By Nathaniel Bullard

The first way the collective rise of clean energy technologies has changed us? Money. Their success frees up significant early-stage capital to support new companies, unlocks orders of magnitude more long-term cash for financing assets, and has been a major factor in the re-emergence of cleantech (or climate tech, depending on your vintage) investing.

As veteran cleantech investor Rob Day noted this week, the last wave of investment was often “defined too narrowly” around heavy manufacturing and processing, a poor fit for venture capital because it requires billions of dollars to scale and often takes years to do so. Now that wind, solar, and batteries no longer need venture financing, climate investors can focus on companies that’ll benefit most from an early-stage angel, and hopefully create a virtuous cycle of investments and returns.

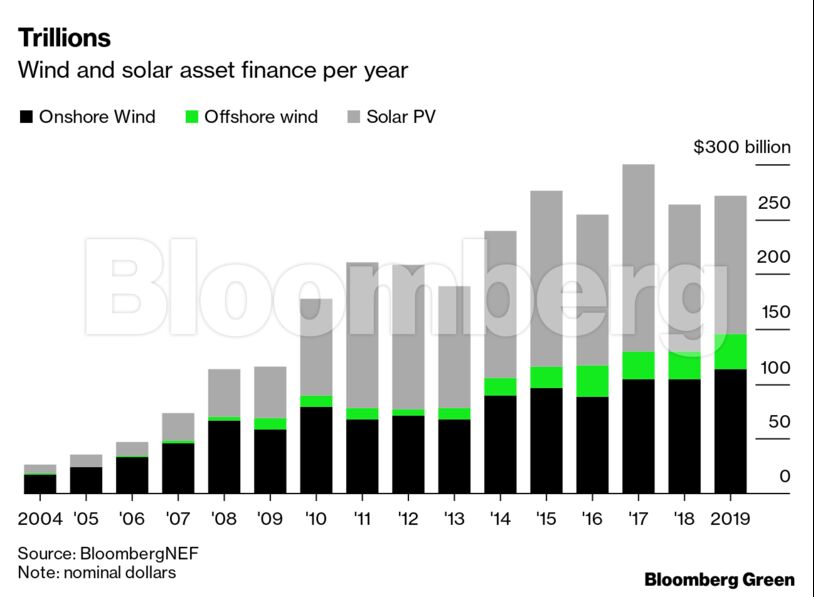

Shayle Kann, another veteran investor, last week drew up what he calls the “Climate Tech Hype Cycle,” plotting everything from carbon-free steel to energy efficiency along the undulating curve of investor interest. On the far left are open questions in terms of technology and market: direct air carbon capture, electric aviation, plastic alternatives. The far right? Utility-scale solar, lithium-ion batteries, and onshore wind—which, not incidentally, have by now attracted trillions of dollars in financing.

Another way these technologies have changed us is time: now that solar, wind, and batteries are officially low-risk, we can include them in our vision of the future. There’s a nice example of this shift in risk perception in a recent story by the Texas Observer on the state’s booming solar business. A rancher whose land has been in the family since the 19th century recently leased a plot to a solar developer who wants to install 709,000 panels on the property. The rancher’s logic? With oil leasing looking increasingly risky and likely to be a depleting source of revenue over time, solar is the long-term option. “I want to be able to hand the land down to the next generation,” he told the paper. “If I can make enough on 1,300 acres to pay the taxes on 10,000 acres, it’s worth it.”

A third way these technologies change us? Scale. Not just their own, but the scale of the markets they could create. Earlier this year my BloombergNEF colleagues analyzed the potential consequences of electrifying energy-intensive sectors of Europe’s economy, including doubling the continent’s clean energy capacity. One result: total electricity generation, which has essentially zero growth right now, would increase by 75% over the next three decades. That’s a huge change in an already huge market, not to mention a qualitative shift in our concept of how big a market can be and the purpose scale could serve.

In 2001, the world installed 290 megawatts of solar generating capacity. The solar project on the Texas rancher’s land alone will generate 200 megawatts of solar power. This year, the world will probably install more than 100 gigawatts of solar, about 350 times more than it did 19 years ago. Something impossible two decades ago, and still fairly remarkable a decade ago, is now commonplace, which makes a person wonder: what’s next?

Nathaniel Bullard is a BloombergNEF analyst who writes the Sparklines newsletter about the global transition to renewable energy.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS