By Sharon Cho and Grant Smith West Texas Intermediate futures held above $52 a barrel after the biggest decline in almost a week on Thursday. Three of the euro area’s four largest economies — Germany, France and Spain — rounded off the pandemic year suggesting the region can avoid a deeper recession.

The virus variant identified in South Africa has reached the U.S. just as Europe is set to tighten its rules on the export of vaccines. Stay-at-home orders to combat the spread of the disease have hit travel and crimped consumption of fuels from China to Los Angeles. India’s demand for diesel, the country’s most-used fuel, is also struggling to shake off the pandemic’s crippling effects on its economy. The crawl back to pre-virus levels will be slow, with annual diesel consumption growth rates seen fully recovering in the year ended March 2022, a senior oil executive said.

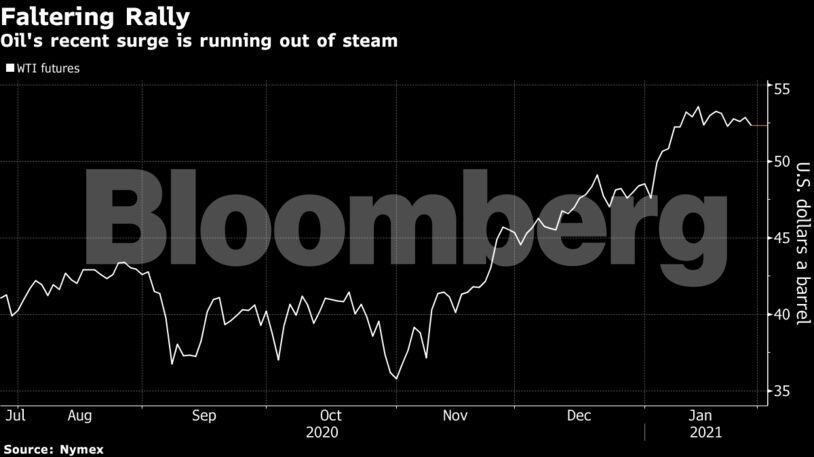

Oil’s rally has faltered recently after surging following a series of Covid-19 vaccine breakthroughs and a pledge by Saudi Arabia to deepen output cuts. A stronger dollar is now reducing the appeal of commodities priced in the U.S. currency, while the persistence of the virus and recurring lockdowns around the world are also capping price gains. In Europe, a vaccine-shortage crisis is forcing some countries to slow delivery of shots.

“Europe’s Covid-19 vaccination campaign is in tatters,” said Stephen Brennock, an analyst at PVM Oil Associates Ltd. “Any loss of momentum in vaccination programs will undermine the strength of the global oil demand recovery.”

The oil futures curve, meanwhile, is looking more bullish. Prompt timespreads for the U.S. benchmark crude and global Brent have firmed recently in backwardation — a market structure where near-dated contracts are more expensive than later-dated ones — indicating shrinking supplies.

Prices

Other oil-market news:

Share This:

Oil Holds Steady Amid Economic Data Boost, Fears Over Demand

These translations are done via Google Translate

These translations are done via Google TranslateFEATURED EVENT

GET ENERGYNOW’S DAILY EMAIL FOR FREE

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS