By Tsuyoshi Inajima and Alex Longley

Oil is still down about 12% from its peak in April as a deepening trade dispute between the U.S. and China dents the outlook for global demand. Prices fell on Tuesday — halting a four-day gain — after Bolton’s exit gave the market some supply comfort. Yet the API’s stockpile data prompted a rebound.

“Oil prices are regaining some ground this morning as attention shifts to U.S. oil inventories,” PVM Oil Associates analyst Stephen Brennock wrote in a report.

West Texas Intermediate oil for October delivery rose 54 cents, or 0.9%, to $57.94 a barrel on the New York Mercantile Exchange as of 11:58 a.m. London time.

Brent for November settlement increased 48 cents, or 0.8%, to $62.86 a barrel on the ICE Futures Europe Exchange. The global benchmark traded at a $5.01 premium to WTI for the same month.

See also: Bolton Exit Shifts Outlook in Oil Market Roiled by Sanctions

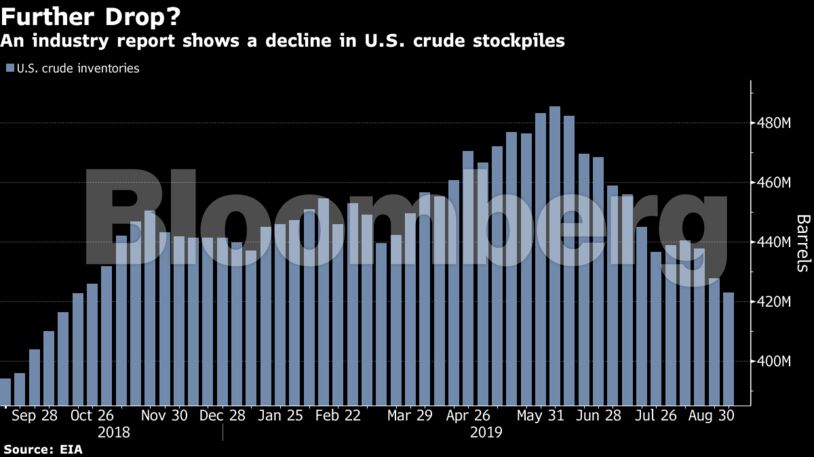

U.S. crude stockpiles fell to about 423 million barrels in the week through Aug. 30, the lowest since October 2018. A Bloomberg analyst survey shows the level shrinking by a further 2.9 million barrels last week, which would be a fourth weekly drop if confirmed by Energy Information Administration data on Wednesday.

U.S. President Donald Trump said he fired Bolton after disagreeing with many of his positions. His adviser’s departure may be “a catalyst for a material de-escalation in the Iran standoff” and could bring back around 700,000 barrels a day of Iranian crude, possibly by the first quarter, said RBC Capital Markets’ Global Head of Commodity Strategy Helima Croft. Iran’s output has slumped 42% since May 2018, according to data compiled by Bloomberg.

| Other oil-market news: |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS