By Shadia Nasralla and Stephanie Kelly

- Shell reserves at lowest since at least 2013, faces output gap

- Reserve life 8 years, markedly below Exxon

- Analysts see need for M&A, exploration success

LONDON, Feb 9 (Reuters) – Shell needs an acquisition or exploration breakthrough to make up for an expected production shortage of 350,000-800,000 barrels of oil equivalent per day by 2035 due to maturing fields unable to meet its output targets, the company and analysts say.

For years, oil majors have been restrained in topping up reserves, mindful that a swift industry transition to other sources of energy could curtail oil and gas demand.

However, with such a transition lagging and demand still climbing, the focus has swung back to those with enough in the tank.

GAP BETWEEN OUTPUT TARGETS AND WHAT IT CAN DELIVER

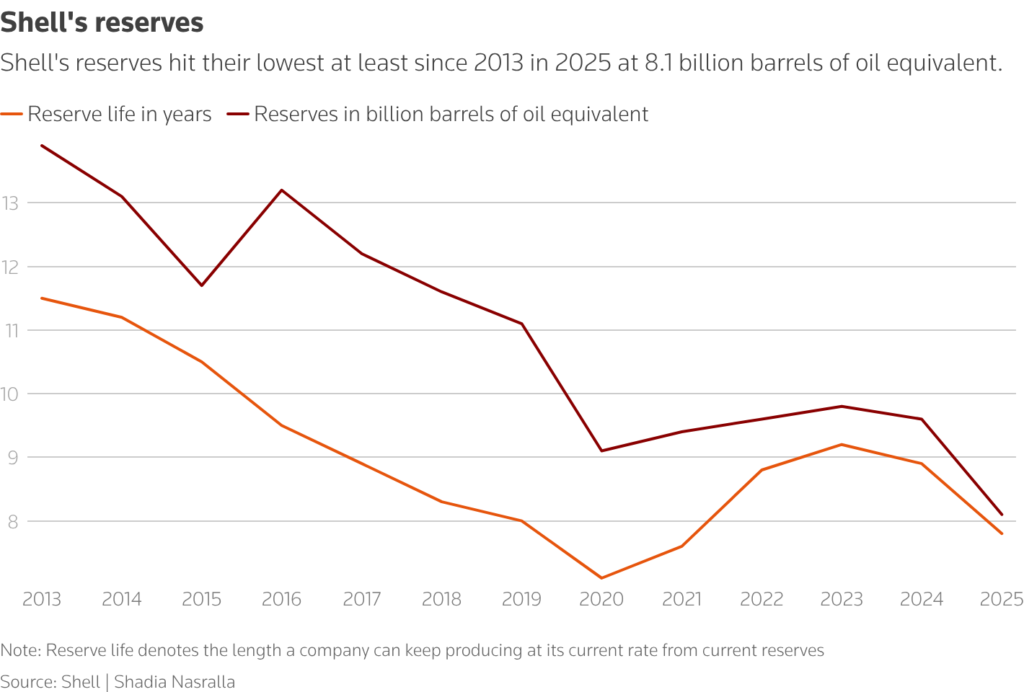

Shell’s portfolio is in the spotlight because its so-called ‘reserve life’ – or how long its proven reserves can sustain current output levels – is equivalent to less than 8 years of production as of 2025, from 9 a year earlier, which was its lowest since 2021.

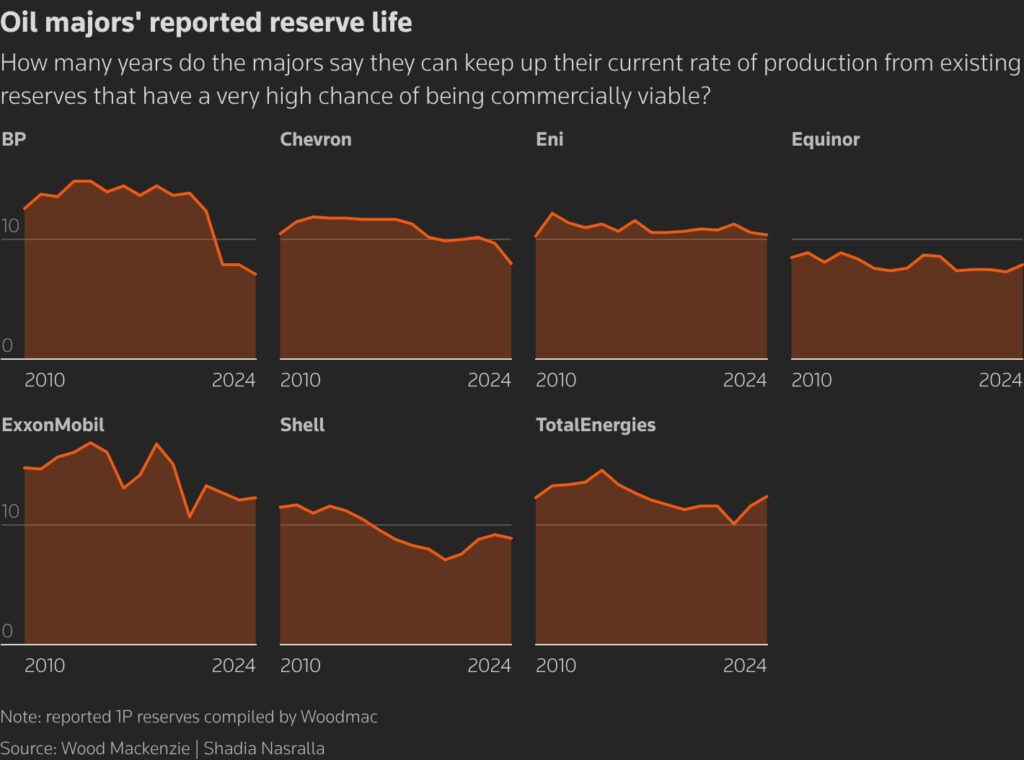

This compares with over 12 years each at Exxon (XOM.N) and TotalEnergies (TTEF.PA)

at the end of 2024, data by Wood Mackenzie shows.

A shorter reserve life increases pressure to buy assets or to have a big exploration success to grow or maintain production.

Shell has pledged to grow hydrocarbon output by 1% a year through the decade while keeping crude volumes flat. It is betting long-term on a huge liquefied natural gas market, aiming to boost its LNG sales by at least 5% a year, albeit not necessarily underpinned by its own output.

Total reserves at Shell dropped to 8.1 billion boe, the lowest since at least 2013.

Chief Executive Wael Sawan warned investors last year that declines across Shell’s portfolio would leave a 350,000 boed gap by 2035 between its production goals and what its current assets can deliver.

Shell’s reserves hit their lowest at least since 2013 in 2025 at 8.1 billion barrels of oil equivalent.

EXIT FROM US SHALE, GUYANA HURT OUTPUT PROSPECTS

The tightening resource base follows years of retrenchment, including Shell’s exit from U.S. shale in 2021 and from Guyana in 2014 — two regions that underpin rival Exxon’s growth plans.

“I wish we hadn’t walked away from Guyana when we did,” Sawan said on Thursday.

Indeed, Shell has already tried to bridge some of the expected shortfall in output.

In March, Sawan projected a 100,000–200,000 boed gap by 2030, as its mature fields are set to produce less.

The company says investments in U.S. Gulf, Brazil, Nigeria, Angola, South Africa and Namibia, and field improvements have largely covered that near‑term shortfall.

But Sawan offered no updated figure for the post‑2030 gap, and Shell declined further comment.

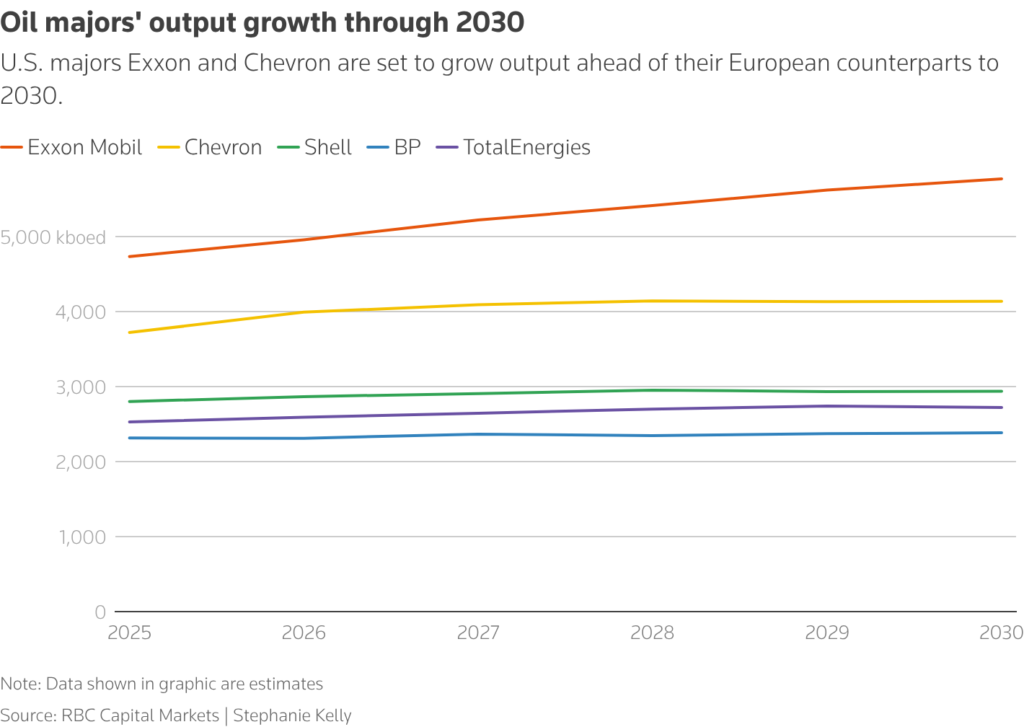

A graphic shows oil majors’ output growth through 2030

Analysts are skeptical that incremental projects alone will get Shell to its desired production level.

“Absent M&A in the near term, we expect these concerns over [production] longevity to linger,” said RBC’s Biraj Borkhataria.

Equity analyst Irene Himona from Bernstein called Shell’s reserve life very low and said a renewed focus on exploration is needed.

Sawan said he was “less pleased” that Shell had yet to deliver a major discovery, but did not want to add assets just for the sake of volumes.

Wood Mackenzie expects Shell’s output to fall sharply from 2028, with free cash flow in its gas and upstream units weakening from 2032.

Shell’s production is likely to drop by 800,000 boed in a decade based on its current portfolio, said Wood Mackenzie’s vice president of corporate research, Luke Parker. It currently produces around 2.8 million boed.

“Shell’s biggest challenge, from our perspective, is that it doesn’t have the portfolio to support its strategy to go longer in oil and gas,” said Parker.

How many years do the majors say they can keep up their current rate of production from existing reserves that have a very high chance of being commercially viable?

UBS estimates production will drop to 2.5 million boed by around 2035 without further action, leaving a gap of about 400,000 boed to be filled through asset purchases or squeezing more from existing fields.

Reporting by Shadia Nasralla and Stephanie Kelly in London Editing by Bernadette Baum

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS