By Sharon Cho and Alex Longley

Trading has been volatile in recent days, with some consultants and banks forecasting a decline in oil demand for the first time since the financial crisis. The Federal Reserve implemented an emergency half-percentage point interest-rate cut on Tuesday.

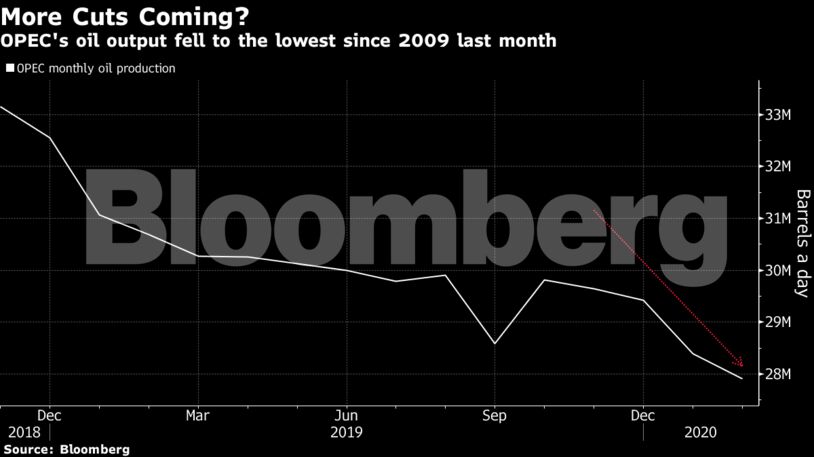

While the Organization of Petroleum Exporting Countries and its allies are widely expected to agree on deeper output cuts, whether they will be enough to prop up prices. Beyond near-term prices, the market’s structure remains weak and options pricing is at its most bearish since June. That comes as Goldman Sachs Group Inc. and two consultants said they expect demand to shrink this year for only the fourth time in four decades.

“In terms of fundamentals the numbers are being changed very quickly,” says Olivier Jakob, managing director of Petromatrix GmbH. “It’s going to be about OPEC and the reaction to that. There’s a lot of uncertainty.”

West Texas Intermediate futures for April delivery rose 56 cents, or 1.2%, to $47.74 a barrel on the New York Mercantile Exchange as of 10:34 a.m. in London. Brent futures for May increased 1% to $52.38 a barrel on the ICE Futures Europe exchange.

See also: OPEC Producers Peddle More Oil to Asian Refiners on Virus Hit

For OPEC+ to secure a significant output cut to stem a price rout, the group must overcome Russian resistance. The outbreak has worsened since the Joint Technical Committee last met in February. At that meeting, they recommended an output cut of just 600,000 barrels a day.

The rate cut by the U.S. Federal Reserve was the first move outside of regular meetings since the 2008 global financial crisis and was announced hours after Group of Seven finance chiefs held a rare teleconference to pledge they would do all they can to fight the health crisis.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS