By Nathaniel Bullard

Demand growth is also highly concentrated in just a few sectors. Road transport, the largest chunk of oil demand today, and petrochemicals, the second-largest, also account for almost 60% of total demand growth. In terms of relative growth, though, aviation is tops, with almost a one-third growth in demand from 2020 to 2040.

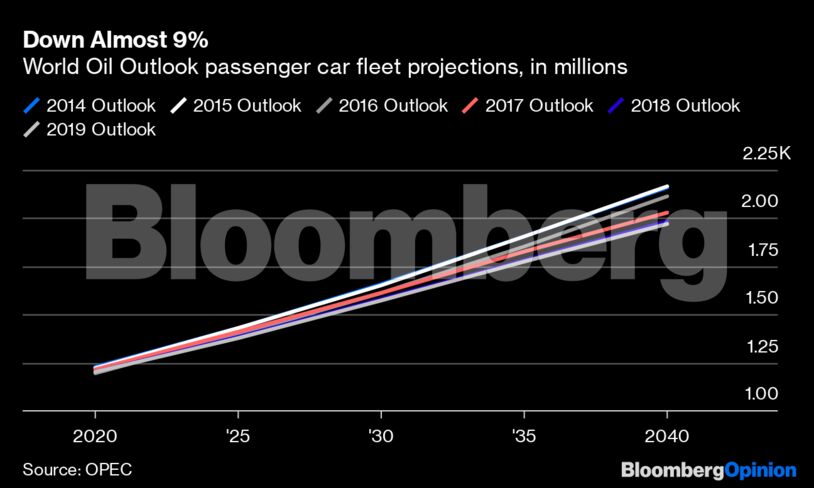

Road transport might be the king of oil demand, but OPEC is changing its tune on cars, even if slightly. Its expected passenger vehicle fleet size, almost 2 billion in 2040, is hundreds of millions of vehicles more than my BloombergNEF colleagues expect. More interesting, though, is OPEC’s consistency in reducing its expected fleet size each year.

It doesn’t look like much year on year, but since 2014, OPEC has reduced its expected number of new cars on the road by nearly 200 million. For comparison, there are just over 250 million passenger vehicles in the U.S. today.

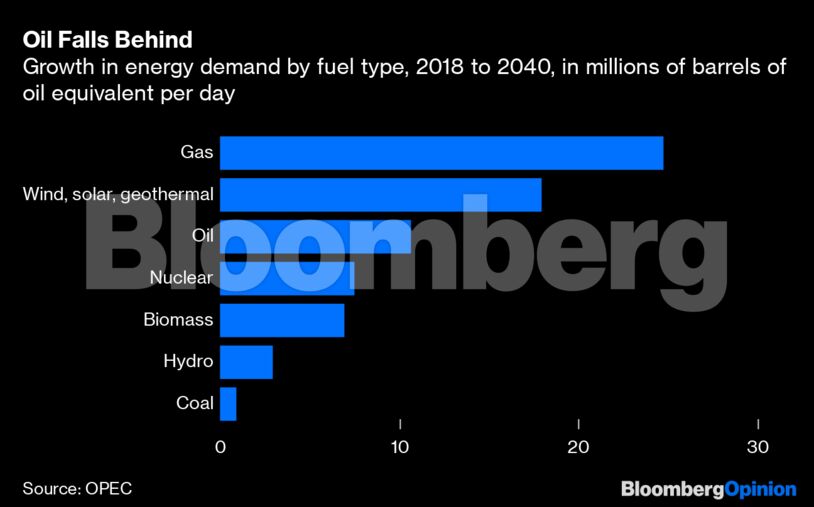

OPEC’s vision of total demand growth — less than 10% in two decades — reveals another finding: Oil is not the biggest contributor to meeting growing energy demand. That would be natural gas. But oil also trails wind, solar and geothermal energy.

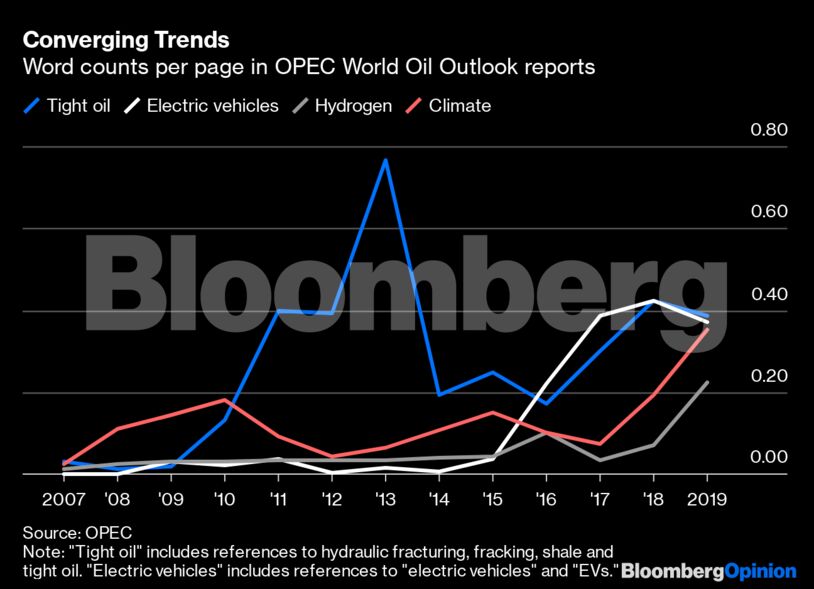

Here’s an update to a data set Denning and I explored in our take on OPEC’s 2018 outlook: the number of appearances of keywords or concepts over time. Last year, we noted that the number of mentions of “electric vehicles” and “tight oil” were exactly the same. This year, given that the outlook is significantly shorter than it was last year, I’ve adjusted the number by page count. In 2019, “tight oil” is narrowly ahead of “electric vehicles” for mentions.

Hot on the heels of both of these significant drivers of system change are two other concepts: “hydrogen,” which could be a significant replacement for hydrocarbons in the energy system (as well as a new investment opportunity for oil and gas firms), and “climate.” “Hydrogen” is on its way up, while “climate” is at nearly the same level as “electric vehicles” and “tight oil.” It’s worth watching these same terms again next year, and in years after.

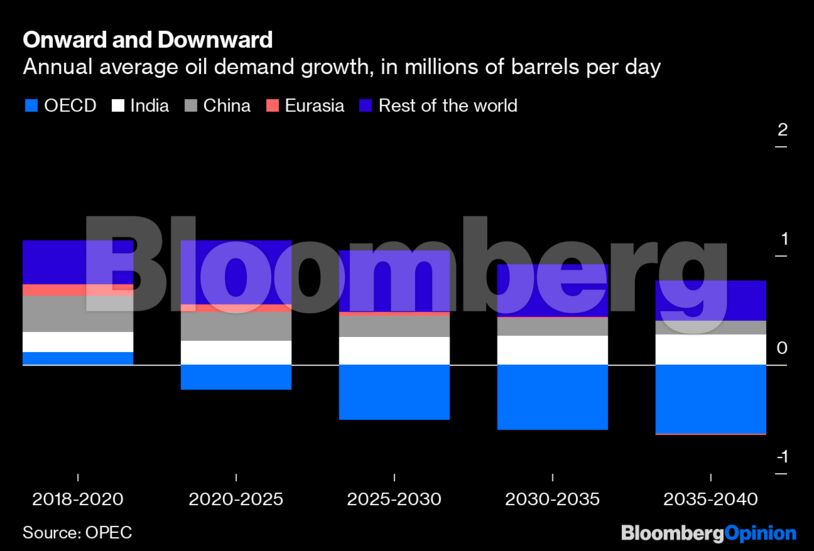

OPEC’s latest World Oil Outlook looks at the future of the cartel’s contribution to energizing the global economy, and finds an ever-flattening trajectory. It’s not calling the top on oil demand, but it’s not far from it, either: It looks ahead, and it sees oil’s plateau.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS