By Vivian Nereim and Sylvia Westall

Saudi Arabia, the biggest Arab economy, tripled its value-added tax and trimmed allowances for government workers. Oman cut salaries of new state employees.

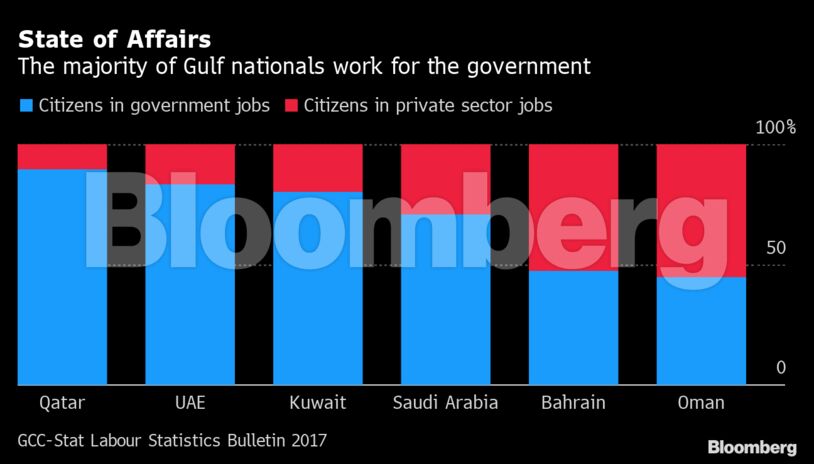

Even in the United Arab Emirates — a financial and commercial hub with the Gulf’s most diversified economy — there are calls for overhauling a so-called “rentier state” model, which depends on hydrocarbon wealth to support government jobs for citizens, generous benefits and a largely tax-free environment. A prominent Emirati lawyer recently called introducing corporate tax “unavoidable.”

Yet for all the talk of accelerating overdue changes, there were also moves to protect state jobs and shield nationals employed in the private sector, casting doubt on whether the downturn will prompt deeper reforms that outlive the crisis.

“The global economic recession has become a trigger for real reconsideration of the fundamentals of the economic models in the Gulf,” said Ayham Kamel, head of Middle East and North Africa at Eurasia Group. “In Saudi, Crown Prince Mohammad bin Salman wants change, but it’s far from easy to kill off the rentier-state model.”

Austerity will affect Saudis like Mohammed, who works for the state, like almost two-thirds of his compatriots. When his pay was cut by 1,000 riyals ($266) a month after a cost-of-living allowance was canceled, the 29-year-old doctor said the measures were necessary. But he also hopes they’ll be reversed later, like they were in past crises.

“If it’s temporary, one or two years, I can adapt,” he said, asking to withhold his full name. “My concern is that more taxes will be permanent — and that will be an issue.”

Thrift may be in place for longer this time given the fiscal outlook. And with less money to spend on citizens, governments could face increased public scrutiny of how their oil wealth is used.

In an unusual move for Saudi Arabia’s state-friendly media, local newspaper Okaz recently published two columns questioning the policy changes.

“Citizens worry that the pressure on their living standards will outlast the current crisis,” wrote columnist Khalid Al-Sulaiman. “Increasing VAT from 5% to 15% will have a big effect on society’s purchasing power and will reflect negatively on the economy in the long term.”

Fiscal Woes

Almost all the countries in the region are expected to run budget shortfalls of 15%-25% of economic output, leading to a build-up of debt, dwindling reserves, and tough choices. Saudi Arabia’s economy is forecast to contract by 2.9% this year, the most since 1999, according to Bloomberg Economics, with risks of an even deeper downturn.

Saudi Arabia Triples VAT, Cuts State Allowances Amid Crisis

Saudi officials had been trying to reduce dependence on oil and trim the wage bill long before the epidemic; both are goals of the “Vision 2030” plan championed by the crown prince. The kingdom’s de-facto ruler has pushed through big changes since late 2015, though some were rescinded or softened after public blowback. Simultaneously, he’s cracked down on dissent, stifling criticism. The crisis could be an opportunity to intensify the transformation, particularly when nationalism is running high.

Others around the region are following suit.

“We will have a lot of questions about what constitutes a Gulf rentier-state model,” UAE Minister of State Anwar Gargash said on a panel last month. “I think this is going to accelerate the necessity for us to find something a little bit more sustainable.”

In Kuwait, ruler Sheikh Sabah Al-Ahmed Al-Sabah renewed a call for an economy less reliant on oil and urged rationalizing spending. His son, who sits on the planning & development council, lamented a lack of progress and said the impact of the pandemic might make such changes unavoidable.

| What Our Economists Say… |

|---|

| “You have seen some examples of austerity measures but we have also seen moves that indicate a doubling-down on rentierism. Recent examples include Oman’s call for foreigners to be replaced with nationals in government jobs, the UAE preventing banks from firing citizens and Saudi Arabia’s finance minister alluding to state support for the kingdom’s workforce.”

— Ziad Daoud |

Saudi Arabia’s decisions are worth emulating, said Eid Alshihri, a 42-year-old business consultant and a member of the Kuwaiti Entrepreneurs Society. But reforms are caught up in a political struggle with Kuwaiti lawmakers, who are blocking them for fear of losing seats and instead point to the sovereign wealth fund as a possible source of money to help weather the crisis.

Government steps to help businesses were too little, too late, and the result will be the opposite of diversification, Alshihri said. “Many will shut down and apply for government jobs.”

While some in Saudi Arabia say they’re happy to assume part of the burden, others are frustrated. Complaints could increase as the impact of the crisis sinks in; the higher VAT starts in July.

The government has already stirred controversy by continuing to spend elsewhere. Officials say the sovereign wealth fund is seizing an opportunity to take advantage of market turmoil, building stakes in companies including Carnival Corp., Boeing Co. and Facebook Inc.

“Why are they investing abroad so much and so impulsively, while investment in the people and their minds is so weak?” said Talal, a 23-year-old accountant, whose company cut his monthly salary by 600 riyals when the pandemic struck. “Officials say that there’s growth and there’s revenue and blah, blah — where did that go?”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS