By Saket Sundria and Alex Longley

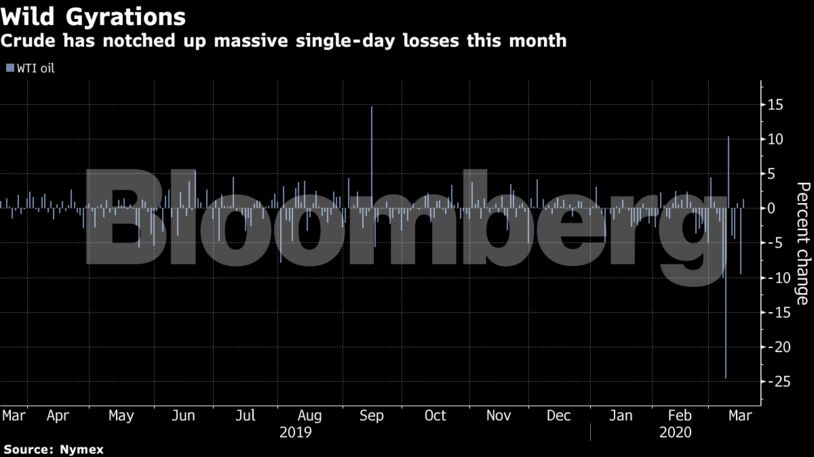

As airlines cut more flights and a growing number of countries go into lockdown, oil markets are facing a glut. The slump in demand is coinciding with a flood of supply as Saudi Arabia and Russia engage in a price war for market share. New York futures lost 23% last week, the most since December 2008.

“Demand losses across the complex are now unprecedented,” Jeff Currie, head of commodities research at Goldman Sachs Group Inc., wrote in a report, saying oil consumption is down by 8 million barrels a day. The bank said it expects West Texas Intermediate to trade higher than Brent this quarter, and cut its Brent forecast for the second quarter to $20 a barrel.

Brent for May settlement traded up 1 cent at $30.06 a barrel on the ICE Futures Europe exchange as of 10:40 a.m. in London. WTI for April delivery rose 44 cents, or 1.5%, to $29.14 a barrel on the New York Mercantile Exchange.

The turmoil in oil is being played out across financial markets, with Wall Street stocks suffering their biggest plunge since 1987 on Monday after President Donald Trump warned of a possible recession. U.S. equity futures fluctuated on Tuesday and European stocks dropped as investors struggled to find their feet.

Oil’s spectacular crash hasn’t deterred Saudi Arabia from pumping historic levels of crude. State-run Saudi Aramco plans to produce at its maximum capacity of 12 million barrels a day in April, Chief Executive Officer Amin Nasser told investors, saying, “I doubt if May will be any different.”

| More oil news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS