By Verity Ratcliffe and Anthony DiPaola

The world’s biggest company by market value, which listed in the Saudi Arabian capital of Riyadh in December, will pay the dividends on a quarterly basis, it said in its 2019 financial results released on Sunday.

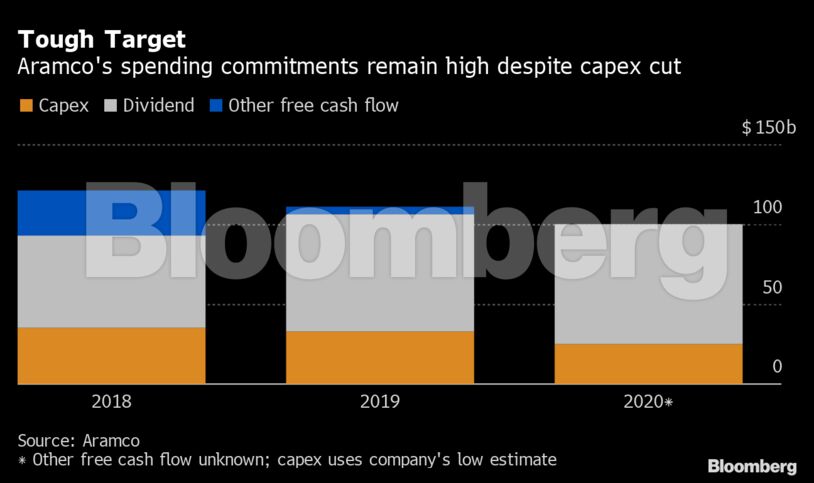

Capital expenditure will be cut to between $25 billion and $30 billion this year, from $32.8 billion in 2019. But the firm would still need at least $100 billion to meet its dividend and capex commitments alone, almost matching its 2019 payments.

The spread of the coronavirus and the oil-price war instigated by Saudi Arabia after Russia rejected coordinated production curbs has sent Brent crude prices spiraling. They have fallen almost 55% since the end of December to barely $30 a barrel, and some analysts predict they’ll drop further to below $10.

Low oil prices would crimp Aramco’s earnings and hurt Saudi Arabia’s finances. The kingdom’s royalties dipped more than 12% in 2019 and it needs an oil price of $84 to balance this year’s budget.

Aramco’s shares lost 3.1% on Monday, closing at a record low of 27.80 riyals. They’re down 13% from the listing price.

Aramco will be able to achieve a free cash flow of $63 billion in 2020, according to Riyadh-based Al Rajhi Capital. That calculation assumes the company pumps 10.7 million barrels per day and Brent crude prices average $30 a barrel.

Raising debt is an option as borrowing costs are low and the company is still within its debt-to-equity ratio of 5-15%. The yield on Aramco’s $3 billion bond due in 2029 has climbed this month amid a global selloff of emerging-market assets, but at 3.76% is not much higher than when the debt was issued last April.

The government could also cut its own dividend allocations while paying private shareholders, which own around 1.5% of the company, their portion of the $75 billion.

“They don’t need to liquidate assets, restructure or borrow capital,” said Mazen Al-Sudairi, head of research at Al Rajhi. “They can do it easily from their cash flow, but it might affect the money transfer to the government for one or two quarters.”

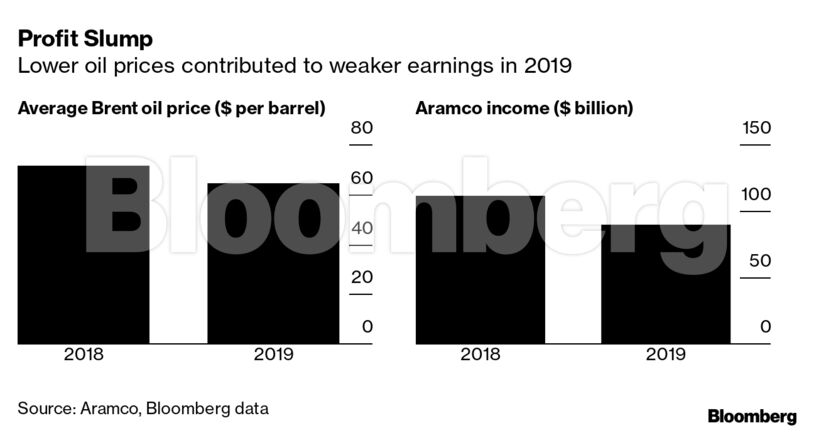

Aramco’s profit slumped 21% in 2019 to 331 billion riyals ($88 billion) because of lower oil prices and production. Drone and missile attacks on two major facilities in September temporarily slashed its supply by more than half.

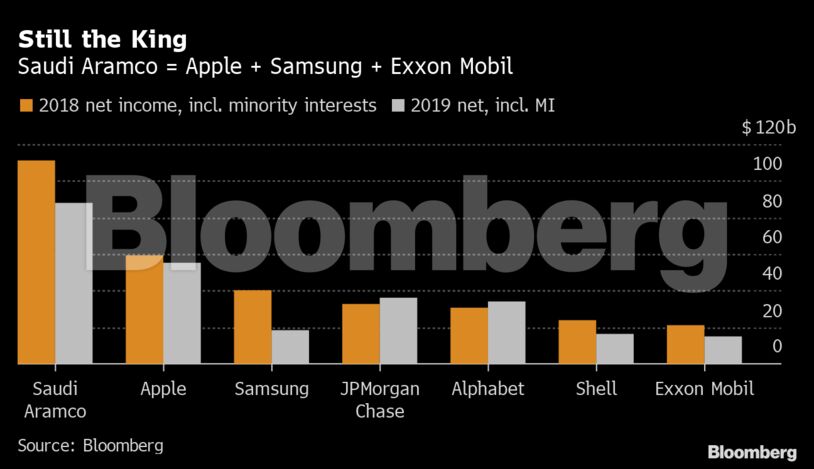

Despite the fall, the energy producer is still the world’s biggest company by market value and the most profitable. Aramco’s 2019 income was equal to that of Apple Inc., Samsung Electronics Co. and Exxon Mobil Corp. combined.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS