By Tsuyoshi Inajima and Alex Longley

Glut concerns were also fueled this week by speculation that Donald Trump had discussed moderating sanctions on Iran, with RBC Capital Markets estimating such a move could bring back around 700,000 barrels a day. Meanwhile, the U.S. and China showed signs of rapprochement in their trade war and Saudi Arabia’s new energy minister downplayed oil-demand concerns, leaving any talk of deeper output cuts to OPEC’s next ministerial meeting in December.

“An increasingly heavy balance for 2020, along with the risk of possibly more leniency on Iran with sanctions, is weighing on sentiment,” said Warren Patterson, head of commodities strategy at ING Bank NV. “OPEC was never going to announce deeper cuts now; I think that will only happen in December, unless they are forced before then by a selloff.”

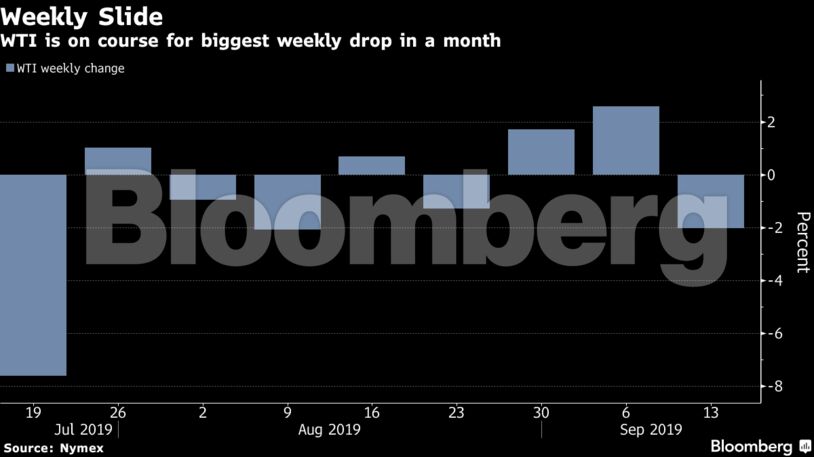

West Texas Intermediate crude for October delivery advanced 40 cents to $55.49 a barrel on the New York Mercantile Exchange as of 9:15 a.m. local time.

Brent for November gained 14 cents to $60.52 a barrel on the ICE Futures Europe Exchange, and traded at a $5.20 premium to WTI for the same month.

See also: Saudi Prince’s Oil Diplomacy Makes Mark at OPEC+ Meeting Debut

OPEC+ faces a “daunting” challenge as output growth in countries from Brazil to Norway means 2020 could see a significant increase in stockpiles and pressure on prices, the IEA said on Thursday. Demand for OPEC’s crude in the first half of next year will be 1.4 million barrels a day below its August production, the agency said.

There were some signs of goodwill ahead of planned trade talks between the U.S. and China. The Asian nation plans to encourage companies to buy American farm products including soybeans and pork, and it will exclude those goods from additional tariffs, the editor-in-chief of a prominent state-run newspaper said.

| Other oil-market: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS