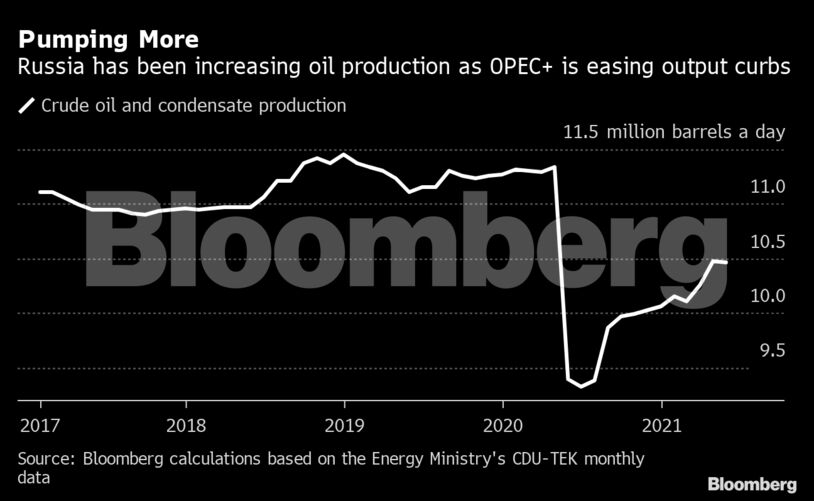

The current agreement between the Organization of Petroleum Exporting Countries and its allies allows Russia to make a modest output boost in July, then keep the rest of its spare capacity idle until April 2022. At a meeting of the group on Thursday, Moscow may try to persuade the group to adjust that schedule and revive production more quickly.

If the cartel were to agree to add a further 500,000 barrels a day in August, Russia could easily add its share of about 125,000 barrels a day, according to analysts from Bank of America, Fitch, Wood & Co., Renaissance Capital and BCS Global Markets.

“Russian producers have repeatedly proven that they can add back idle production on very short notice,” said Ron Smith, senior oil and gas analyst at BCS Global Markets. “I think the market may be underestimating Russia’s ability to raise output.”

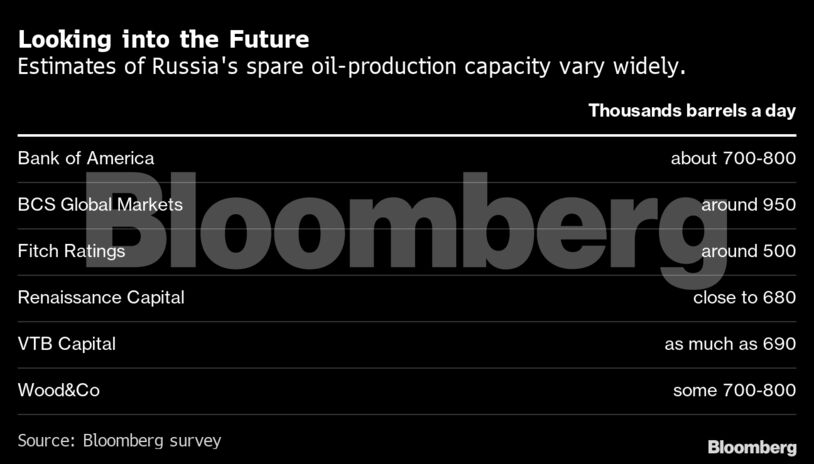

BCS estimates that Russia has spare capacity of about 950,000 barrels a day. That’s the most optimistic outlook among the analysts surveyed by Bloomberg, and others have smaller numbers because they anticipate lasting damage to the country’s fields.

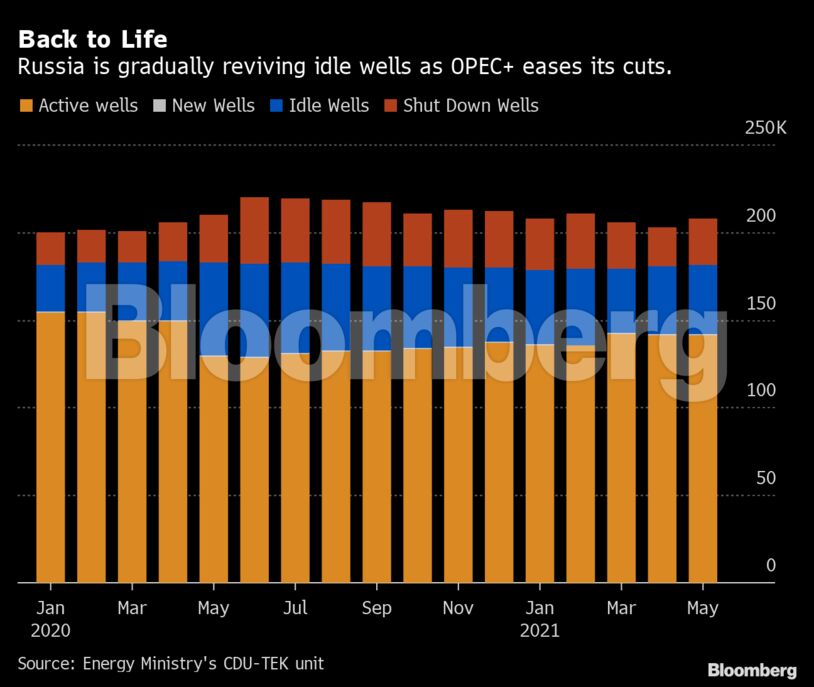

Russia had to idle or shut down an unprecedented number of wells within a couple of months to comply with last year’s OPEC+ deal. Some of its older facilities, known as brownfields, have since struggled to recover, according to London-based consultant Energy Aspects Ltd.

“Some of the brownfield wells — given their age and high water-cut — may never come back to produce the same volume of oil,” Amrita Sen, chief oil analyst and co-founder of Energy Aspects, said in a note.

She sees Russia’s oil output capped at about 10.5 million barrels a day this summer — about 30,000 above May levels. Production could tick higher in the autumn, but rise no higher than 11 million barrels a day next year, Sen said.

Russia’s daily crude oil and condensate output from June 1-29 declined 0.5% compared to May, Interfax reported, citing the industry’s statistics. Production was 10.42 million barrels a day, according to Bloomberg calculations based on the Interfax data.

The nation’s daily crude-only output, which is subject to the OPEC+ agreement, reached 9.495 million barrels a day in June, some 38,000 barrels a day above Russia’s quota for the month, Interfax said.

Well Management

Some Russian oil companies did idle “some of the most marginal wells,” such as those with very high water content, said Vitaly Yermakov, a senior research fellow at the Oxford Institute for Energy Studies. Lukoil PJSC, for example, halted wells with a water-cut of 91%, above the company average of 86%.

Yet through more than a year of production cuts, major Russian producers rotated their stock of wells, reviving some while idling others to avoid permanent losses and “conserve as much spare capacity as they can,” said Karen Kostanian, head of Russian equity research at Bank of America. Rosneft PJSC, the country’s largest producer, also reduced oil flows at wells with better economics without shutting them completely.

Russia’s Energy Ministry and key companies including Rosneft, Lukoil, Surgutneftegas PJSC and Gazprom Neft PJSC didn’t respond to Bloomberg requests seeking comments on spare capacity.

The various well-management strategies, and the lack of data from the producers themselves, make Russia’s spare capacity difficult to quantify and there’s a wide variation in analysts’ views. Fitch is at the low end with an estimate of 500,000 barrels a day, while BCS’s figure of 950,000 is almost twice as big.

Renaissance Capital, which is in the middle of the pack, sees Rosneft and its Bashneft unit holding 300,000 barrels a day of spare capacity, Lukoil with 130,000 barrels a day, Surgutneftegas at 120,000 barrels a day, Tatneft at 70,000 barrels a day, and Gazprom Neft and its Slavneft joint venture at 60,000 barrels a day.

Those estimates look unlikely to be fully tested this year. While Russia may be keen to increase output, it will only be able to do so if OPEC+ agrees this week to amend its current agreement. Saudi Arabia has consistently urged the cartel to act slowly and cautiously.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS