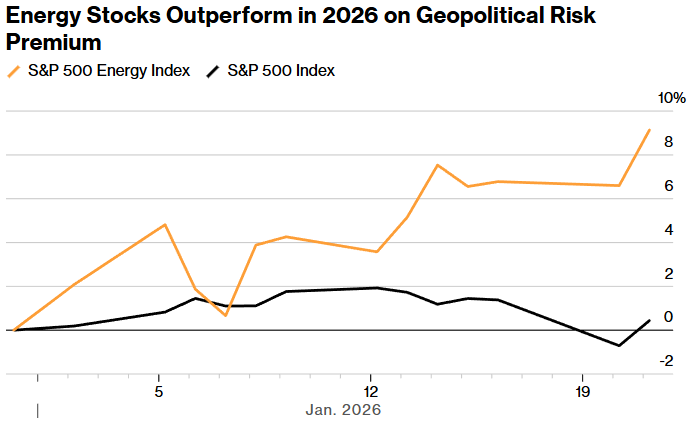

A sizzling rally in energy stocks over the past few months has the group reaching a new high as rising geopolitical uncertainty pushes investors to bet on elevated oil prices.

The S&P 500 Energy Index rose 2.4% to close at $750.17 on Wednesday, making it the best performing sector in the S&P 500 Index. Shares of major oil producers advanced as West Texas Intermediate crude prices advanced on uncertainty around tensions between the US and Europe over Greenland. Later in the day, President Donald Trump said the US reached a “framework of a future deal” on the island.

“Geopolitical stress involving Venezuela, Ukraine and Greenland is sustaining a modest risk premium for oil, with $60 a barrel for WTI a key threshold,” Bloomberg Intelligence analyst Vincent Piazza wrote in a note.

Oil stocks have climbed steadily since April, recovering from Trump’s tariff onslaught earlier that month. However, the gains picked up strength in early December as the US ramped up pressure on Venezuela and Russia. Trump’s pledge to revive Venezuela’s energy industry after ousting President Nicolás Maduro at the start of 2026 has driven major oil producers higher.

Source: Bloomberg

Note: Data is normalized with percentage appreciation as of December 31, 2025.

Energy stocks’ recent outperformance marks a reversal for the group. The index saw gains of 5% in 2025, lagging the S&P 500’s 16% advance as it struggled to recover from tariffs. The cohort fell 20% in the week after Trump announced global tariffs. It wasn’t until this year on Jan. 5, when US intervened in Venezuela, that the energy benchmark regained pre-tariff levels.

Banks have also become more constructive on oil due to the widening geopolitical risk premium. Citigroup Inc. recently raised its near-term base case forecast for Brent to $70 a barrel. Still, the biggest cloud that looms over the sector is the threat of an upcoming oversupply, which would weigh on crude prices.

As Trump reiterated his desire to take control of Greenland, but said he didn’t plan to use force, WTI crude prices rose as much as 2.1% on Wednesday. It pared gains later in the day and was up 0.5% as of 4:25 p.m. in New York. Oil prices also got a boost after the International Energy Agency increased its forecast for oil demand in 2026. Last year, WTI fell 20%.

Read More: The World Is Awash in Oil and Prices Are Poised to Keep Falling

Though upstream oil companies’ cash return have been resilient in the recent macroeconomic volatility, they face risks, Barclays analyst Betty Jiang wrote in a note to clients.

“The oil backdrop is further complicated by a rising geopolitical premium that may not be sustainable,” Jiang wrote.

Meanwhile, gas stocks like EQT Corp., Expand Energy Corp. and Coterra Energy Inc. have been outperforming this week as an Arctic blast is forecast for two-thirds of North America through next week.

“Despite higher natural gas production, colder weather across the eastern half of the US should rally domestic gas sentiment while frigid European temperature sustain seaborne benchmarks,” BI’s Piazza wrote.

(Updates with closing share price throughout and adds Greenland framework deal in second paragraph. Updates chart.)

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS