By Grant Smith and Serene Cheong

As the overhang begins to accumulate, top oil traders such as Vitol SA, Royal Dutch Shell Plc and Litasco SA are seeking to hoard crude on vessels at sea. One Chinese energy company has invoked a legal clause to avoid taking delivery of liquefied natural gas.

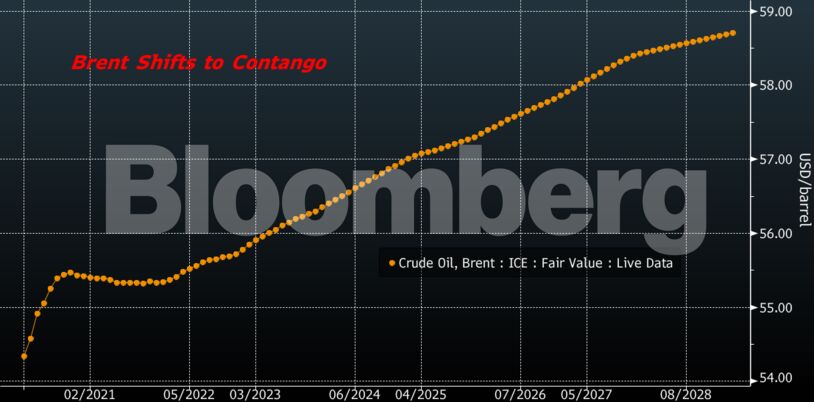

“When the oil market is in surplus — as it is now — the forward curve needs to be in contango in order to pay for the storage of the building surplus,” said Bjarne Schieldrop, chief commodities analyst at Swedish bank SEB AB. It’s the first time a full contango has taken hold in a year, he said.

Brent crude for April settlement rose $1.11 to $54.38 a barrel on the ICE Futures Europe exchange in London as of 12:22 p.m. local time. The U.S. benchmark, West Texas Intermediate, was at $50.48 on the New York Mercantile Exchange.

The North Sea crude market, priced using Brent, suffered an “immediate collapse” when shipments to Asia were disrupted, said Olivier Jakob, managing director at consultants Petromatrix GmbH. With Europe also receiving shipments from the U.S., “a surplus can quickly be created.”

The Organization of Petroleum Exporting Countries and its partners have fanned speculation over the past two weeks that they might take action to arrest the slump in prices. A committee of their technical experts recommended last week that the coalition deepen current supply curbs by a further 600,000 barrels a day to drain the excess created by the virus.

Yet the latest signals from the group have deflated those hopes. Azerbaijan’s energy minister said on Monday that the alliance probably won’t meet before it’s scheduled March meeting. And days after promising to announce Russia’s position, Energy Minister Alexander Novak would only say on Tuesday that Moscow is considering the proposal.

Russian President Vladimir Putin will meet Rosneft PJSC chief Igor Sechin later on Tuesday and may discuss OPEC+ issues with him, Kremlin spokesman Dmitry Peskov told reporters.

| Other oil-markets news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS