What is ESG, and why is it ‘all of the sudden’ important?

Environmental, Social, Governance (ESG) – considered a buzzword only a few short years ago, has gained significant traction in the last year as public interest and investor attention on ESG performance has surged. COVID-19 and a heightened focus on climate change have only intensified this dramatic uptake.

Increasingly, demonstrating a commitment to ESG to drive resiliency and adaptability across all business units is becoming a condition for gaining access to capital, loans, bonds, and insurance. Once considered a “nice-to-have” for gaining a social license, understanding material ESG risks and integrated these ESG factors into the decision-making process is quickly becoming a critical part of doing business.

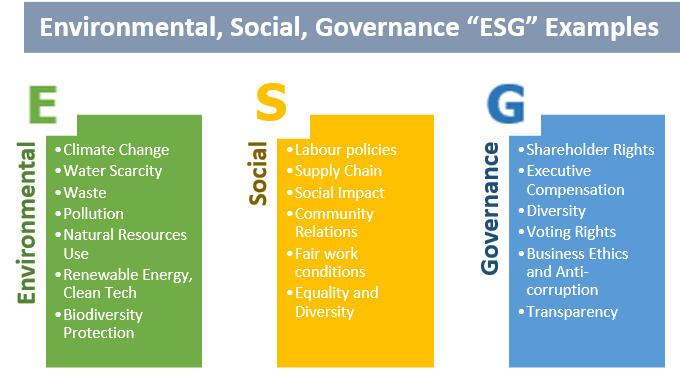

ESG is defined as “environmental, social, and governance factors that arise from a company’s operations, products, or supply chain as potentially having financial material implications for the business performance of interest to investors.” By considering ESG factors material to a business and taking a risk-based approach to strategic thinking and growth management, companies improve transparency across their whole organization, allowing for better supply chain and operational management.

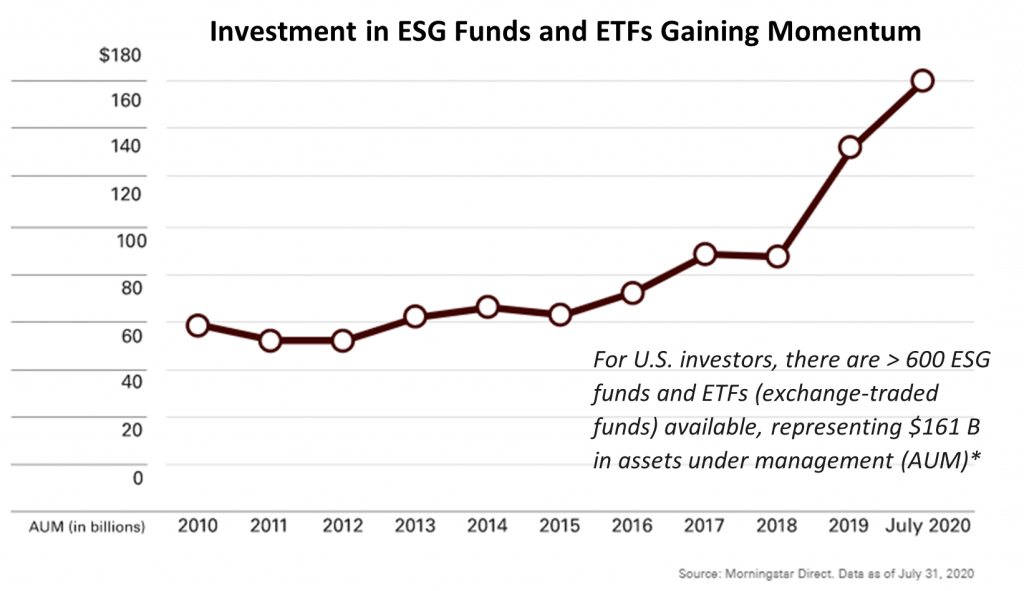

ESG is typically used interchangeably with the term “sustainable investing.” Whereas ESG is the data toolset for identifying and informing strategy and solutions, sustainable or responsible investing refers to the investment in funds that consider financially material ESG information in addition to more tangible monetary values, such as assets, liabilities, income, and cash flow. Under the sustainable investing philosophy, companies that manage their business’s material long-term risks are better prepared, through informed decision-making, to tackle future challenges for continued sustainable growth. In fact, in a study conducted in June 2020 by Morningstar, funds investing in companies with a relatively high rating for ESG factors proved more resilient than non-ESG funds during market downturns.

A company’s ability to manage its ESG risks can have potential financial consequences on its business value as it can impact its:

- Ability to access capital

- Credit rating

- Operational efficiency and bottom-line

- Ability to enter new markets

- Social license to operate

- Brand reputation

A shift in capital allocation and investor expectations

With two of the largest global asset management companies (Vanguard and BlackRock) publically supporting the full integration of ESG into their investment-design process, more institutional investors have begun to join the ESG movement.

Close to 3,000 investors, asset managers, and pension funds have signed up to the UN Principles of Responsible Investment. As a result, gaining access to capital has become more challenging as institutional investors make commitments to reduce investments in companies and industries that do not meet their ESG criteria.

The past year has seen ESG metrics become some of the leading guidelines for investment, especially when it comes to climate action. ESG investing has gained tremendous traction in the last two years – doubling in the value of assets under management (AUM) from 2018-2020. ESG investments’ rise is predominately attributed to the growing realization that ESG factors can be material to a company’s long-term financial performance.

Global exchanges, such as Hong Kong SAR’s stock exchange, are also jumping on the ESG bandwagon with the release of new mandatory disclosure requirements. Under the new disclosure conditions, companies must explain their key ESG performance indicators and publish an ESG report within five-months of a financial year-end.

The current political landscape

In the United States, one would be remiss not to mention President Joe Biden’s campaign promise to “transition” the country away from oil and natural gas in favor of cleaner power sources over time. In addition to rejoining the Paris climate agreement, President Biden’s plans include an acceleration of policies to combat climate change domestically and a focus on investment in clean energy technologies that will help accelerate the transition. With a renewed urgency and focus on climate change, the topic of ESG will likely continue to trend upwards over the next four years.

In Canada, on December 11, 2020, the federal government released its new climate action plan, A Healthy Environment, and a Healthy Economy. Under this plan, the Government of Canada proposed to invest $15 billion to combat climate action, launched a net-zero challenge for large emitters to transition their facilities to net-zero emissions by 2050, and introduced an increasing cost on carbon that will reach $170/tonne by 2030. Further, the Clean Fuel Standard requires producers and distributors of fossil fuels to reduce their carbon content by 2.6% by 2022 and by 13% by 2030.

Commitment to net-zero by 2050

As the energy transition gains momentum, many companies have pledged their intent to become Net Neutral by 2050 as part of the United Nations (UN) Race to Zero campaign. The number of governments and businesses committed to reaching net-zero emissions by 2050 has roughly doubled in less than a year from 2019 to 2020. Those that have pledged their commitment include 22 regions, 452 cities, 1,101 businesses, 549 universities, and 45 of the largest investors.

As more companies are jumping on this wave, the need to reduce emissions has become a business imperative. For the energy industry, Shell, Enbridge, BP, Repsol, and Total SE have communicated their ambitions of achieving net-zero emissions from their operations by 2050. For many of these leading oil and gas companies, the business strategy has shifted from a “low-cost producer” to a “transition to a lower-carbon future” narrative that targets renewable energy and/or alternative energy revenue streams to supplement its current asset portfolio.

ESG is not just about being green

A company’s ability to manage its environmental risks, especially concerning climate change and GHG emissions, is undoubtedly one of the most critical risk factors that an organization must address. Although a fundamental metric to measure, it is essential to remember that it is only one part of the equation. Another vital area to highlight is the focus on social factors. With numerous social movements taking place in 2020, social inclusion is taking center stage, with more companies setting targets around diversity, minority, and female representation. This past year saw many businesses transform their business model overnight and prioritize health and safety over immediate, short-term financial bottom-line factors. Under the governance pillar, common discussion points focus on diversity representation at the board level and linking executive compensation to ESG performance.

ESG in the energy sector

Recent investor, political, and industry shifts have made it evident that companies, big and small, must begin to adapt to ESG requirements and expectations

Recent large transactions in the energy sector highlight the strategic benefits of integrating ESG into business practices.

In October 2020, ConocoPhillips acquired Concho Resources. In an official press release, ConocoPhillips stated that the transaction “elevated commitment to environmental, social, and governance excellence with a newly adopted Paris-aligned climate risk strategy.”

That same month, Pioneer Natural Resources acquired Parsley Energy. In a joint public statement, the companies stated that one of the acquisition’s strategic benefits is that “Pioneer and Parsley have demonstrated strong commitments to best-in-class environmental, social, and governance practices. The combined company will continue to aggressively pursue improvements and promote a culture that prioritizes sustainable operations.”

For larger public energy sector operators and producers, communicating sustainability key performance indicators (KPIs) is not a new concept. However, the type of metrics reported has evolved to focus on more meaningful ESG disclosure that aligns with investor expectations. Investors want high-quality, clear, and consistent information that details a plan for long-term resiliency and value creation.

Unfortunately, companies of all sizes are still struggling to understand what role they should play in the ESG game. With several reporting standards and frameworks available, including Global Reporting Initiatives (GRI), Sustainability Accounting Standards Board (SASB), Task Force on Climate-Related Financial Disclosures (TCFD), and CDP, the road to starting down the path of ESG reporting can seem overwhelming and confusing. A statement of intent issued in September 2020 by five global organizations should help streamline reporting requirements and alleviate some uncertainty. In the press release, CDP, Climate Disclosures Standards Board (CDSB), GRI, SASB, and the International Integrated Reporting Council (IIRC) acknowledged that they would work together towards a comprehensive corporate reporting structure.

ESG disclosure is not just for large, public companies

With the mounting pressure to access capital, the need to communicate ESG commitments and practices is no longer reserved for just larger, more visible public organizations. Companies, small and large, will likely begin to feel the pressure to adapt to ESG disclosure requirements and expectations, which demand greater transparency as they seek additional funding sources, debt, and/or insurance.

Where to start?

With the ongoing introduction of new ESG indexes, standards, frameworks, and funds, knowing where to start along the ESG journey can feel overwhelming. A common misconception is that a company has to set ESG targets and all its frameworks and practices before heading down the disclosure path. In actuality, increasing transparency can go a long way to improving accountability, even with an incomplete ESG narrative.

Is ESG a key part of your decision-making and risk management framework?

A good place to start is to simply start.

- Start mapping out the systems, practices, and frameworks already in place to track environmental, health, and safety (EHS) factors

- Start conducting a benchmarking and gap analysis to determine where you stand against your peers

- Start identifying relevant ESG risks by conducting a materiality assessment

- Start mapping the role your organization may want to play in the transformation of the energy sector

- Start exploring how to integrate ESG into business strategy to drive more value creation

If the thought of incorporating ESG into your organization makes you anxious or feel extremely behind your peers (hint…you are not as late to the game as you may think), Integrated Sustainability can help you navigate through the uncertainty.

Contact us today for more information.

Oksana Kielbasinski, B.Comm

Director, ESG, Sustainability & Risk

oksana.kielbasinski@

1 (403) 681-1221

IntegratedSustainability.ca

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS