By Robert Tuttle

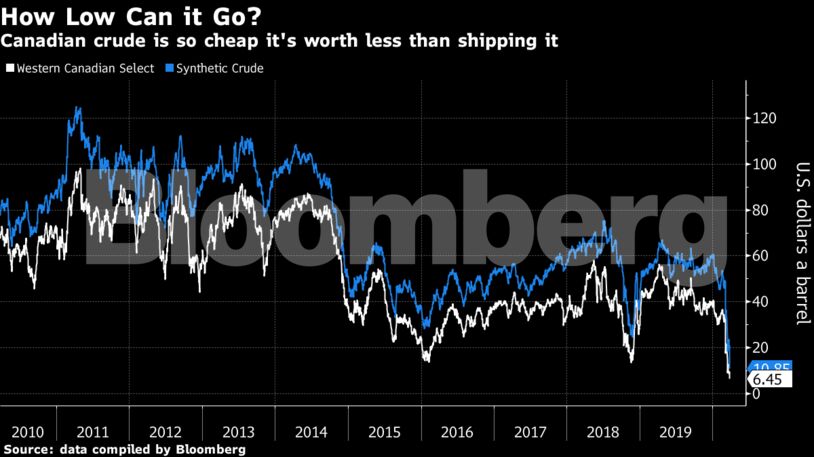

Canadian heavy crude now costs less than the price paid by a company with long-term contracts to ship it down Enbridge Inc.’s Mainline and Flanagan South systems to Texas. That’s a problem for oil-sands producers like Cenovus Energy Inc., which has commitments to ship 75,000 barrels a day down the system. MEG Energy Corp., another heavy oil producer, has contracts to ship 50,000 barrels a day and has plans to expand to 100,000 barrels a day in the second half of 2020.

Enbridge charges between about $7 to a little over $9 a barrel to ship heavy oil to Texas, excluding additional charges such as for power, according to tariff documents. Emails to Cenovus and MEG weren’t immediately returned.

Due to its relative isolation and the limited availability of pipelines for export, Canada’s oil patch has been among the first to experience the full weight of the global crude price collapse, caused by the massive contraction in oil demand due to the coronavirus outbreak and a pledge by Saudi Arabia to unleash record amounts of supply. Some of the largest oil-sands producers, like Suncor Energy Inc. and Athabasca Oil Corp., have been forced to react to benchmark crudes hitting historic lows, and have limited or shut down operations.

And even more shutdowns may be expected, according to Tudor Pickering Holt & Co.

“At current bitumen prices, large scale in-situ shut-ins are possible as operating netbacks trend into challenging territory,” Tudor said in a note Thursday.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire