By Yawen Chen

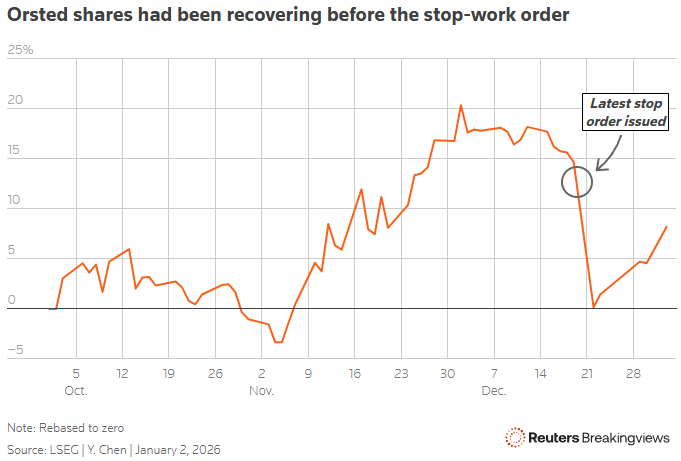

LONDON, Jan 7 (Reuters Breakingviews) – Orsted (ORSTED.CO) has been reminded again that offshore wind developers can do many things right but can still be undone by politics. U.S. President Donald Trump’s 90-day halt on new wind projects is the latest jolt for the $27 billion Danish power group. For CEO Rasmus Errboe, the pause will make it harder to stabilise earnings and may dent an already fragile valuation.

The order itself is striking. The U.S. Department of the Interior announced in December it was pausing offshore wind construction with immediate effect, citing national security risks and concerns that turbine blades and towers create radar “clutter”. Developers have been told to halt offshore construction for 90 days, a period that can be extended. And although Orsted said on Wednesday it will challenge the order, the U.S.’s use of classified documents as grounds for the new directive may be difficult to battle in court.

Investors can take some comfort from Orsted’s relatively healthy balance sheet. In October the Danish group raised $9 billion through a rights issue, followed by the sale of a 50% stake in the UK’s Hornsea 3 project and a 55% share of the Greater Changhua 2 project in Taiwan. That buys Errboe some time. Each year the affected U.S. projects are unable to sell power, Orsted risks losing about 4.5 billion Danish crowns of revenue. Given analysts polled by Visible Alpha reckon the group will deliver around 32 billion Danish crowns of EBITDA in 2027, the initial hit looks manageable.

More worrying, however, is the prospect that the stop order drags on and drives up costs. Offshore wind projects are tightly sequenced, capital-heavy undertakings where suppliers are often paid even if there are delays. Orsted is investing around 100 billion Danish crowns in its two U.S. projects, per S&P estimates. Revolution Wind, a 704-megawatt project due to supply power to Rhode Island and Connecticut as early as this month, is about 87% complete, while the 920-megawatt Sunrise Wind, contracted to deliver electricity to New York state, is 45% complete. When a stop-work order was previously imposed, Orsted estimated the delay would cost $25 million a week across the two projects until late September, rising thereafter. That implies at least $70 million worth of costs per gigawatt per week of delay, Bernstein analysts reckon. If the current pause persists for months, Orsted could burn through several billion dollars.

Credit degradation is another looming headache. In August, after an earlier stop-work order, S&P Global Ratings said Orsted could sustain a three to six months pause in construction before its credit rating would be affected. A downgrade could lead to higher borrowing costs, which will also damage earnings.

That leaves its valuation exposed. At roughly 130 Danish crowns a share, investors appear sanguine about the prospects of prolonged stoppages. With an AI boom driving up U.S. electricity costs and states desperate for cheaper, sustainable energy, shareholders may be betting that Trump will be pressured into cancelling or postponing the directive. Citi analysts estimate U.S. offshore wind contributes about 47 Danish crowns a share to Orsted’s anticipated growth, and that value is already reflected in the stock. But a long delay would be harder to shrug off. If a quick resolution fails to materialise, investors may endure a painful shock.

Editing by Aimee Donnellan; Production by Oliver Taslic

Share This:

CDN NEWS |

CDN NEWS |  US NEWS

US NEWS