By David Blackmon

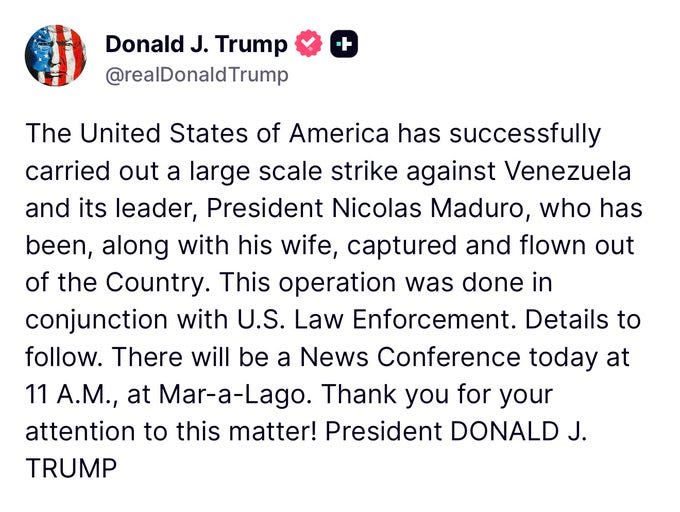

As many people are no doubt aware by now, President Donald Trump ordered a surgical U.S. incursion into Venezuela last night to destroy narco-terrorist infrastructure and take the illegitimate dictator Nicolas Maduro into custody. You can read more details about all that on my political Substack here and here.

Where energy is concerned, the immediate question which arises in the wake of this operation is how it might impact oil prices when markets open on Monday?

Based on what we know at the moment, the likely answer is “not much.”

Simply put: The fear premium in crude oil prices has disappeared, as we saw in real time several months ago when the U.S. launched a massive stealth bombing run to take out Iran’s nuclear facilities. Had that operation taken place 20 or even 10 years ago, oil prices would have spiked by $20-$30 per barrel. Now, it created a tiny blip on the screen.

Short of the kickoff of a massive third world war, there is only one foreseeable geopolitical event which would cause a big immediate rise in oil prices: A shutdown on shipping traffic out of the Persian Gulf through the Strait of Hormuz.

Because somewhere between 20-25% of global crude supply sails through that key Strait every day, any shutdown which promises to last for more than a few days would send oil prices soaring, perhaps to record levels, as traders scrambled to secure supplies needed to fill their obligations.

No such possibility is remotely in play related to Venezuela, even though it is at least theoretically home to the biggest crude reserves on earth. There was a time when Venezuela was a power player on the global market for crude oil, but that time ended more than 20 years ago during the rule of the socialist despot Hugo Chavez. Maduro’s own illegitimate, despotic reign has only served to further collapse the country’s domestic oil industry, rendering it not exactly a rounding error in terms of global supply, but certainly an afterthought.

Though its domestic production has recovered somewhat since it reached a low of barely half a million barrels per day in 2020, Venezuela today produces barely 1 million barrels each day, much of which is consumed for its own needs. Its total exports represent a fraction of 1% of a global market that is today in excess of 100 million bpd.

Bottom line: Don’t expect any significant impact on crude prices in the coming days. Venezuela is no longer important enough to cause that.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS