By Gerson Freitas Jr.

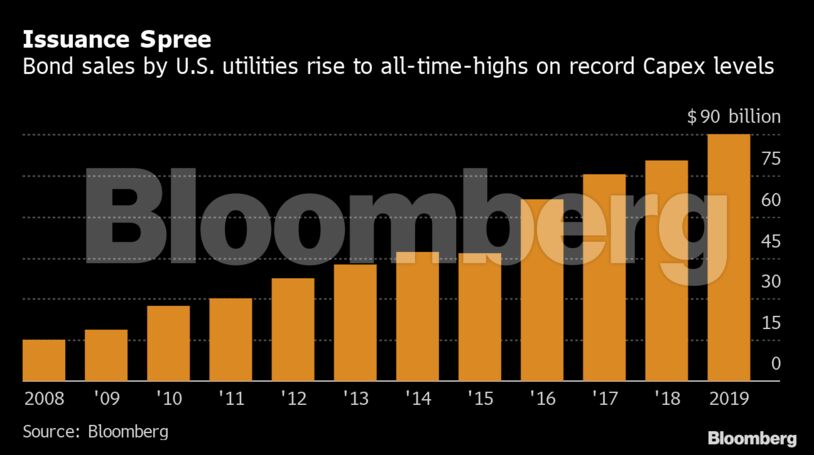

The surge in debt from NextEra Energy Inc., Duke Energy Inc. and other power giants comes as interest rates are at historic lows, leaving investors hungry for the safe and relatively strong returns offered by utility bonds.

The trend has implications that reach far beyond bond markets and company balance sheets. Utilities are in the midst of a sweeping transformation to modernize grids and slash emissions by replacing coal plants with wind, solar and cleaner-burning natural-gas generators. The flood of cheap cash from bonds is making that possible.

“Financing costs are lower than we ever thought they would be,” Morgan Stanley analyst Stephen Byrd said in an interview. “The low-interest rate environment helps the deployment of renewables.”

There is, however, reason for concern. Capital spending by energy companies is set to reach an all-time high of $136 billion in 2019, according to industry group Edison Electric Institute. And net debt for utilities in the S&P 500 index rose to an average 5.4 times earnings before interest, taxes, depreciation and amortization, up 34% from five years ago.

While utility credit ratings remain strong, they could take a hit if current levels of spending and borrowing continue.

“It’s a concern of ours,” says Maergrethe Amoussou, an analyst at Segall Bryant & Hamill, which manages about $11 billion in fixed-income assets. “I forecast declining credit fundamentals for many of the utilities in my coverage.”

But capital spending is forecast to decline in the next two years, according to Edison Electric. In the meantime, many utilities have stepped-up equity offerings and sold assets to improve fundamentals, including Southern Co. and Dominion Energy Inc.

Low Yields

The borrowing binge by utilities comes as yields on the benchmark 10-year note are at 1.93%, down from 2.68% at the end of 2018 and almost half the average in the past two decades. Utility bonds, meanwhile, have an average yield of about 3%. And since many electric companies are regulated monopolies, investors see them as a safe bet.

Power bonds have returned investors an average 15% this year, the most in at least nearly a decade, as a broader market frenzy sent yields around the world to multi-year lows.

Utilities are likely to use at least two-thirds of the proceeds for capital spending, said Cliff Andrus, who helps manage $150 billion in fixed income assets at Voya Financial Inc.

One of the biggest issuers has been Duke, a Charlotte, North Carolina-based company that owns utilities serving more than 7 million customers in the Midwest, South and Mid-Atlantic. It sold about $7 billion in notes with maturities ranging from 2 years to 30 years. Duke is spending $37 billion through 2023 on projects including adding 700 megawatts of solar capacity in Florida.

“Our debt issuances were largely as a result of the funds needed to cover investments we are making to strengthen the energy grid, generate cleaner energy and expand natural gas infrastructure,” Duke spokeswoman Catherine Butler said in an email.

Low borrowing costs have also allowed utilities to float bonds to refinance existing debt at lower rates. Vistra Energy Corp., for example, refinanced much of its debt after selling $5.7 billion in notes.

The Irving, Texas-based power generator used proceeds from the new bonds to help pay down about $6.2 billion in previous debt. Its $800 million in notes due 2027, issued last month, pay a coupon of 3.7%, which is half the amount paid by some of the bonds it retired. That helped the company, which isn’t regulated, slash its annual interest expense by approximately $120 million a year, Vistra said by email.

“You’ve seen a huge amount of refinancing by utilities,” said Shalini Mahajan, managing director at Fitch Ratings.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS