By Sing Yee Ong, Elena Mazneva, and Julian Hast

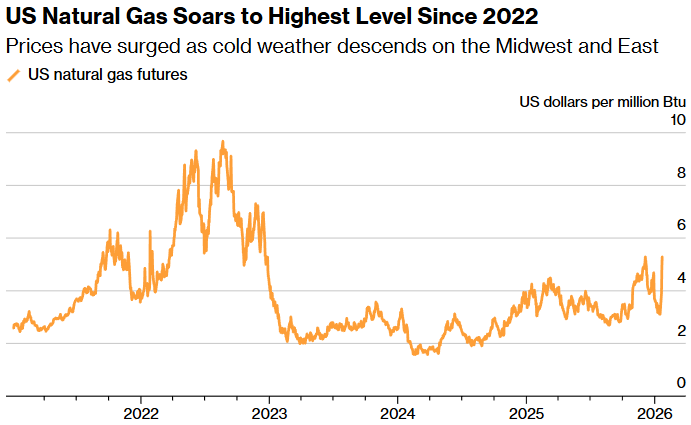

US natural gas futures surged about 75% in three days, rocketing to the highest price since 2022, as frigid weather sweeps across major markets for the heating fuel and forces traders to cover bearish positions.

More than 175 million people across the country will face snow, rain, sleet and ice through the weekend as record-breaking cold across the central and eastern regions fuels the season’s largest winter storm. Low temperatures could freeze water inside pipelines, disrupting gas production and exports. Consumption is expected to rise as households crank up their heaters, potentially draining inventories.

“This is a textbook winter-driven squeeze: fast, violent, and sentiment-shifting,” Ole Hvalbye, an analyst at SEB AB, wrote in a note to clients.

Read More: Record Cold Fuels Winter Storm Aimed at Texas, New York

The shift in US weather forecasts came days after hedge funds turned more bearish on gas at the end of last week, leaving the market poised for a rally as traders rushed to close out those wagers. On Thursday, overnight weather models turned even colder in the central and southern US for Jan. 27 through Jan. 31, according to commercial forecaster Atmospheric G2.

“We would have to go back to 2022, then 2018, to see this kind of volatility” in US gas futures, said Dennis Kissler, senior vice president for trading at BOK Financial Securities Inc.

Soaring gas prices are bad news for US consumers grappling with rising energy bills, which have become a liability for politicians including US President Donald Trump. But they stand to benefit US gas producers, especially those that have not locked in prices for a large share of their planned output through financial hedges.

Gas for February delivery rose 13.8% to $5.549 per million British thermal units at 10:33 a.m. in New York after earlier climbing to $5.650, the highest since December 2022. The February contract’s 14-day RSI level has topped 70, typically signaling overbought levels.

“A major correction is due, but it will likely take a change in the weather forecast to trip it,” Kissler said.

Source: CME Group

Contracts for nearer-term delivery also soared. Cash prices for the Henry Hub trading point in Louisiana — the benchmark for US futures — for the balance of January surged to nearly $13 per million British thermal units Thursday morning from around $7 on Tuesday and under $4 at the end of last week, according to traders. Cash prices in the pipeline-constrained Northeast, meanwhile, were trading around $30 per mmbtu, traders said.

A weekly storage report showed US gas inventories fell 120 billion cubic feet last week to 3.065 trillion cubic feet, a larger drop than median analyst estimates of -98 bcf compiled by Bloomberg. The decline is below the five-year-average withdrawal of 191 bcf.

The decrease puts total stockpiles 6.1% above the five-year average, providing a cushion of inventories as demand climbs.

Still, analysts at BloombergNEF expect that the inventory report will be followed next week by the second largest withdrawal ever as this weekend’s frigid weather triggers higher demand.

Polar cold has also lifted gas prices in Asia and Europe this week. While European gas prices slipped Thursday, the continent is getting ready for another deep freeze in the next few days. It relies on the US for liquefied natural gas imports ever since it lost most Russian supplies during the 2022 energy crisis. The US is the world’s biggest exporter of LNG, and supplies to export terminals now account for about 17% of the nation’s gas production.

Asia’s gas benchmark also jumped this week to the highest level since late-November, according to traders, as temperatures in the region dropped, lifting demand. While Asia has ample inventories — unlike Europe — a prolonged cold snap could raise global competition for the fuel.

The rallies this week across global gas markets comes after a period of relative calm, as new LNG projects slated to start up in 2026 and later this decade raised expectations of a looming glut that could dampen gas prices for years to come. SEB’s Hvalbye said the immediate trigger has been the weather, rather than any structural shock or change in long-term fundamentals.

Still, he said the price reactions underline a shift that has taken place in the gas market, particularly in Europe.

“Gas has become a far more global and flexible commodity, where traditional European seasonal logic matters less than before,” Hvalbye said. “That also means that when weather or global flows shift, price reactions can be faster and sharper, exactly what we are now seeing play out.”

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS