By Saket Sundria and Grant Smith

Brent futures increased for a seventh day, the longest run of gains since early 2019, even as Chinese refineries slashed processing by 25% from last year as the virus hit travel and economic activity. The contract jumped 1.8%.

Crude is being supported along with equities by signs that China, the world’s biggest oil importer, is considering steps to shore up its economy, such as direct cash infusions and mergers to revive its airline industry.

Prices are also drawing support from a range of supply disruptions.

Cease-fire talks were suspended in OPEC member Libya after the capital’s port was shelled by forces loyal to military commander Khalifa Haftar, who has choked off the country’s exports. Venezuela’s ability to export crude was further threatened as the U.S. sanctioned a unit of Russia’s Rosneft PJSC for maintaining ties with President Nicolas Maduro and the state-run oil company.

“The Rosneft story and the outage in Libya could help make the market less oversupplied in the first quarter,” said Giovanni Staunovo, an analyst at UBS Group AG in Zurich. Equities are also lending support to crude, he said, citing expectations that “this virus situation will all be sorted out at some stage.”

Brent for April settlement climbed $1.07 to $58.82 a barrel on the ICE Futures Europe exchange as of 2:26 p.m. in London, after gaining more than 8% in the past six sessions. West Texas Intermediate for March delivery advanced 82 cents, or 1.6%, to $52.87.

Besides the involuntary losses in OPEC countries, the cartel and its partners are contemplating deepening the deliberate production cutbacks they’ve made this year. A technical committee representing the OPEC+ alliance recommended earlier this month that the producers should curb supply by a further 600,000 barrels a day to offset the impact of the coronavirus.

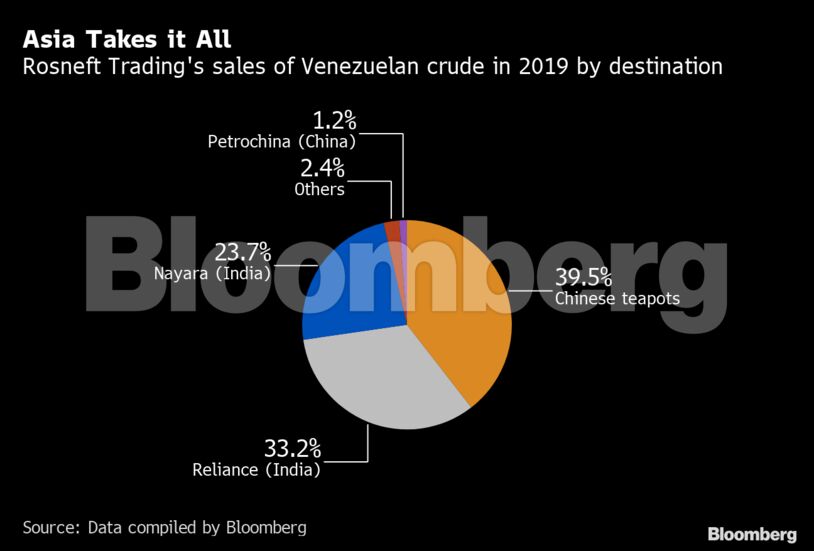

Rosneft Trading, the main exporter of Venezuelan crude, was targeted by the U.S. for helping to sell the commodity that bankrolls Maduro’s regime. The sanctions are the toughest in the U.S. Treasury’s arsenal and render Rosneft Trading effectively untouchable to international companies, including shipowners, insurers and banks.

Meanwhile, the latest attack in Libya forced authorities to evacuate tankers carrying gasoline and liquefied petroleum gas before they had unloaded, according to an official from state-run National Oil Corp. The nation’s crude output has dropped to around 123,000 barrels a day from 1.2 million a day before a blockade of ports by Haftar’s supporters started in mid-January.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS