By Heesu Lee and Alex Longley

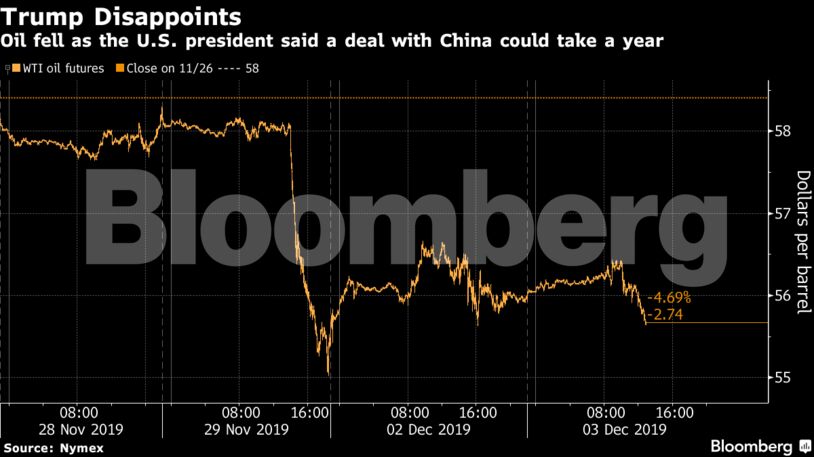

Crude has climbed since early October on signs the U.S. and China were edging closer to an initial trade deal. Without a resolution to the standoff, concerns about the strength of global oil demand next year may return. OPEC+ has signaled it’ll stick with its existing production deal, but Iraq said on Sunday that the group may consider deepening output cuts.

“The global oil supply-demand balance requires an extension of the current OPEC+ cuts,” Goldman Sachs Group Inc. analysts including Damien Courvalin wrote in a report. “Already large speculative buying in recent weeks and some expectations for a longer/larger cut suggests that an uneventful three-month extension is unlikely to provide much upside to current prices.”

West Texas Intermediate for January delivery fell 31 cents to $55.65 a barrel on the New York Mercantile Exchange as of 7:58 a.m. New York time. Brent for February settlement dropped by 31 cents to $60.61 on the London-based ICE Futures Europe Exchange. The global benchmark crude traded at a $4.98 premium to WTI for the same month.

Read our OPEC+ Reality Check: Deal Extension Likely, Compliance in Focus

OPEC’s production dropped last month led by Angola, whose output fell to the lowest in more than a decade. Iranian volumes, already squeezed to the lowest since the 1980s by U.S. sanctions, dwindled even further.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Busting Biases, Boosting Innovation – Geoffrey Cann