By Saket Sundria and Grant Smith

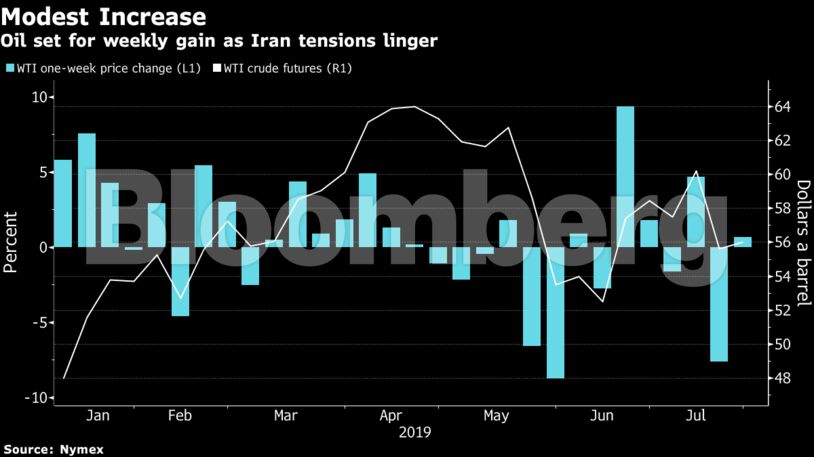

Futures gained 0.6% in New York on Friday and are up 1.4% this week. American crude inventories have declined for the past six weeks, the longest run since January 2018. Iran tested a medium-range ballistic missile on Wednesday, according to a CNN report. European governments are seeking to assemble a naval mission to provide safe passage for ships through the Persian Gulf after a British tanker was seized by Iranian forces last week.

Oil is still down this month as fears about the demand outlook counter concern Middle East supplies could be curtailed. A gauge of American factory activity fell in July to the lowest in almost a decade, while the European Central Bank said it would consider options including rate cuts as President Mario Draghi warned the economy was looking “worse and worse.” The U.S. and China are set to resume trade talks next week after negotiations broke down in May.

West Texas Intermediate for September delivery rose 33 cents to $56.35 a barrel on the New York Mercantile Exchange as of 8:34 a.m. local time. The contract ended Thursday up 14 cents at $56.02 a barrel. Brent for September settlement climbed 34 cents to $63.73 a barrel on the ICE Futures Europe Exchange after gaining 0.3% on Thursday. The contract is up 2% this week. The global benchmark traded at a $7.31 premium to WTI.

See also: Permian Oil Prices Dip to 2-Month Low as West Texas Stocks Swell

“Given the growing tensions between the West and Iran,” the price response “has been extremely muted so far,” said Carsten Fritsch, an analyst at Commerzbank AG in Frankfurt.

While U.S. crude stockpiles dropped by 10.8 million barrels last week, the large decline was mostly attributed to the short-term impact of Tropical Storm Barry, which halted output from some facilities in the Gulf of Mexico. Nationwide production slid the most since October 2017.

Iran test-fired a ballistic missile that traveled 1,000 kilometers (620 miles), escalating tensions after a series of attacks on tankers and drones. The Shabaab-3 missile didn’t pose a threat to shipping in the region, CNN Pentagon correspondent Barbara Starr tweeted, citing an unnamed U.S. official.

Other oil-market news

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS