By Saket Sundria and Alex Longley

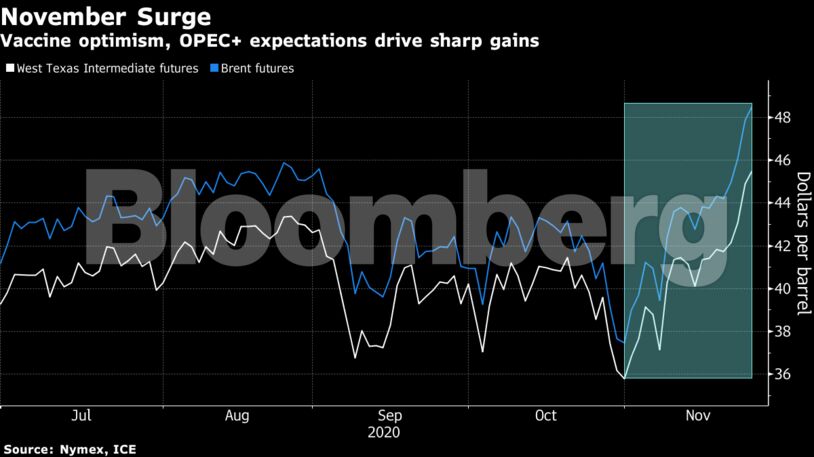

Oil’s value has risen by more than a quarter this month amid positive vaccine results. With the market’s prospects picking up, Brent crude could reach $60 a barrel by the summer of 2021, according to Bank of America Corp. Prices have also been supported by renewed geopolitical tensions, with recent attacks on a fuel depot in the Saudi city of Jeddah and on an oil tanker in the Red Sea.

Click here for OPEC Q&A with Bloomberg oil strategist at 9 a.m. NY time

“The recent news around Covid-19 vaccines has boosted crude prices as markets start to look to a return to some sort of normality in 2021,” said HSBC Bank analyst Gordon Gray. “We expect OPEC+ to err on the side of caution as it evaluates how the market evolves.”

| Prices |

|---|

|

As well as the structure of the futures curve, prices further out have also been moving higher. WTI prices for 2021 were at their strongest level since March early on Wednesday, while those for 2022 topped $45 to reach their highest since September. The higher forward prices are boosting the incentive for oil producers to lock in their supplies for the coming years.

The American Petroleum Institute, meanwhile, reported a 3.8 million-barrel increase in U.S. crude inventories, according to people familiar with the data. That would be a third straight week of gains if confirmed by government figures due later on Wednesday. The median estimate in a Bloomberg survey showed inventories probably rose by 225,000 barrels last week.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire