By Julian Lee

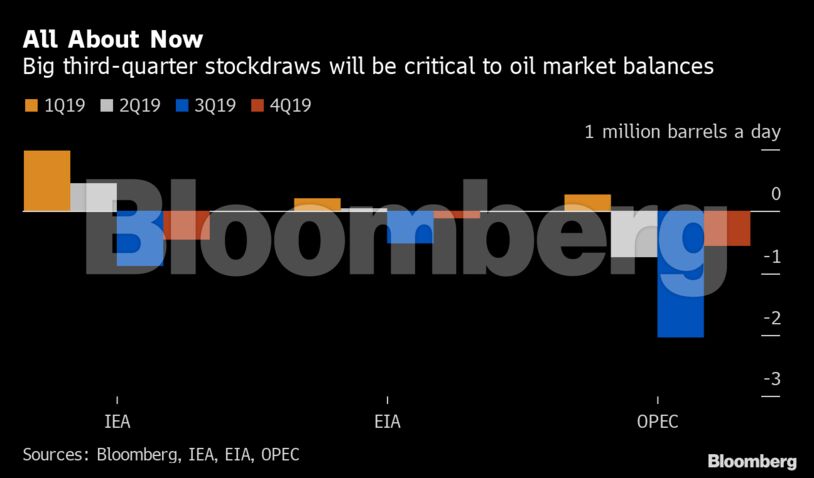

The International Energy Agency, the U.S. Energy Information Administration and the Organization of Petroleum Exporting Countries all see the biggest oil inventory draws for the year happening now, during the period of peak demand and before non-OPEC supply surges seasonally, as the summer maintenance season at fields in the Northern Hemisphere comes to an end.

There are big differences between the ways the three agencies see the global oil supply/demand balance evolving this year. OPEC is much more bullish than either of the others about the size of the stockdraw that we can expect. The producer group now sees global stockpiles falling at an average rate of 780,000 barrels a day in 2019, driven by a draw of more than 2 million barrels a day in the third quarter. The EIA sees inventories coming down by a much more modest 100,000 barrels a day, while the IEA sees a tiny build over the course of the whole year.

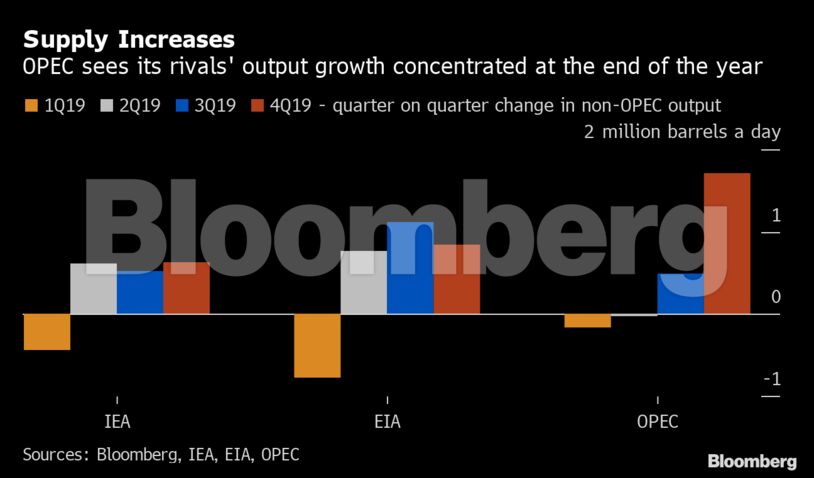

Assessments of non-OPEC supply growth explain part of the difference. While all three agree that non-OPEC oil production will grow during 2019, OPEC is alone in seeing that growth heavily weighted to the fourth quarter, with the IEA and EIA both seeing much steadier growth over the course of the year. Some of the differences are hard to reconcile, as assessments of oil production in the first quarter of the year should be pretty reliable by now.

Things are about to get a lot more difficult for the producer group – at least that’s the view of its own analysts. While non-OPEC oil supply is set to increase by more than 1.7 million barrels a day between the third and fourth quarters, demand will rise by a much more modest 220,000 barrels a day. Inventories need to be falling fast now if we are to avoid a huge build towards the end of the year.

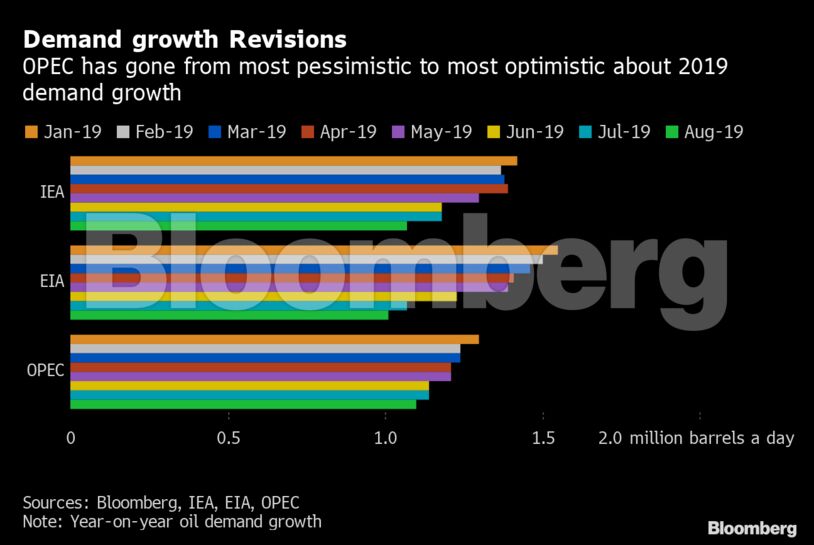

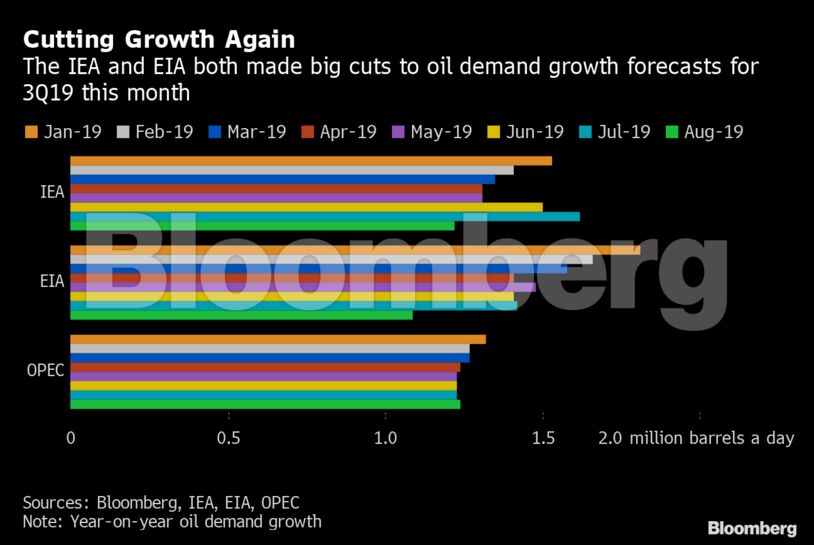

It is not only on the supply side of the balance where differences are apparent, though. Although all three agencies now see global oil demand increasing by a little more than 1 million barrels a day this year, the routes they have taken to arrive at their current estimates are very different.

OPEC, which began the year as the most pessimistic of the three on global oil demand growth is now the most optimistic, having cut its forecast much less than either the IEA or the EIA. That could be evidence that the producer-group’s analysts had a better read on the situation well ahead of their counterparts in the oil-consuming countries. But there are some worrying details in the quarterly assessments that suggest the OPEC forecast may have further to fall.

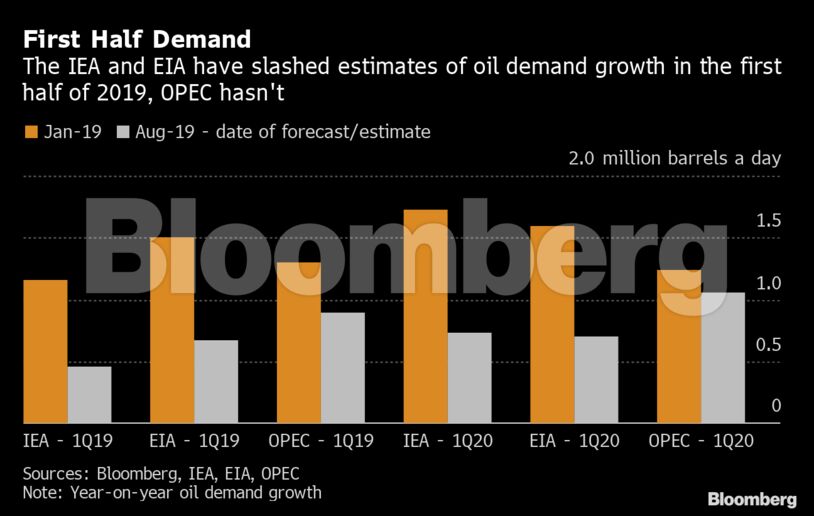

While both the IEA and the EIA have slashed their demand growth figures for the first and second quarters, OPEC’s have hardly moved. The IEA and EIA have also started to cut their estimates for oil demand growth in the current quarter, leaving OPEC alone in maintaining its estimate at 1.24 million barrels a day.

If OPEC is forced to follow suit and start cutting its own estimates of third-quarter oil demand growth, that big stock draw that it sees helping to drain excess inventories this year will begin to erode. OPEC and its non-OPEC partners will need to do more.

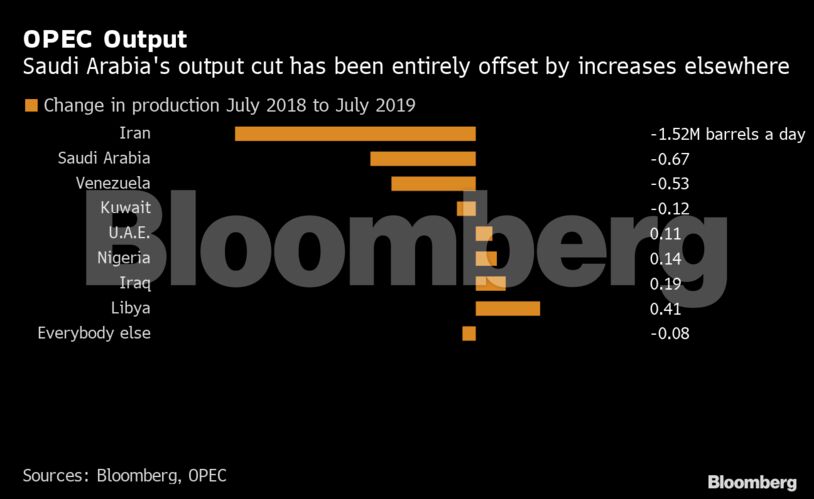

OPEC oil production is already down year on year by more than 2 million barrels a day, according to secondary source data compiled by OPEC. All of that can be accounted for by the involuntary cuts that have been forced on Iran and Venezuela. Saudi Arabia’s voluntary output cut of 665,000 barrels a day between July 2018 and July 2019 has been entirely offset by higher production from Libya, Iraq and Nigeria.

OPEC members will be hoping that their analysts have gotten it right and that they have done enough to drain global stockpiles at a rate of 2 million barrels a day this quarter. Ministers from the OPEC+ group will be gathering in Abu Dhabi next month to assess the progress of their cooperation. If their analysts are wrong, it could be a gloomy meeting.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS