By Julian Lee

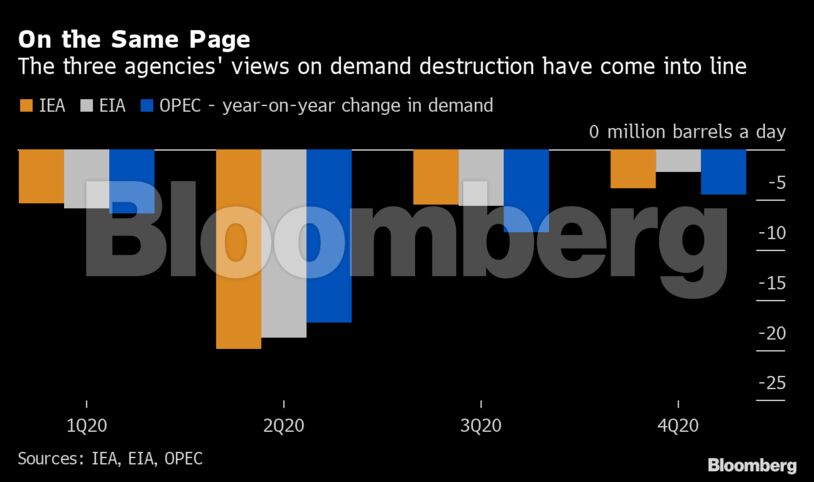

The International Energy Agency, the Organization of Petroleum Exporting Countries and the U.S. Energy Information Administration have all updated their oil market forecasts in the past week and they have come into much closer alignment in their views of the depth of demand destruction. The pessimistic stance adopted last month by the International Energy Agency has now become the consensus view — the world will use about 1.7 billion barrels less oil this quarter than it did during the same period last year.

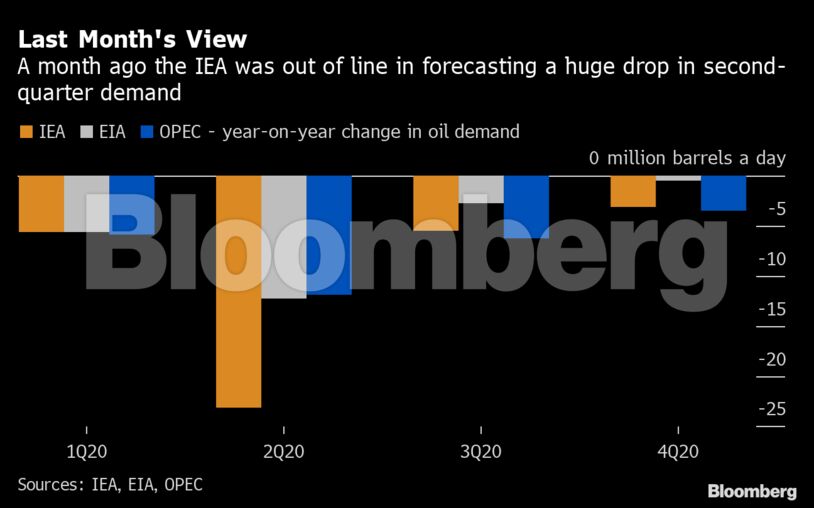

In reports published mid-April, the EIA and OPEC both saw demand falling by about 12 million barrels a day in the second quarter, compared with the same period last year. The IEA alone forecast a drop in excess of 20 million barrels a day. It has since become a little more optimistic, as lock-downs are eased and businesses gradually begin to reopen. But the other two forecasters have moved sharply in the opposite direction, seeing much more demand destruction than they did a month ago and catching up with the IEA’s more pessimistic view on oil consumption.

All three still see the situation improving dramatically in the second half of the year. Although demand is expected to remain below year-earlier levels throughout 2020, the size of the drop is seen to shrink significantly. The IEA and the EIA see it around 5 million barrels a day below last year’s levels in the third quarter, while OPEC is less optimistic, with its forecast still showing a year-on-year loss of more than 8 million barrels a day. The situation is seen improving further in the final three months of the year, with estimates of the demand loss ranging from 2.26 million barrels a day from the EIA to 4.5 million from OPEC.

But, as the IEA warns, the biggest uncertainty is “whether governments can ease the lock-down measures without sparking a resurgence of Covid-19 outbreaks.” At present, the forecasts assume that they can. If that assumption proves incorrect, then we could be in for another slump in demand as widespread lock-downs return.

Even as the EIA and OPEC have become more pessimistic about the size of the second-quarter demand destruction, the overall mood surrounding the oil market has become more optimistic. In part that’s the result of the first signs that the worst of the demand destruction may have passed, but it also reflects optimism about the impact of output cuts that are a necessary part of balancing the market.

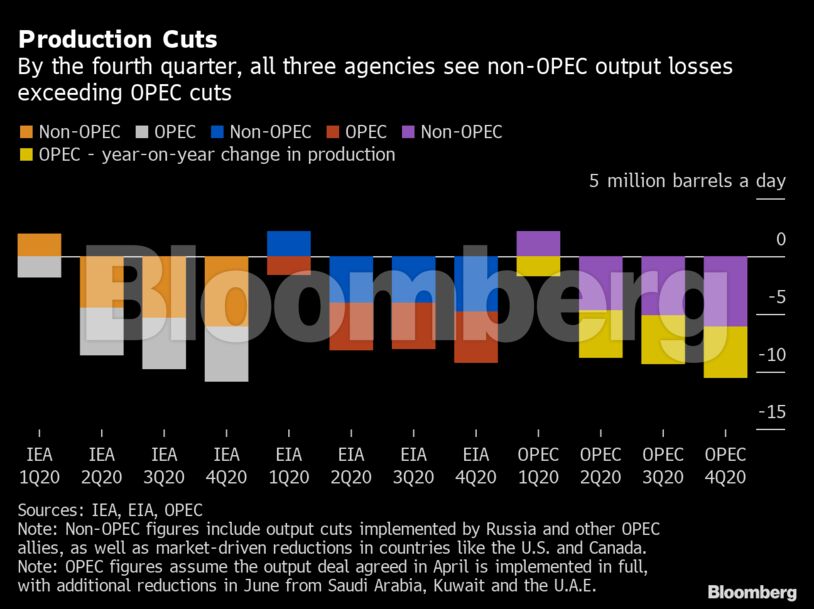

The IEA points to “massive cuts” in production from countries outside the OPEC+ agreement, which itself saw 20 countries agree to cut output by an unprecedented 9.7 million barrels a day in May and June from baselines that were mostly set at October 2018 levels. If the OPEC+ countries comply fully with their agreed cuts — which would be a first — the agency sees global oil production in May some 12 million barrels a day below the April level. A further cut of 1.2 million barrels a day by Saudi Arabia, Kuwait and the United Arab Emirates has been pledged for June.

The IEA and OPEC already see declines in non-OPEC output — including the cuts implemented by Russia and other OPEC allies, as well as the market-driven reductions in countries like the U.S. and Canada — outstripping the effect of the OPEC cuts. All told, they see global oil production more than 8.5 million barrels a day lower than it was a year ago on average in the second quarter, while the EIA sees it down by a little over 8 million barrels. By the end of the year, the IEA and OPEC see producers everywhere pumping in excess of 10 million barrels a day less than they were a year earlier. The EIA sees the reduction at a little over 9 million barrels.

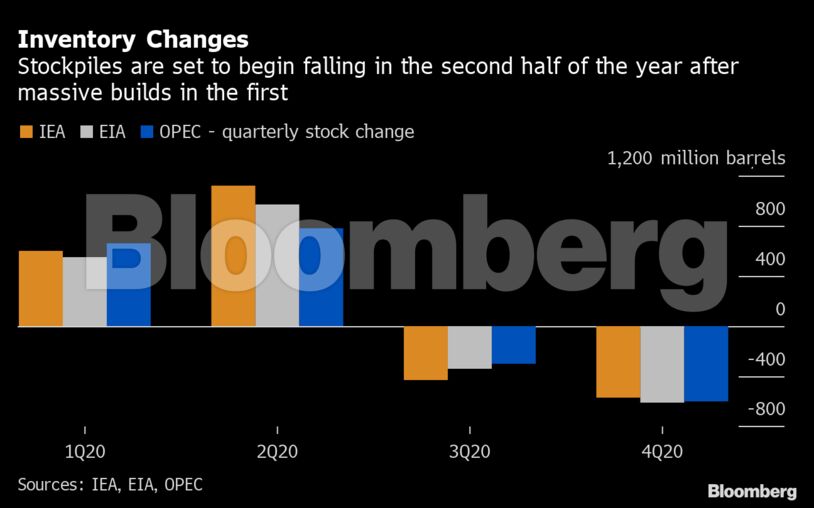

The output cuts, voluntary or otherwise, aren’t nearly big enough to offset the collapse in demand during the current quarter. Inventories are expected to build by somewhere between 780 million barrels (OPEC) and 1.12 billion barrels (IEA) over the course of the second quarter. But they should start to come down again in the second half of the year, as demand begins to recover and output cuts get deeper.

Even if the OPEC+ countries implement their output deal as planned and in full, including the additional reductions offered by Saudi Arabia and its closest allies for June, the world’s stockpiles of oil will be much higher at the end of the year than they were at the beginning. OPEC’s latest forecast shows an increase of about 530 million barrels in global stockpiles, while the EIA’s figures show a build of 620 million barrels. The IEA foresees the biggest addition of the three, with worldwide oil inventories ballooning by more than 725 million barrels, a volume that exceeds the U.S. government’s strategic crude reserves.

Even if oil demand returns to pre-virus levels in 2021, which remains an optimistic view, oil producers will remain under pressure while excess inventories are drawn down.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS