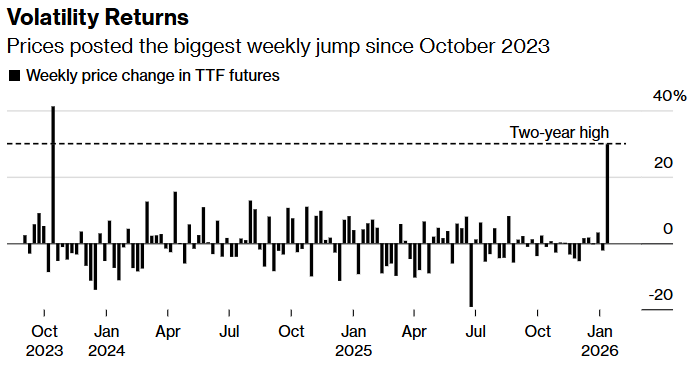

The biggest weekly price swings in two years show the power of speculative traders

After a period of relative calm, intense volatility has returned to European gas prices.

The region’s benchmark futures plunged 10% on Monday after surging 30% last week. There were real reasons for prices to be moving — a plunge in temperatures, geopolitical tensions linked to protests in Iran, President Donald Trump’s tariff threats over Greenland — but the sheer size of the swings reflected the clout of speculative traders.

At the start of winter, there was a strong conviction that Europe would have enough gas to navigate the heating season thanks to strong imports and mild temperatures. This lifted net-short positions in benchmark futures — held mostly by hedge funds — to the most bearish levels since early 2020.

More recently, amid growing worries about the region’s supply picture, speculators who had placed bets on a weaker market started to buy futures to cover their short positions, further stoking the price rally.

Source: Bloomberg

Hedge funds piled into Europe’s gas market amid the volatility caused by Russia’s invasion of Ukraine. While their presence has provided extra liquidity by creating more buying and selling opportunities, their trading patterns can amplify shocks.

Any heavy concentration of positions — be they long or short — can stress the market, pushing it beyond normal limits.

Gas prices are still far below the records seen during the 2022 energy crisis, but volatility creates vulnerability. Such abrupt moves in essential commodities like power and gas can hurt consumers grappling with the high cost of living and make life difficult for entire industries.

The future doesn’t necessarily look more stable. An overhaul of Intercontinental Exchange Inc. will see the trading of gas and electricity products expanded to 22 hours a day. Longer hours could widen the pool of speculators across time zones, with buyers and sellers dipping in and out of the market more frequently as they do in oil.

—Priscila Azevedo Rocha, Bloomberg News

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS