By Sharon Cho and Grant Smith Futures in London initially surged more than 5% as the Islamic Revolutionary Guard Corps claimed responsibility for the missile strikes in Iraq, and held above $68 a barrel on concern of further escalation in the oil-rich region. Yet the gains had largely dissipated by the end of the morning, following a U.S. statement that no personnel had been killed and an early tweet by President Donald Trump that “all is well” following the attacks.

Crude hit a three-month high of almost $72 a barrel immediately after the incident, in which 10 missiles struck the Ayn al-Asad base in western Iraq and another facility in Erbil. The strike followed the killing of Iranian General Qassem Soleimani last week on Trump’s orders. Tensions have flared between the two nations since the U.S. re-imposed sanctions on Iran last year over its nuclear program.

“Not a single drop of oil supply has been lost due to the recent incidents and that is why the oil price so quickly has fallen back down again,” said Bjarne Schieldrop, Oslo-based chief commodities analyst at SEB AB.

Wednesday’s early rally faded after Trump’s tweet, while Iranian Foreign Minister Mohammad Javad Zarif said on Twitter that the country had “concluded proportionate measures in self-defense” and is not seeking “escalation or war.” Prices also abated as officials from the Organization of Petroleum Exporting Countries promised to keep supplies flowing to customers.

“We are not forecasting a shortage of supply unless we have a catastrophic escalation, which we don’t see,” United Arab Emirates Energy Minister Suhail Al Mazrouei said in Abu Dhabi. OPEC Secretary-General Mohammad Barkindo said he was “confident that our leaders are doing everything possible to restore normalcy.”

Brent crude rose as much as $3.48 to $71.75 a barrel, before trading 14 cents higher at $68.41 on the ICE Futures Europe exchange as of 12:33 p.m. London time. West Texas Intermediate climbed as much as $2.95, or 4.7%, to $65.65 on the New York Mercantile Exchange, it later slipped to $62.52.

While oil flows from the Middle East continue unimpeded for now, fears persist about the risk to exports from the region, which accounts for almost a third of global supplies. Half of Saudi Arabia’s production was briefly knocked out by a missile strike in September, and most crude exports from the Persian Gulf transit the Strait of Hormuz waterway, which Iran has in the past threatened to close.

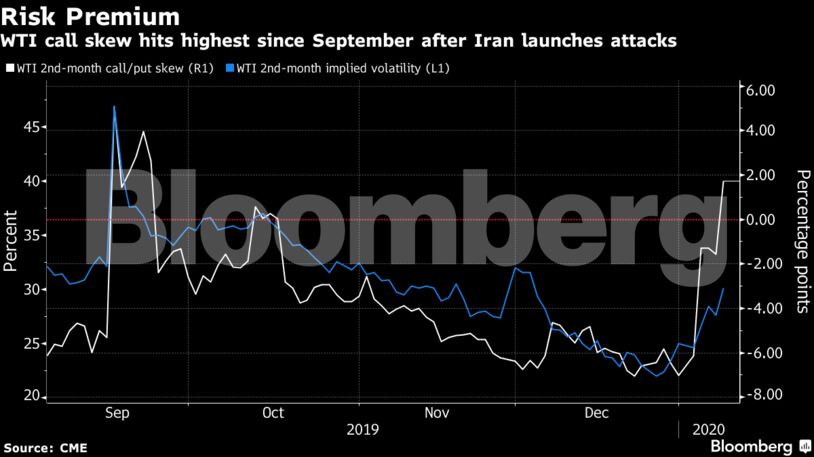

Investors are paying up in order to protect against higher prices after the strikes. Call options on WTI — which allow the holder to buy futures at a set price — are at the biggest premium to puts since September, when it spiked in the wake of the attacks on Saudi oil sites. Implied volatility — a key measure of how expensive the options are — reached the highest since early December.

“If Iran seeks further targets for retaliation to the killing of Soleimani, but without crossing declared U.S. red lines that would prompt a military response, energy infrastructure may be appealing,” said Jason Bordoff, a former Obama administration official who now works at Columbia University. An actual supply disruption would send prices soaring, depending on the magnitude and expected duration of the outage, he said.

The market’s relatively muted response is another sign that global supplies are in an era of abundance, largely powered by the American shale-oil revolution. Furthermore, OPEC is sitting on huge amounts of spare capacity after reducing supplies for most of the past three years, while big oil consumers including the U.S. and China also hold millions of barrels in strategic reserves that can be deployed to offset any shortage.

Share This:

Oil Rally Cools as Iranian Strike Causes No U.S. Casualties

These translations are done via Google Translate

These translations are done via Google TranslateFEATURED EVENT

GET ENERGYNOW’S DAILY EMAIL FOR FREE

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS