By Sharon Cho and Grant Smith

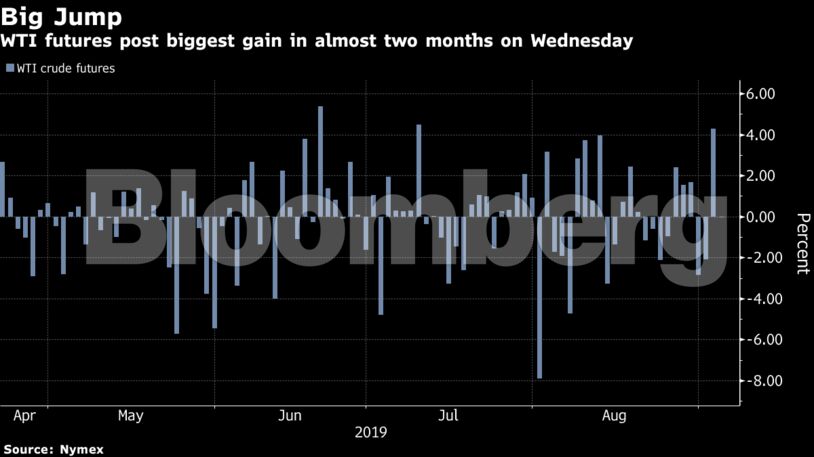

Futures in New York were little changed after jumping 4.3% Wednesday in the biggest advance since July 10. Chinese trade negotiators will head to Washington in early October for talks, the nation’s commerce ministry said in a statement on Thursday. Crude surged the previous day as the White House placed new sanctions on Iran, while Russia said it would keep to its OPEC+ output limits this month.

Oil has also been supported by more positive sentiment across financial markets, buoyed as Hong Kong’s leader sought to quell unrest in Asia’s key financial hub and as British lawmakers moved to block an imminent no-deal Brexit. Nonetheless, continued uncertainty on the outlook for the global economy is preventing prices from climbing much higher.

“The economic pessimism abated somewhat yesterday,” said Eugen Weinberg, head of commodity research at Commerzbank AG in Frankfurt.

West Texas Intermediate for October delivery was unchanged from Wednesday’s close, trading at $56.26 a barrel on the New York Mercantile Exchange as of 10:49 a.m. in London after swinging between gains and losses earlier. The contract surged $2.32 on Wednesday.

Brent for November settlement rose 12 cents to $60.82 a barrel on the ICE Futures Europe Exchange. The contract gained 4.2% on Wednesday. The global benchmark crude traded at a $4.74 premium to WTI for the same month.

“Oil coat-tailed the overnight dialing down of global political tensions and the rotation out of defensive macro positioning,” Jeffrey Halley, a senior market strategist at Oanda Corp., said in a note. More direction will come from U.S. crude inventory data, he said.

U.S. oil stockpiles rose by 401,000 barrels last week, the industry-funded American Petroleum Institute reported Wednesday, according to people familiar with the data. The surprise increase pushed down prices slightly, although the impact was tempered by a drop in gasoline stockpiles. Nationwide inventories were forecast to have fallen by 2 million barrels in a Bloomberg survey of analysts before the official Energy Information Administration figures.

Vice Premier Liu He agreed to travel to Washington next month in a telephone call Thursday morning in Beijing with Treasury Steven Mnuchin and U.S. Trade Representative Robert Lighthizer, China’s commerce ministry said. A statement from the U.S. Trade Representative’s office confirmed that ministerial level talks will take place in “the coming weeks,” without specifying when.

On Iran, the U.S. hinted that more measures are coming after imposing new sanctions, while deflecting questions about French diplomatic efforts meant to help the Persian Gulf producer restart oil sales. That comes after the Treasury Department placed new restrictions on a shipping network controlled by Iran’s Islamic Revolutionary Guard Corps earlier.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS