By Julian Lee

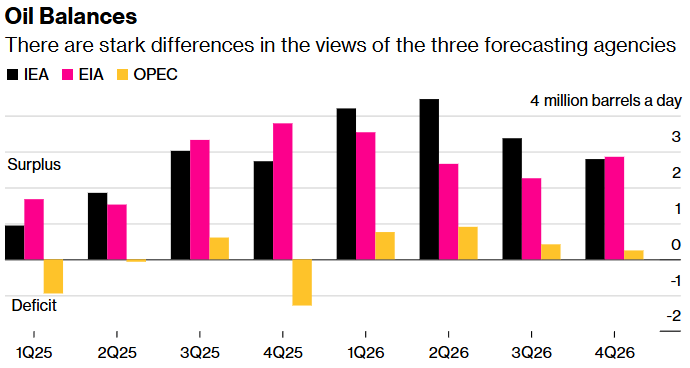

Oil traders seeking to plot the path for prices this year are juggling sharply different assessments of the supply-demand outlook, from a huge surplus to a broadly balanced market.

The world’s three main forecasting agencies — the International Energy Agency, the US Energy Information Administration and the Organization of the Petroleum Exporting Countries — have all updated their forecasts and the differences remain as stark as ever, split between the views of the two consumer-side groups and the very different outlook of the producers.

The IEA sees the biggest surplus, exceeding 4 million barrels a day in the first half of 2026 and averaging more than 3.7 million barrels day for the year as a whole. The EIA isn’t so far behind. It sees supply running ahead of demand by more than 2.8 million barrels a day this year, with the excess peaking above 3.5 million barrels a day during the current quarter.

Source: IEA, EIA and OPEC

Estimates based on OPEC figures, in contrast, suggest a market that’s much closer to being balanced, with supply exceeding demand by about 600,000 barrels a day on average this year.

The latest forecasts reaffirm the positions of the three agencies, which have long held widely differing views on oil market balances.

Neither OPEC nor the IEA forecasts OPEC production, so those future imbalances require assumptions to be made.

In its report, the IEA uses the current OPEC+ output agreement as a proxy for future supply, and the same basis has been applied to OPEC figures to generate the chart above, assuming production for the three countries outside the agreement — Iran, Libya and Venezuela — remain steady at about the 5.4 million barrels a day seen in December.

Demand Growth

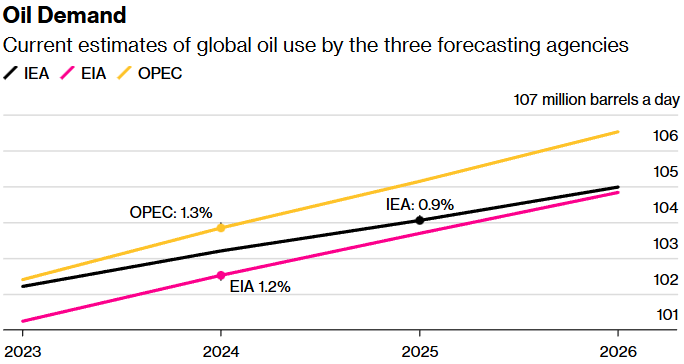

A large part of the different outlooks can be attributed to the agencies’ views on oil demand and growth.

At just under 105 million barrels a day, the IEA’s demand forecast for 2026 is about 1.5 million barrels a day below that of OPEC. The gap has slowly narrowed since August, with the IEA increasing its forecast by 540,000 barrels a day over the past five months, while the OPEC view has remained unchanged.

The IEA’s more optimistic view comes as a result of what it foresees as a normalization of economic conditions after turmoil caused by actual and threatened tariffs impacted consumption in 2025.

It now expects consumption to increase by 930,000 barrels a day in 2026, but that’s still only about two-thirds of the growth seen by analysts at OPEC. The EIA’s growth outlook lies midway between the two.

But the divergence isn’t just in the strength of growth this year. It also reflects deep-seated historical differences.

Source: IEA, EIA and OPEC

Note: Labels show average growth rates over the whole period.

The OPEC analysts see oil demand growing at an annual average rate of 1.3% since 2023, broadly in line with the long-term growth rates seen before the Covid-19 pandemic. The EIA sees a slightly lower growth rate of 1.2% a year. That’s led to a widening for the gap between the EIA’s and OPEC’s views of demand, which has increased from about 1.2 million barrels a day for 2023 to 1.7 million barrels a day for this year.

The divergence between OPEC and the IEA is starker. From demand estimates for 2023 that are just 200,000 barrels a day apart, the gap has widened to more than 1.5 million barrels a day for 2026. The IEA sees consumption rising at an annual average rate of 0.9% between 2023 and 2026 — well below the historical average.

All three agencies continually revise their demand forecasts and even their assessments of historical consumption.

— With assistance from Grant Smith

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS