Investment firms, including KKR & Co. and Energy Impact Partners, are scouting for possible acquisitions.

By Coco Liu and Brian Kahn

qw(g}0ld37k}ipd0dgh0fd5m_media_dl_1.png BloombergNEF

Clean-energy dealmaking is showing signs of a comeback in the United States after last year’s sharp contraction.

One of the first notable transactions that may occur is BlackRock Inc.’s Global Infrastructure Partners teaming up with private equity firm EQT AB to acquire AES Corp., Bloomberg News reported earlier this month. The majority of AES’s power generation comes from renewable energy and is supplied to technology companies such as Microsoft Corp.

KKR & Co. and Energy Impact Partners are among other investment firms on the lookout for possible purchases.

“Investor interest is very high,” said Hans Kobler, founder and managing partner at Energy Impact Partners, which plans to deploy part of its new US$1.4 billion fund to acquire clean energy assets.

Emmanuel Lagarrigue, a partner at KKR, added that sellers’ price expectations are coming down, making the market for mergers and acquisitions “more pragmatic” in 2026.

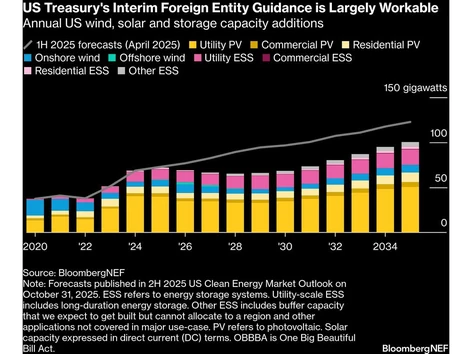

Buyer interest is picking up after President Donald Trump’s return to the White House put many investors in a wait-and-see mode for much of 2025. About 12 gigawatts of solar, wind and energy-storage power capacity changed hands through completed acquisitions last year, down more than 50 per cent from a year earlier and the lowest level since 2013, according to data tracked by BloombergNEF. Power capacity was used as the measure rather than deal value because prices for assets and projects are often undisclosed.

Several factors now point to a rebound. Power demand from artificial-intelligence data centres continues to boost investment in renewables, with U.S. data-centre electricity consumption projected to triple by 2035 from 2024 levels, BNEF estimates. At the same time, last year’s slowdown has forced developers and asset owners to reassess valuations.

Reduced federal support under Trump has squeezed capital-constrained companies, weighing on prices and increasing the appeal for buyers, Lagarrigue said.

“Some rules of the road have been set,” which makes it easier for dealmakers to get back to work, said Alex Darden, who leads infrastructure investment in the Americas for Sweden’s EQT.

That’s among the drivers underpinning Darden’s expectations that clean-energy deals will climb this year.

Big Tech and utilities are joining private equity firms in the pursuit of acquisitions. Amazon.com Inc. agreed in January to buy Pine Gate Renewables’ solar and battery-storage project in Oregon. That same month, Pattern Energy Group said it would acquire Cordelio Power, which has 16 wind, solar and battery-storage projects across the U.S. and Canada.

The prospects for new deals are being supported by clean energy’s ability to come online faster than alternatives. Developers of natural gas plants sometimes face waits of five years or more for new turbines because of supply bottlenecks, while nuclear facilities can take at least a decade to get up and running. By contrast, a five-megawatt large-scale solar farm can be completed within two years.

“Renewables, solar in particular, is still the fastest solution to deploy,” said BNEF analyst Musfika Mishi.

The outlook for wind is less bullish given the Trump administration’s open hostility toward the industry and its efforts to cancel projects. The Interior Department in December suspended leases for five offshore wind farms under construction off the East Coast, triggering a legal battle with developers that’s currently being fought in the courts.

“Wind is a very difficult story, no matter what,” Darden said.

Darden and Lagarrigue said their firms prefer solar projects paired with battery storage, which they see as better positioned than wind to withstand political headwinds and market volatility. In states such as Texas and California, where storage is badly needed to help utilities cope with intermittent renewable supplies and prevent outages, investor appetite for giant battery projects is growing, according to Darden.

For batteries, risks persist since much of America’s supplies come from China and can’t be easily sourced elsewhere. That means the threat of tariffs on Chinese goods may change the equation for projects still in early-stage development. And the Chinese government also isn’t shy about using the country’s stronghold as leverage in its trade negotiations with the U.S.

There is “significant tariff risk,” Darden said, requiring additional due diligence. “We’re pretty cautious on how we think about” investing in battery storage, he added.

Even with all the challenges, investors say they remain confident.

“The bar for us is very high,” Energy Impact Partners’ Kobler said. “But we’re still looking, and we’re open for business.”

—With assistance from Mark Chediak.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS