By Elizabeth Low and Grant Smith

“As much as the API has taken the wind out of bulls’ sails, the lull in upside is expected to be short-lived,” said Stephen Brennock, an analyst at PVM Oil Associates Ltd. in London. “After all, recent positive developments have given oil fundamentals for next year a supportive shot in the arm.

Crude has rallied almost 10% this month as the Organization of Petroleum Exporting Countries and its allies agreed to deeper-than-expected output cuts and the world’s two largest economies announced a limited trade deal. However, forecast increases in production next year from non-OPEC countries may keep a lid on price gains.

West Texas Intermediate crude for January delivery, which expires Thursday, fell 48 cents, or 0.8%, to $60.46 a barrel on the New York Mercantile Exchange as of 10:56 a.m. in London. The contract finished up 1.2% on Tuesday at $60.94, the highest close since Sept. 16. The more-active February contract traded 49 cents lower at $60.38.

Brent for February settlement declined 31 cents to $65.79 a barrel on the London-based ICE Futures Europe Exchange after climbing 1.2% Tuesday. The global benchmark crude traded at a $5.40 premium to WTI for the same month.

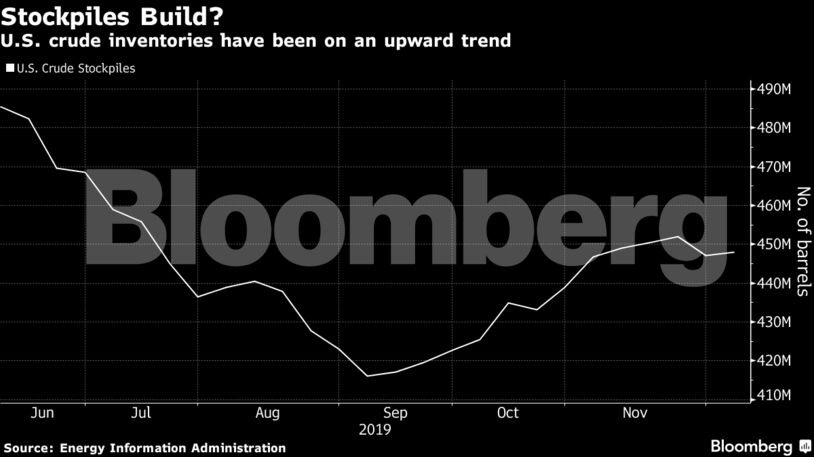

If the API data is confirmed by the Energy Information Administration later, it would be the largest weekly increase in U.S. crude stockpiles since early November. Analysts surveyed by Bloomberg had forecast a 1.75 million barrel drop in inventories.

| Other oil market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS