By Saket Sundria and Grant Smith

Oil is down about 13% from a peak in April as the on-again, off-again trade talks sap global demand. A report on Thursday that China proposed more face-to-face talks revived hopes for a deal. Forecasters are also predicting a new tide of American production in 2020, overshadowing the resurgent risk to supply from the outbreak of protests in Iraq and Iran, two of the Middle East’s five biggest producers.

“After the euphoria of yesterday’s rally on favorable U.S. oil statistics, the market woke up today to face the broader, bearish challenges ahead,” said Harry Tchilinguirian, head of commodity-markets strategy at BNP Paribas SA. “It still faces a weakening economy, and growing shale-oil supply from the U.S.”

West Texas Intermediate for January delivery gained 32 cents to $57.33 a barrel on the New York Mercantile Exchange as of 8:46 a.m. local time. The December contract, which expired Wednesday, added $1.90 to close at $57.11.

Brent for January settlement rose 25 cents to $62.65 a barrel on the London-based ICE Futures Europe Exchange, after climbing $1.49 on Wednesday. The global benchmark crude traded at a $5.30 premium to WTI.

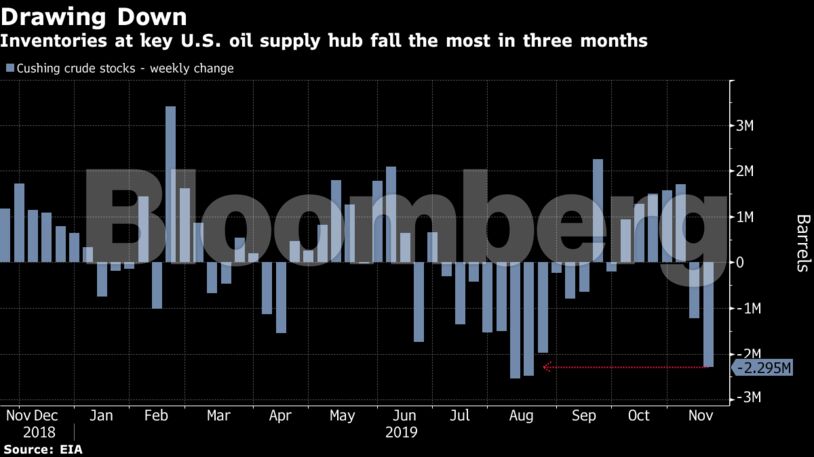

Crude inventories at Cushing, Oklahoma, fell by 2.3 million barrels to the lowest level in about a month. While nationwide stockpiles increased by 1.38 million barrels, it was less than the 1.5 million-barrel build estimated in a Bloomberg survey.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS