electricity generation and distribution, electric-vehicle charging, sustainable aviation fuels, low-carbon hydrogen and carbon capture and storage.

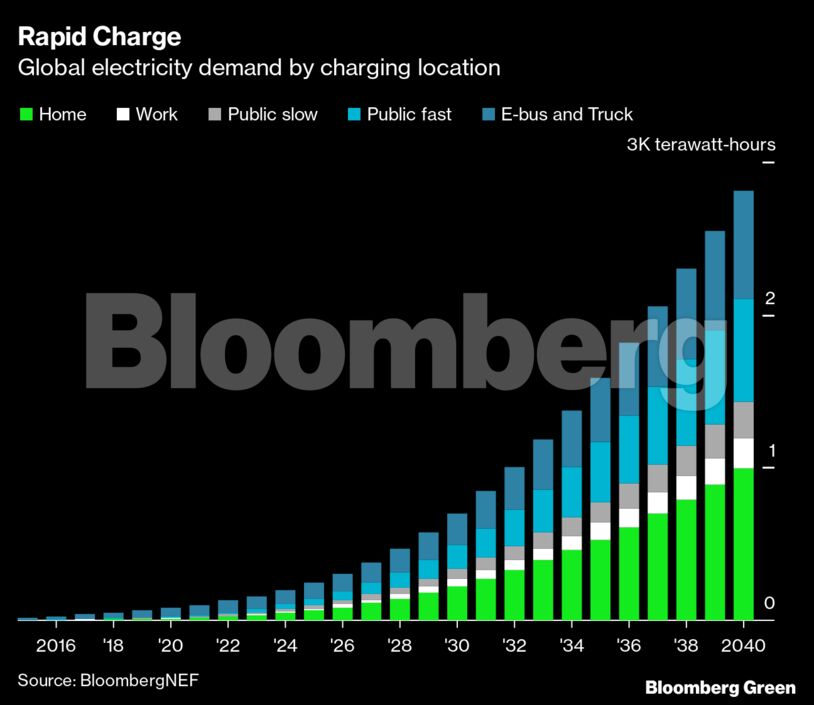

It’s not a straightforward switch. Take the explosion of electric vehicles, for example. Oil companies ideally would like to make up for the revenue lost from selling gasoline to internal-combustion engine cars by powering EVs instead. The trouble is that fast-charging networks are likely to be responsible for less than half the energy EVs need, according to BloombergNEF’s estimates. Also, because EVs are highly efficient, they need less than half the energy to travel the same number of miles as an ICE car. And the profit margins on electricity are typically smaller than those on fuels, according to BNEF’s Ryan Fisher. That means oil companies are likely to end up supplying less energy per EV and make lower profits on the energy they do supply.

The math may be discouraging, but it’s not all bad. Oil companies that get into EV charging early could end up enjoying a larger share of the market than they did serving fuel to ICE cars. Similar calculations can be made for renewable electricity, which can replace gas power plants, and sustainable aviation fuels, which replace conventional fuels.

Crucially, technologies such as low-carbon hydrogen and carbon capture offer new streams of revenue. A steelmaker replacing coal with hydrogen is a potential customer for an oil company. A cement company needing help to transport and bury carbon dioxide is a business opportunity. Yet these industries are nascent or don’t exist yet. That’s where oil companies will have to use their lobbying power to push for policies that will create those businesses, said BNEF’s David Doherty.

The history of major oil companies has shown that they can successfully lobby governments to slow down regulations to cut emissions. It’s not hard to imagine they could do the opposite, says Mark van Baal, who founded the activist-investor group Follow This. “People don’t want fossil fuels,” he said. “People want energy, and increasingly clean energy.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS