LITTLETON, Colorado, Feb 18 (Reuters) – U.S. exporters of LNG consumed more natural gas than both households and commercial businesses last year, tightening U.S. gas supplies and putting the LNG export boom squarely in the frame of discussions surrounding rising U.S. energy costs.

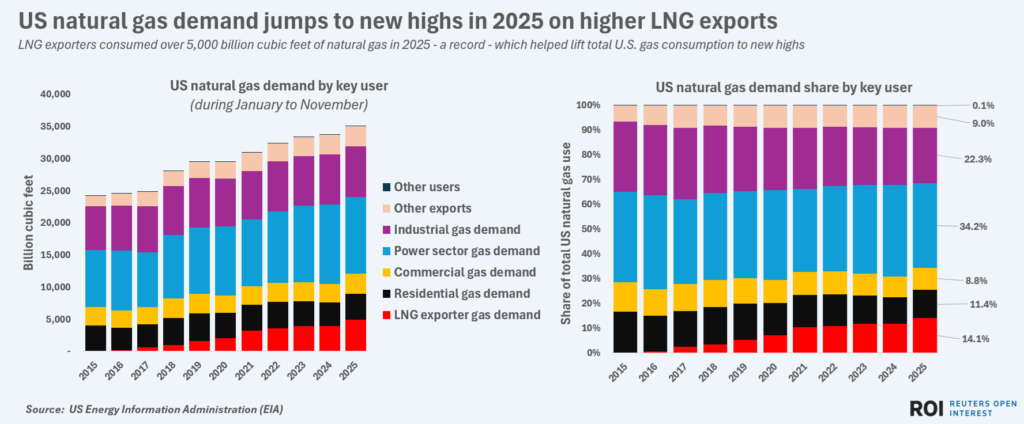

Liquefied natural gas exporters gobbled up a record 5,000 billion cubic feet (141.6 billion cubic meters) of natural gas during January to November of 2025, the latest data from the U.S. Energy Information Administration (EIA) shows.

That total sharply exceeds the roughly 4,000 BCF of gas consumed by residences and the 3,000 BCF consumed by commercial sites during that period, and means LNG exporters are now the third-largest U.S. gas consumer behind industry and power firms.

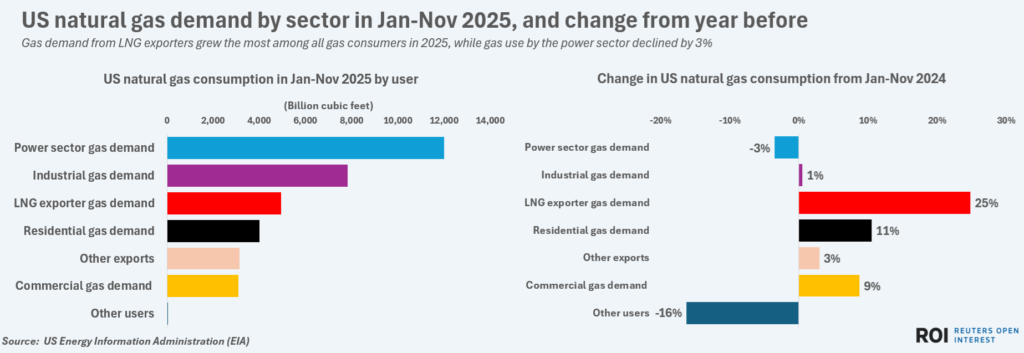

Gas demand from LNG exporters grew the most among all gas consumers in 2025, while gas use by the power sector declined by 3%

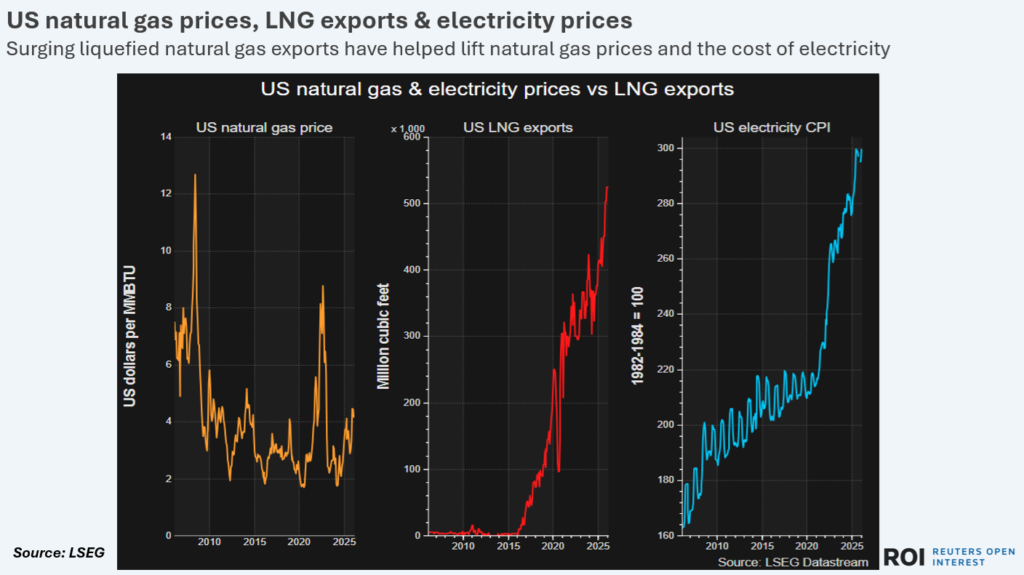

The U.S. LNG export tally was 25% higher than in the same period of 2024, and accompanied a 61% rise in the benchmark U.S. natural gas price – the Henry Hub spot price – last year.

As natural gas power plants account for around 40% of U.S. electricity supplies – the most of any power source – that run-up in natural gas costs in turn fed into electricity bills for consumers, which hit all-time highs last year.

With U.S. households already grappling with record costs for insurance, housing, food and medical care, pushback against further increases in power bills is likely to be a major issue among voters in the run up to this year’s midterm elections.

That in turn means that LNG exporters who compete with households and power firms for gas could come under fire, even as additional LNG export capacity is due to come online and lift potential U.S. LNG export volumes even higher.

STEEP GAINS

The total amount of gas procured by U.S. LNG exporters during the first 11 months of 2025 marked a 209% increase compared with the same months in 2019.

In contrast, total gas consumption by residences, commercial sites (restaurants, hospitals and retail stores), industry and power firms increased by an average of 3% over that same span.

LNG exporters consumed over 5,000 billion cubic feet of natural gas in 2025 – a record – which helped lift total U.S. gas consumption to new highs

That means that LNG exporters have been by far the fastest growing source of U.S. gas demand within the past decade, and have resulted in dramatic shifts in domestic gas market dynamics, which are characterized by tighter gas supplies for other consumers and greater volatility in natural gas prices.

On the price front, every major consumer group faced steeply higher gas costs in 2025 compared to 2019, with residences and commercial sites registering roughly 50% increases while industry and power firms grappled with a roughly 30% climb.

In response to such a steep climb in gas costs, several major end users have attempted to replace gas with alternative power sources, which in the case of households and businesses often meant electrification of heating and power systems.

For power firms, higher output from renewable energy sources has been the main means of reducing gas reliance, although utilities also sharply raised output from cheaper coal-fired power plants in 2025 as gas costs jumped.

LNG EXPORTER IMPACT

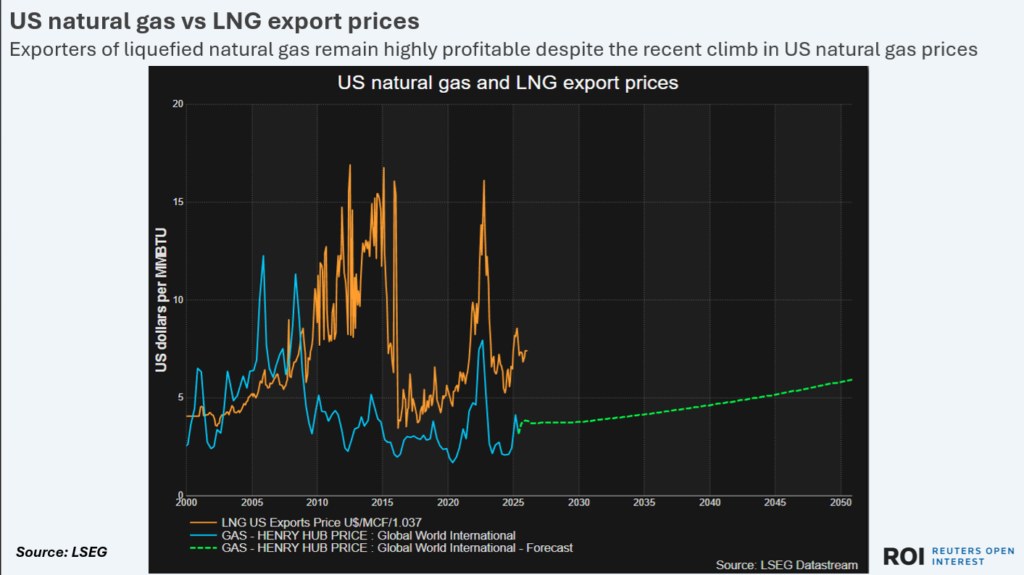

LNG exporters can more easily absorb higher domestic gas costs than rival consumers, as the sale price of LNG in foreign markets remains multiple times the cost of local gas.

Indeed, the average U.S. LNG export sale price in 2025 was roughly $7.87 per thousand cubic feet (MCF), which compared to an average of $3.66 per MCF for benchmark Henry Hub prices, EIA data shows.

That means that LNG exporters could easily add a $2 per MCF liquefaction fee as well as another $1 per MCF in shipping fees and still make a profit when selling the LNG overseas.

Exporters of liquefied natural gas remain highly profitable despite the recent climb in US natural gas prices

With several LNG cargoes sold at even higher prices on the spot market, many LNG exporters recorded even heftier margins which has spurred them to expand their export capacity as quickly as possible.

Total North American LNG export capacity could more than double from 11.4 BCF in 2024 to 24.3 BCF by the end of 2027, according to the EIA’s latest short term energy outlook.

PRICE RESPONSE

If it materializes as planned, such a steep climb in potential export capacity will trigger a fresh surge in LNG export volumes and further tighten gas supplies for other domestic consumers.

That in turn could result in even higher natural gas costs for all other gas buyers, including households for heating and power firms for generating electricity.

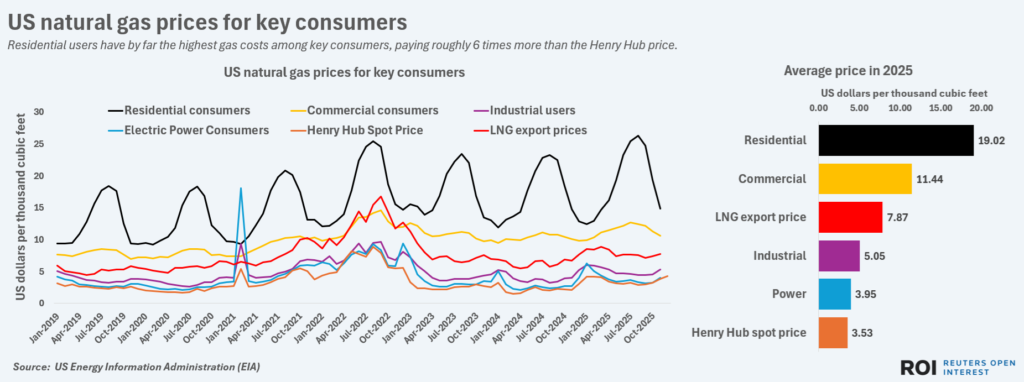

Residences already face the highest gas costs of all consumers, with prices averaging around $19 per MCF in 2025, EIA data shows.

Residential users have by far the highest gas costs among key consumers, paying roughly 6 times more than the Henry Hub price.

But commercial and industrial users also pay far more than power firms for gas, with the commercial price averaging around $11.44/MCF last year and the industrial price averaging around $5.05/MCF.

Even power firms – which have access to wholesale pools of gas that other consumers do not – also faced a steep climb in average gas costs last year, to around $3.95/MCF.

That indicates that all major gas consumers are being squeezed by the ongoing boom in LNG export demand, and so could push back against any factors that threaten to further elevate the cost of such a critical resource.

Surging liquefied natural gas exports have helped lift natural gas prices and the cost of electricity

That in turn suggests that LNG exporters could come under intense scrutiny in 2026 and may face pressure to curb their expansion plans even if doing so slows the pace of LNG sales and undermines the vision for U.S. energy export dominance.

The opinions expressed here are those of the author, a columnist for Reuters.

Reporting by Gavin Maguire; Editing by Michael Perry

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS

COMMENTARY: Booming LNG Exports May Get Dragged into US Cost-of-Living Debate