By Weilun Soon

Rates to ship crude on tankers are surging more widely across the world after the US moved to exert control over Venezuelan flows, a trade once primarily handled by a dark fleet of aging vessels.

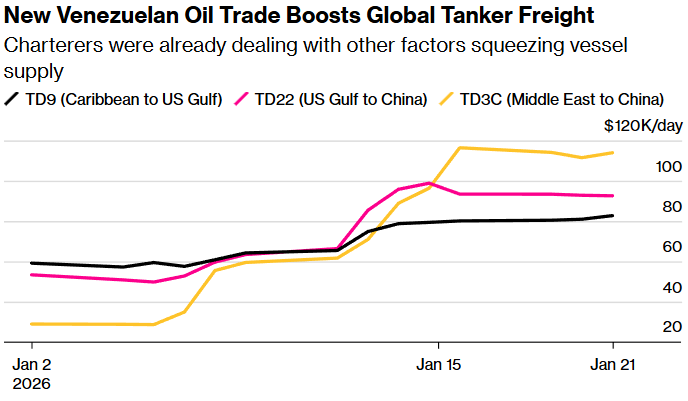

Shipowners are deploying legitimate tankers near the US Gulf in anticipation of higher demand for vessels instead of positioning them in the seas surrounding major production hubs such as the Middle East. That’s led to rates on routes to China jumping, mirroring recent gains in the Caribbean and Mexico.

Source: Baltic Exchange

Daily earnings on the Middle East-to-China route have almost tripled this year to nearly $114,000, while rates from the US Gulf to China are 73% higher. Earnings for ships traveling from the Caribbean to the US Gulf have also jumped further, hitting a new two-year high on Wednesday at nearly $82,800.

In a rare move, an empty tanker last week started a 45-day journey to the Americas from the Middle East. The Megan Glory completed a delivery to Sohar in Oman, signaled its intention to stay in the area on Jan. 12, and then days later indicated it was headed to the US Gulf to wait for orders.

Actions such as that from the Megan Glory are prompting charterers to dangle higher fees to deliver near-term cargoes on routes not involving the Americas. The Al Riqqa was fixed on Wednesday at a year-to-date high of 140 Worldscale points — an industry standard that uses 100 as base cost for a specific voyage — to ship Kuwaiti crude to Singapore by early February.

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS