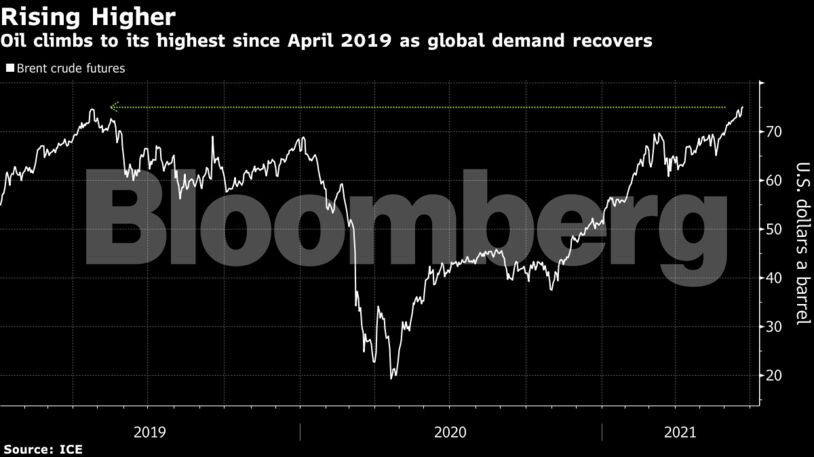

Brent crude edged above $75 in Asian trading hours as price indicators and inventory data showed that demand continues to outstrip supply. The gains faltered as Russia — which jointly leads the OPEC+ coalition with Saudi Arabia — was said to mull a proposal that the group should continue to revive halted output in August.

The Organization of Petroleum Exporting Countries and its partners has been gradually restoring supplies shuttered during the pandemic, and will gather on July 1 to weigh another hike. While Saudi Arabia has signaled it prefers to maintain a cautious stance, the roaring comeback in demand is putting pressure on the kingdom to open the taps.

“The market is hungry for oil,” Saad Rahim, Trafigura’s global chief economist, said Tuesday in an interview with Bloomberg Television. Prices could top $100 a barrel in the next 12 to 18 months, he said.

Brent has rallied more than 40% this year as a strong rebound from the pandemic in the U.S., China and Europe underpins increasing fuel consumption, although a virus comeback in parts of Asia is a reminder that the recovery will be uneven. Brent is also the most expensive against Middle Eastern oil in 21 months.

Other market gauges also reflect growing strength, with one timespread for West Texas Intermediate expanding to the widest backwardation in seven years. Genscape Inc. reported stockpiles at the key American storage hub of Cushing fell again last week from the lowest level since March 2020, according to people familiar with the matter.

| Prices |

|---|

|

One bit of bearish news amid all the optimism is China’s crackdown on the nation’s private refiners. A second batch of 2021 crude import quotas allocated to the independents was about 35% less than last year, which will crimp flows into a sector that accounts for around a quarter of Chinese processing capacity.

| Other market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS