By Harkiran Dhillon

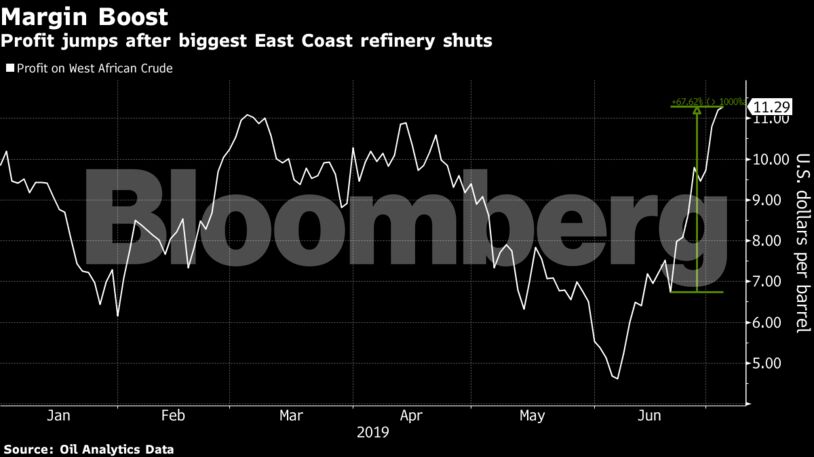

While the profit margin of refining West African Forcados crude in the region was showing signs of recovery earlier in the month, the catalytic cracking margin jumped about 68% after the latest fire, according to Oil Analytics data. Gasoline prices have risen to attract more supply from the U.S. Gulf Coast and overseas, particularly Europe.

“With the closure of the refinery, now all that product isn’t being made so there’s the expectation of a shortage of supply and a tight market,” said Sandy Fielden, director of Oil and Products Research at Morningstar Energy Commodities. “That’s leading to higher prices for gas and thus higher margins for refineries.”

One beneficiary has been PBF Energy Inc, which has taken over the position of the largest East Coast refiner. Its shares have surged about 14% since June 20, compared with about 5.4% for a Bloomberg Intelligence index of North American refiners.

Read for more on the increase in European fuel cargoes heading to America

Margins may have further to rise if a unit that shut Friday at Irving Oil Ltd.’s St. John refinery in New Brunswick, Canada, is down for an extended period. Irving’s refinery, the largest in Canada, is a key supplier of gasoline and diesel to New England. European refiners may reap the rewards, as the increase in demand for cargoes for export to the U.S. supports gasoline margins there.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS