By Will Wade

Read More: Once-Dominant Appalachia Coal Miner Rises Again Through Takeover

The collapse of Contura, which declined to comment, reflects the broader struggles in America’s coal country. U.S. power plants are burning less of the fuel as utilities shift to cheaper natural gas and renewable energy. And the met coal export market that miners were depending on to weather this downturn at home is weakening. At least four U.S. companies have shuttered mines since August and five have gone bankrupt this year.

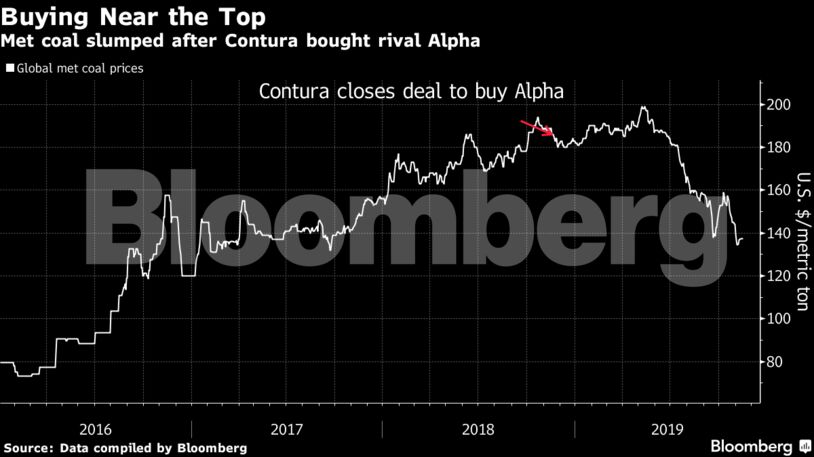

This is not the market that Bristol, Tennessee-based Contura had envisioned. Coal prices, now near a two-year low, came in “significantly below expectations” in the third quarter, Chief Executive Officer David Stetson said in a call with investors Thursday. “Contura, as well as the industry as a whole, experienced weakening demand for our products.”

Read More: Wall Street’s Cold Shoulder Drove This CEO Out of Coal Business

On top of lower coal prices, Contura reported higher production costs at mines where it makes the type of coal burned at power plants. The company blamed lower worker productivity due to vacations and the time needed to move around equipment for that.

The company’s shares plunged 49% on Thursday. They were down another 7.1% to $8.71 at 1:54 p.m. in New York.

Contura said it expects production costs to come down next year and noted that much of its output for 2020 is already sold. But prices may not prove high enough to generate significant cash flow for the miner, said Andrew Cosgrove, a mining analyst with Bloomberg Intelligence. “They’re still looking at burning cash,” he said.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS