By Alex Longley Futures in New York climbed as much as 1.2% after rallying almost 4% over the previous two sessions. European and U.S. equities pared earlier declines as a spokesman for China’s Commerce Ministry signaled that the country wouldn’t immediately retaliate against the latest U.S. tariff increase, saying it was more important to discuss removing the additional duties.

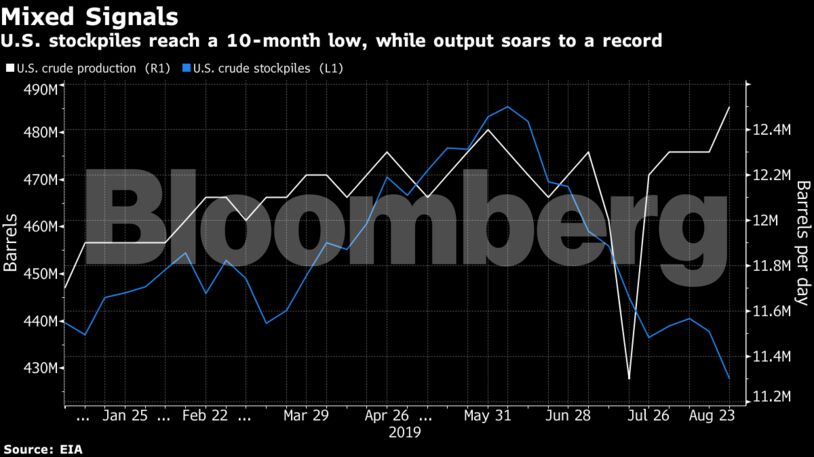

Crude futures have pared their monthly loss this week amid a drop in U.S. stockpiles to the lowest since October, yet record American oil production has tempered price gains. “These gains still remain fragile,” said BNP Paribas Head of Commodity-Markets Strategy Harry Tchilinguirian. “It would not take much in terms of negative economic news tied to U.S.-China trade relations to send the oil price back down.”

West Texas Intermediate for October delivery advanced 32 cents, or 0.6%, to $56.10 a barrel on the New York Mercantile Exchange as of 9:03 a.m. local time, after earlier falling as much as 35 cents.

Brent for the same month slipped 0.3% to $60.30 a barrel on the ICE Futures Europe Exchange. The global benchmark crude traded at a $4.25 premium to WTI.

American crude stockpiles fell by 10 million barrels last week, the most since mid-July, according to the Energy Information Administration. An earlier estimate by the industry-funded American Petroleum Institute indicated a 11.1 million-barrel drop. Meanwhile, U.S. oil output rose by 1.6% to 12.5 million barrels a day, the highest in government records going back to 1983.

Oil-market news

Share This:

Oil Rises as China Stokes Optimism That Trade War May Ease

These translations are done via Google Translate

These translations are done via Google TranslateFEATURED EVENT

GET ENERGYNOW’S DAILY EMAIL FOR FREE

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS