West Texas Intermediate futures declined, with prices having traded within a $10 a barrel range since March. Talks between Iran and world powers are underway in Vienna to revive a nuclear accord, traders are awaiting detail on the negotiations, including sticking points, and the timing of any revival in official flows.

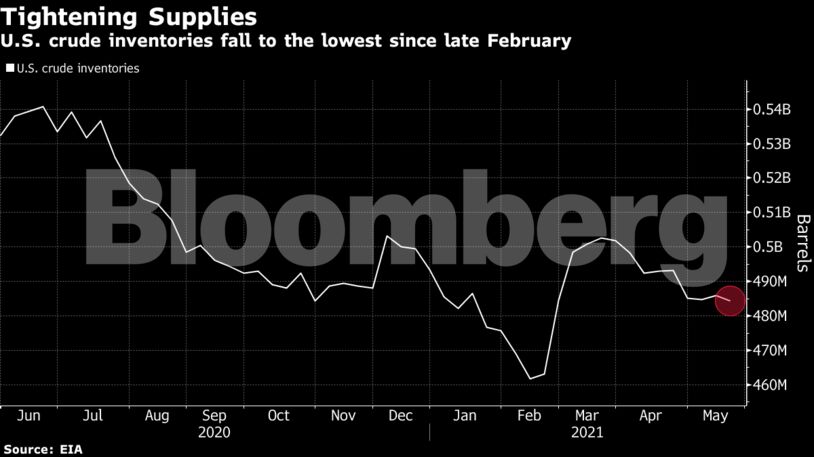

The drop in prices on Thursday came despite more evidence that the recovery in U.S. oil consumption is gathering pace as the pandemic fades. American drivers continue to travel almost as many miles on interstates as they did in 2019, while stockpiles of crude and gasoline fell last week. JPMorgan Chase & Co. expects prices to hit $80 by the end of the year, analysts including Natasha Kaneva wrote in a note.

Oil has largely traded in a tight range since March after an early-year surge, with investors weighing rising demand in the U.S., Europe and China against weaker consumption in parts of Asia where the coronavirus remains potent. At the same time, the OPEC+ alliance is now easing output curbs, and the Iranian talks may usher in a return of more supply if the nuclear deal is revived.

“The data has been supportive but there is currently no trend,” said Giovanni Staunovo, a commodity analyst at UBS Group AG. “That seems to keep some sorts of investors away from the market.”

| Prices |

|---|

|

Ministers from the Organization of Petroleum Exporting Countries and its allies are due to meet June 1 to assess the state of the market and their production policy. Citigroup Inc. said, given the Iranian talks, the group may stick with plans to raise output again next month, but rethink the increase set for July.

The Memorial Day weekend at the end of May usually heralds the start of the summer driving season. However, gasoline stockpiles are low and are setting the stage for a supply squeeze typically only seen when a hurricane knocks out refineries, according to one fuel distributor.

| Other market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS