By Saket Sundria and Grant Smith

Futures were little changed above $56 a barrel in New York on Wednesday. The American Petroleum Institute reported a 3.45 million-barrel decline last week, people familiar with the data said. Nonetheless, with President Donald Trump showing little urgency to resolve trade disputes and calling for a “big” interest-rate cut by the Federal Reserve, concerns about the global economy persist.

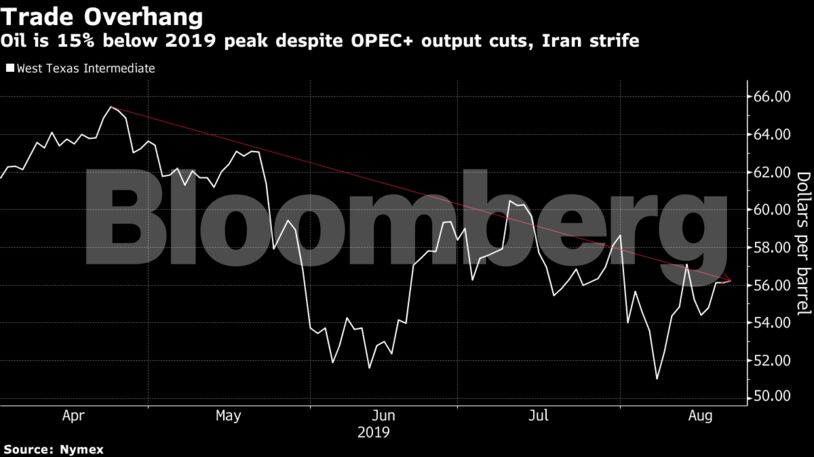

Oil slumped about 15% since late April as the trade war between the U.S. and China, the biggest economies, weighed on demand. Tension in the Middle East and efforts by the Organization of Petroleum Exporting Countries and allied producers to curtail output have failed to arrest the slide.

“It’s a tight market right now,” said Bjarne Schieldrop, the Oslo-based chief commodities analyst at SEB AB. “But the assumption is that the future will be very bleak and bearish.”

West Texas Intermediate crude for October delivery added 19 cents, or 0.3%, to $56.32 a barrel on the New York Mercantile Exchange at 10:05 a.m. in London. The September contract settled 13 cents higher at $56.34 when it expired on Tuesday.

Brent for October settlement rose 37 cents, or 0.6%, to $60.40 a barrel on ICE Futures Europe after closing 0.5% higher on Tuesday. The benchmark crude traded at a premium of $4.13 to WTI, compared with an average of about $7 in the past year.

The decline in U.S. stockpiles in the API data is more than double the 1.5 million-barrel drop forecast in a Bloomberg survey. Inventories at the storage hub of Cushing, Oklahoma, fell by 2.8 million barrels, the API was said to report. That would be the biggest decrease since February 2018 if confirmed by the official Energy Information Administration figures scheduled for release Wednesday.

“The drawback will certainly help support sentiment,” said Daniel Hynes, a senior commodity strategist at Australia & New Zealand Banking Group Ltd. in Sydney. “But the market is definitely taking the glass-half-empty type approach to data.”

There’s a 35% chance the U.S. economy will enter a recession in the next year amid ongoing tensions between the U.S. and China, according to economists surveyed by Bloomberg.

| Other oil-market news |

|---|

|

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS