By Andres Guerra Luz and Alex Longley

Still, rising U.S. jobless claims come as a stark reminder to oil markets of the bumpy road ahead for a recovery in consumption. There are also signs that physical markets are softening in Asia, with Abu Dhabi’s Murban crude at a discount to its benchmark despite continued OPEC+ cuts.

“Bad news was good news in this case,” said Bob Yawger, head of the futures division at Mizuho Securities. “With the jobs numbers, they’re probably going to get a pretty good stimulus plan by Biden,” potentially helping crude demand.

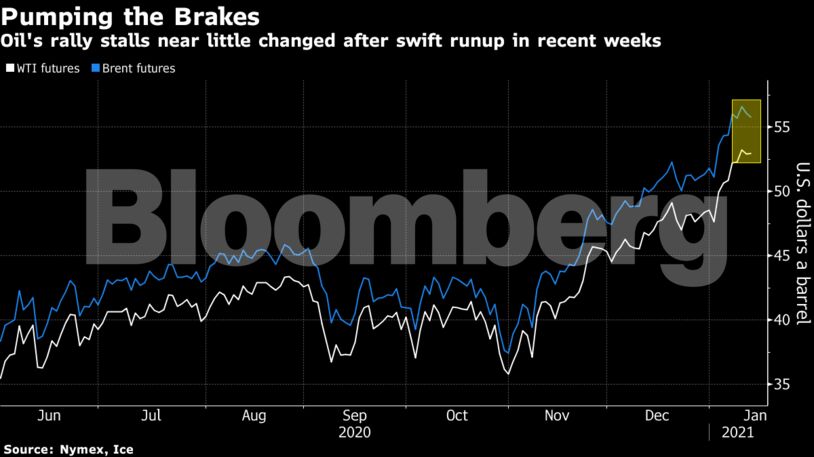

Crude’s recent gains have stoked concern among some investors that the rally is ahead of itself. Technical indicators suggest oil is likely due for a pullback with the U.S. crude benchmark sitting in overbought territory. A strengthening dollar has also been reducing the appeal of commodities priced in the greenback.

Meanwhile, Europe’s oil demand is off to a sluggish start to the new year as renewed lockdowns to curb the spread of Covid-19 limit the use of road fuels.

| Prices |

|---|

|

In Asia, China’s economic recovery gathered pace in December as exports jumped, pushing the trade surplus to a record high. At the same time, Oil imports, however, fell about 15% compared with November.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS