By Ann Koh and Grant Smith

(Bloomberg)

Oil steadied after the biggest decline in three weeks on Friday as Kuwait aimed to reach a deal with Saudi Arabia that will restore crude output along their border, and U.S. shale explorers boosted drilling.

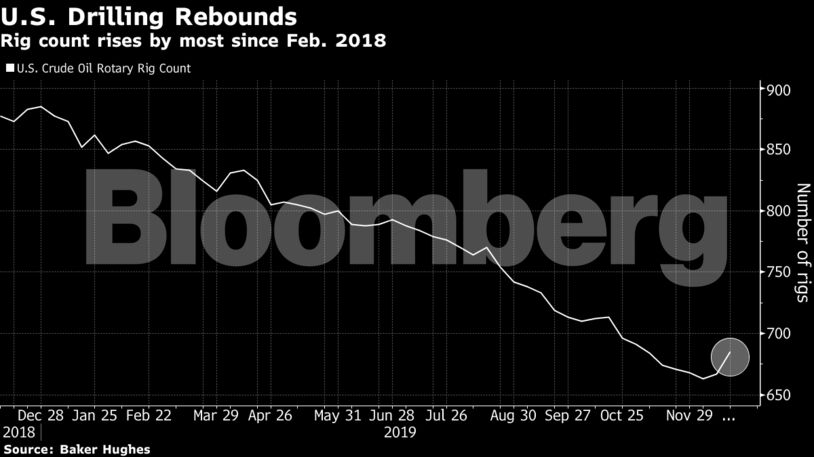

February futures held above $60 a barrel in New York after falling 1.2% on Friday, the steepest pullback since Nov. 29. The Kuwait-Saudi shared neutral zone, which has been shut for at least four years due to disputes between the two countries, can produce as much as 500,000 barrels a day. U.S. explorers last week increased drilling by the most in almost two years, according to data from Baker Hughes Co., boosting the supply outlook.

Oil is having one of its best months of the year after the U.S. and China struck a preliminary trade pact, and as the Organization of Petroleum Exporting Countries and its allies agreed to deepen output cuts in the face of growing supplies from their rivals. Hedge funds increased bullish bets in the week ended Dec. 17 to the highest level in more than seven months, according to data released Friday. Still, there are concerns crude’s rise may be overdone.

“Prices increased a bit too far in the fourth quarter, and I’m keeping a negative price outlook for the first half of 2020,” said Giovanni Staunovo, an analyst at UBS Group AG in Zurich. “It’s surprising that market participants remain unconcerned about what looks to be another strong year of non-OPEC supply ahead.”

West Texas Intermediate for February delivery fell 6 cents to $60.38 a barrel on the New York Mercantile Exchange as of 8:18 a.m. local time. The contract declined 74 cents to settle at $60.44 on Friday.

Brent for February settlement was little changed at $66.14 a barrel on the ICE Futures Europe Exchange, after losing 40 cents on Friday. The global benchmark crude traded at a $5.75 premium to WTI.

Kuwait and Saudi Arabia could reach an agreement on the neutral zone by the end of this year, Kuwaiti Oil Minister Khaled Al-Fadhel said on Sunday. An actual resumption of output at the zone’s Wafra and Khafji oil fields would depend on a political decision. The area wouldn’t add oil to global markets because both nations adhere to OPEC supply limits, a person familiar with Saudi thinking said in October.

Working oil rigs in the U.S. increased by 18 last week to 685. In the Permian Basin of Texas and New Mexico, drillers deployed 15 additional rigs, wiping out several weeks of declines.

| Other market drivers |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Fossil Fuels Show Staying Power as EU Clean Energy Output Dips – Maguire