By Sharon Cho and Elizabeth Low

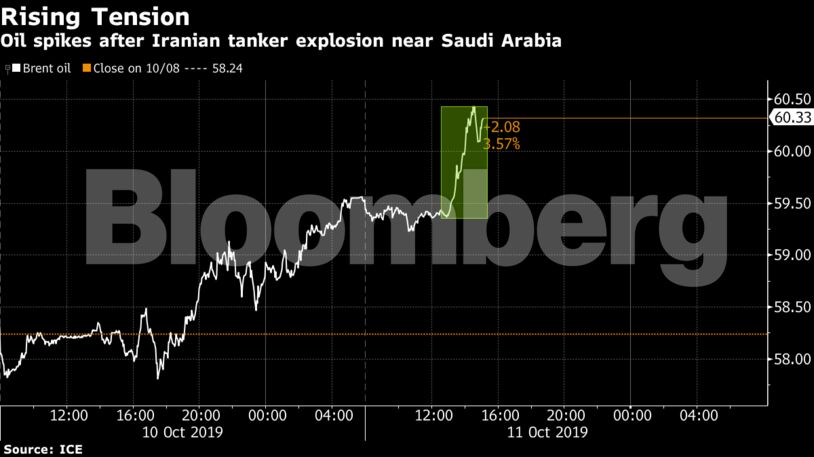

The tanker explosion will spur fresh concern about potential conflict in the Middle East after attacks on ships and drones earlier this year and last month’s strike on Saudi Arabian energy infrastructure that briefly cut global supplies by 5%. Prices were already higher Friday on prospects for progress in the U.S.-China trade dispute, offering a glimmer of hope for demand.

“The event is a reminder to the market that geopolitical tensions in the region can affect supply,” said Harry Tchilinguirian, head of commodity markets strategy at BNP Paribas SA in London.

Brent crude for December settlement rose as much as $1.55, or 2.6%, to $60.65 a barrel on the London-based ICE Futures Europe Exchange. The contract is up 2.9% this week and traded at $60.07 a barrel at 11:27 a.m. in London.

West Texas Intermediate for November rose 96 cents to $54.51 a barrel on the New York Mercantile Exchange. The contract climbed 96 cents to $53.55 on Thursday, the highest level in more than a week. Prices are up 3.2% this week.

The attack is offsetting a more bearish outlook on global markets from the International Energy Agency, Tchilinguirian said. The Paris-based IEA, which advises major economies, trimmed forecasts for global oil demand growth this year and next by 100,000 barrels a day amid a deteriorating economic backdrop.

See also: Oil Market Next Year ‘a Mess’ for Shale Drillers, Seaport Says

The strike ratchets up tension in the Middle East after the attacks on key Saudi Arabian oil-processing facilities on Sept. 14 which were blamed on Iran. In July, a U.S. ship downed an Iranian drone, while tankers have been targeted in the Persian Gulf.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS