By Sharon Cho and Grant Smith

The OPEC+ Joint Ministerial Monitoring Committee convenes at 2 p.m. Vienna time to assess whether vast production cuts they’ve made are tackling a global oversupply.

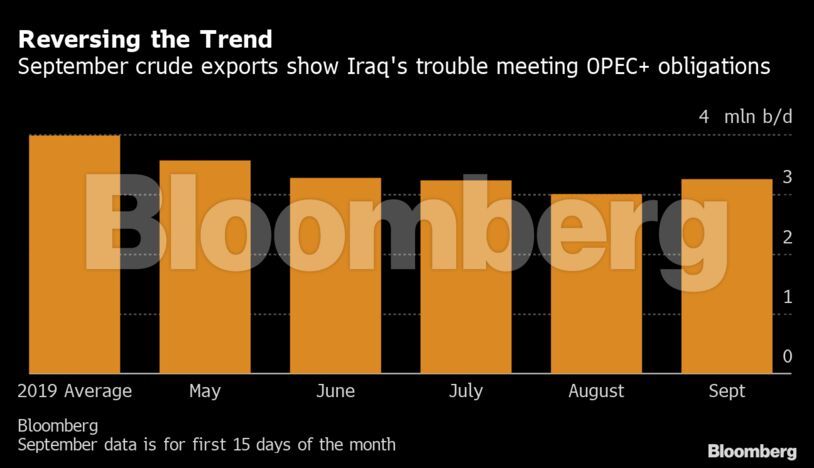

The coalition is still working to get all members to pull their weight in an agreement to constrain supplies: The United Arab Emirates signaled that it would make up for pumping too much oil in the past two months, and Iraq is exporting more crude so far in September than its daily average in August.

“We had a strong increase in two sessions, so it’s not surprising the market will pause while waiting for signals from OPEC+,” said Harry Tchilinguirian, head of commodity markets strategy at BNP Paribas SA.

| Prices |

|---|

|

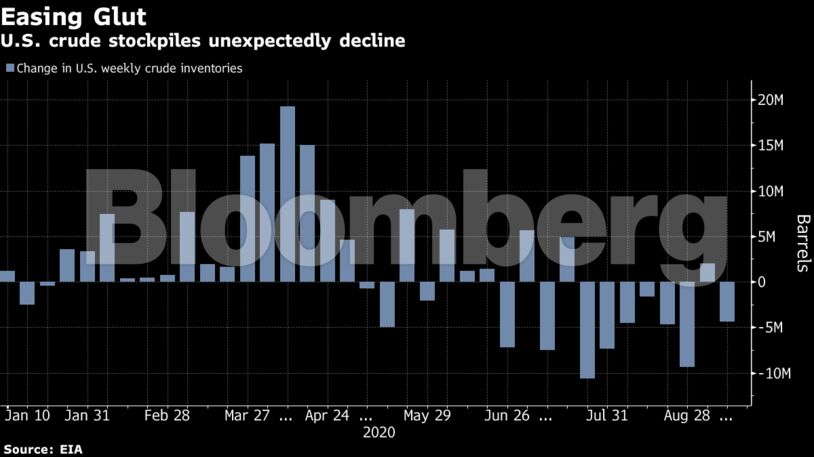

Oil had climbed back above $40 a barrel this week amid some signs of renewed tightness in the market. Inventories fell last week to the lowest level since April, according to government data Wednesday, compared with the forecast for a gain in a Bloomberg survey.

Yet prices have continued to struggle amid bearish calls for the demand outlook from the International Energy Agency and industry players such as BP Plc and Trafigura Group.

The U.S. supply picture remains mixed, despite stockpiles of gasoline falling for a sixth week and crude dropping by 4.4 million barrels. Distillate stockpiles are holding at the highest seasonal level in decades, while demand for diesel, often viewed as an economic barometer, is at the lowest since July.

See also: Tropical Storm Sally Drenches South With ‘Historic’ Flooding

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS