By Liam Denning

Russia’s unwillingness to go along with Saudi Arabia’s emergency supply cut fuels speculation the whole OPEC+ thing is done. I don’t agree. OPEC+ has always been largely a marketing and political tool. Formally ditching it now would merely make obvious the underlying truth: OPEC+ wouldn’t exist in the first place unless OPEC on its own had lost credibility. If we are left with an arrangement mixing co-dependency with disagreement and frustration … well, we’ve all observed marriages like that, haven’t we? (Not yours and mine, obviously.)

What’s more, Russia is right.

It’s now been more than three years since the first supposedly six-month OPEC+ supply cut began. Saudi Arabia, OPEC’s de facto leader, had previously tried flushing the oil market in hopes of squeezing out rival U.S. and Russian barrels. When that didn’t work, it co-opted Russia into a plan to trade market share for higher prices. The results have been — to put it kindly — ambiguous.

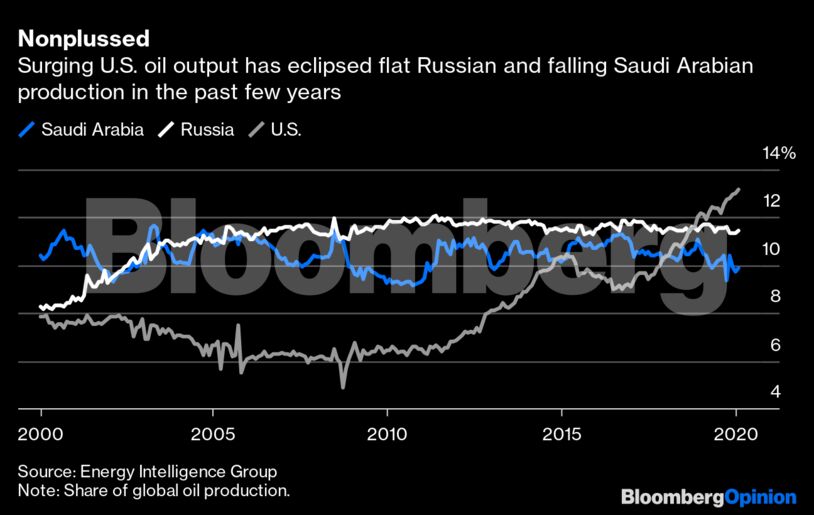

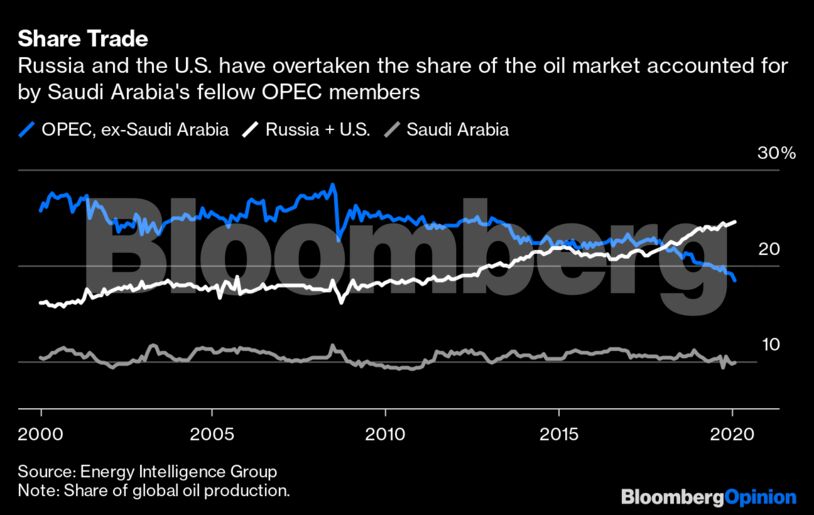

OPEC’s market share has slumped to its lowest level so far this century, and Saudi Arabia’s is back to levels last seen almost a decade ago. Russian production, meanwhile, has flattened rather than dropped. That is positive in one sense, as that country’s oil majors would otherwise probably be raising output by several hundred thousand barrels a day each year. However, U.S. producers, given succor by OPEC+ and the support lent to oil futures, have gamely jumped into the gap.

As of late Friday morning in New York, Brent crude oil was trading below $46 a barrel — close to where it was the day before the OPEC+ agreement was first struck in November 2016. In other words, the group has traded market share in return for … well, maybe not nothing, but not a whole lot of something either.

OPEC’s problem is that the ability to actually manage oil production rests in the hands of just a few members, chiefly Saudi Arabia and a couple of its neighbors on the Arabian peninsula. As I wrote here, much of the group’s apparent restraint these past few years is really just impotence dressed up as abstinence. Deflating production costs elsewhere, as exemplified by (but not confined to) the shale boom, have reduced the economic rents available to OPEC’s under-diversified economies. Meanwhile, even as the coronavirus crisis savages near-term oil demand, challenges to long-term demand are building.

Russia’s position inflicts more pain immediately but also comports more with reality. The lack of flexibility in many OPEC economies — and, by extension, their oil production — makes their supply cuts a blunt tool in a more dynamic and competitive market. A demand shock like the current one is just the most extreme demonstration of this.

In a world where Russia and the U.S. now produce more oil than all of OPEC’s members outside of Saudi Arabia, the group’s ability to manage prices looks more questionable than ever. Moreover, if they want to monetize more of their giant oil reserves as demand growth looks set to taper off, they must encourage demand for as long as possible with lower prices.

The other reason to raise production and let prices fall is the vulnerability of the shale producers. When Saudi Arabia tried to flood the market last time, it ran into the problem of U.S. capital markets. Just as the social costs of OPEC economies add to the breakeven oil price they need, American producers effectively enjoyed a discount on theirs, in the form of equity and bond investors willing to absorb the losses generated by sub-economic projects.

All that has changed. The energy high-yield bond market now carries a spread of about 1,000 basis points, which is where triple-C bonds in general were trading just two weeks ago. And even mighty Exxon Mobil Corp., sticking doggedly with its giant spending budget, has lost almost $100 billion in market cap so far this year and now yields more than 7%.

A year or so of lower oil prices would give a big nudge to the rationalization America’s exploration and production sector has needed for a while, taking U.S. barrels out of the market — and also, importantly, many of the most irrational producers. In doing so, it could ultimately raise the oil cost curve and might also, once the sheer avoidance phase of the coronavirus emergency has passed, spur demand.

Rather than this week’s disagreement leading to a formal break, Saudi Arabia and the other OPEC “haves” should take Moscow’s cue and recognize they cannot cut their way out of a pandemic-inspired crash. Instead, they should be looking to what comes after, when they will still want to influence oil prices and will need Russia’s help to do so. If that means the end of OPEC as an effective standalone organization, well, the creation of OPEC+ signaled that very same thing anyway.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS