By Akshat Rathi, Laura Hurst and Anna Shiryaevskaya

His comments show that Shell is sticking to the optimism showed in its annual LNG Outlook in February, before the Covid-19 pandemic started to ravage markets on a global scale.

In its outlook, Shell said it expects annual LNG demand to double to 700 million tons by 2040. Consumption increased by a record 13% to 359 million tons in 2019.

The International Energy Agency expects LNG, the main driver of international gas trade, to expand by 21% in 2019-2025, reaching 585 billion cubic meters annually. The growth will come from China and India, the IEA said in its Gas 2020 report published Wednesday. Trade will increase at a slower pace than liquefaction capacity additions, limiting the prospects of a tighter market, it said in the report.

But even the global leader will feel some pain in the short term. Shell warned in April that its gas liquefaction volumes may fall in the second quarter.

The company and its peers slashed spending to cope with the collapse in oil prices. International majors have cut capital spending by 20% to 30% with projects being put on hold or shelved altogether. Shell walked away from the multibillion-dollar Lake Charles LNG terminal in March because of the glut, but Chief Financial Officer Jessica Uhl has said production cuts across its oil and gas portfolio would not be permanent.

Biggest Trader

Shell became the world’s top participant in the LNG business after the acquisition of BG Group Plc in 2016, which boosted its portfolio of supply contracts and stakes in LNG plants around the world.

World’s Biggest LNG Players Brace for Oil Slump to Sour Earnings

“We will obviously flex our investment program to be aligned with where we believe the sector will go, but the profitability of the business and the outlook of this business is going to be as good as what you saw before the pandemic,” Van Beurden said.

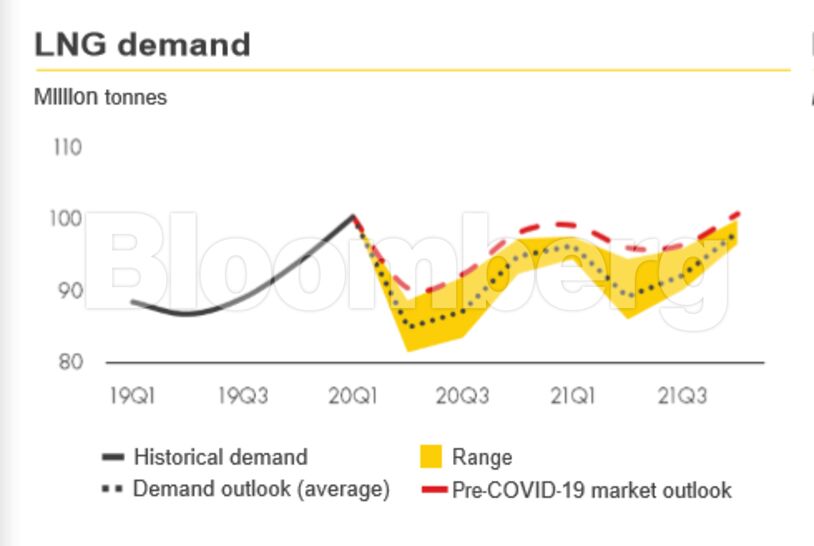

Global LNG demand has surpassed expectations this year, industry consultant Timera Energy, said in a note Monday.

Gas prices in Europe, one of the key consumers regions, could also “surprise to the upside” in the next two to three years as the glut gradually disappears, Timera said. The recovery has already started as lockdown measures are lifted and demand could be back to normal in the next few months, the company said.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS